August 2023 – Too hot

| Updated: |(Disclosure: Some of the links below may be affiliate links)

August 2023 was a relatively standard month, although way too hot. We had to be careful not to go out in the bad heat. I am really happy that the heat wave is over (for now!).

At the beginning of the month, we had a week of vacation. Unfortunately, we got COVID, likely while traveling in Greece. So, this week of vacation was not the greatest.

Financially, it was a good month with average expenses and higher-than-average income. This allowed us to save more than 50% of our income.

August 2023

I do not enjoy the heat. I would love a temperature of 20 degrees all summer. So, for me, it was not the greatest month. In our small village, we got up to 33 degrees temperature. This is way too high for me. And since the nights were not very cold, we could not cool the house down enough. This made it difficult to sleep.

I was more than happy after the end of the heatwave, where we saw temperatures below 20 again. It helps you sleep a lot.

On top of that, we started trying to improve our son’s sleep schedule. We have consulted with a specialist and are following her plan. So far, the main result is that he sleeps less, and it takes us longer to put him to sleep, but we know it will take a while to adjust.

Also, we got COVID (again) at the beginning of the month. Having COVID-19 with three people at home when on vacation is not fun. We had to cancel several events and spread it to a few people before we knew it was COVID.

Other than that, it was a fairly standard month.

Financially, it was a good month. We had average expenses while having a good income. Some of my RSU from work vested this month. And we received a refund for the taxes we paid on the second part of our second pillar withdrawal. Next year, we will finish paying back the withdrawal.

As a result, we saved more than 50% of our income this month.

Expenses

Here are the details of our expenses in August 2023:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 762 | Average | Our three health insurance bills |

| Transportation | 111.60 | Average | More buses than average, one gas refill |

| Communications | 129 | Average | Usual bills and one refill of my prepaid |

| Blog | 212 CHF | Below average | Only ClickUp and a domain |

| Personal | 2013 | New average | Too many small bills piling up |

| Food | 1023 | Well above average | Several meals in the restaurant, many special buys, and usual groceries |

| Housing | 903 | Above average | Mortgage, heating, and internet |

| Taxes | 5929 | New average | Taxes at the three levels |

In total, we spent 11085 CHF. Without taxes and the blog, this amounts to 4943 CHF, slightly below our goal of 5000 CHF. We could have done better in several categories, but at least we met our goal.

Despite having the LLC, you may wonder why there is an expense in the Blog category. This is because this is one of the expenses I forgot. I am sure there will be others, but this category will get empty over time, and I will stop reporting it.

One thing increased in price this month: the daycare bill for our son. It went up more than 10%! We now pay about 511 CHF per month for a single day in daycare per week.

We had almost everything in the Personal category this month. We had health bills, kindergarten bills, tons of small shopping bills, gifts, clothes, and books! It seems we are careful about big expenses, but small expenses also pile up quickly. We will have to be more cautious about them.

Our food category is also quite wild this month. We had lunch outside twice. We also had more coffee and snacks than usual. And we bought 110 CHF of smoked sausages. This is on top of standard groceries. We will be fine if we do not repeat this pattern next month.

Overall, we need to be slightly more careful with small expenses piling up. But since the total is below our goal of 5000 CHF per month, this is not too bad.

2023 Goals

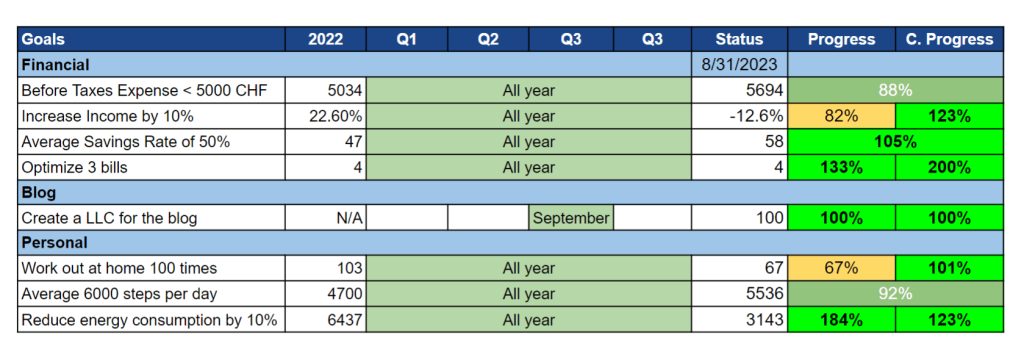

Here is the status of our goals by the end of August 2023:

Overall, our goals are going well. Only two goals are falling behind.

On the optimization side of things, we have dropped our legal protection insurance, which does not seem very useful. This will save us 411.95 CHF every year. We could cancel that before the five years with the new LCA law because the insurance lasted more than three years.

Also, I plan to drop our secondary building insurance (more on that in a future article) under the same conditions.

Because of the heat, I could not walk as much as I wanted. At more than 30 degrees, I would not go for a real walk with my son because we would both suffer. So, I only did my morning walk for several days before the heat.

I will need to ensure that I can also work out when it is too hot. I am considering either a treadmill or an indoor bicycle to complement my outdoor walking. I need to be more proactive and adapt to the weather.

With COVID, I also missed a few workouts. And my son also woke up before I could work out for two days. Given the circumstances, this is a good result.

The LLC is now set up, and we have paid our first salary. For me, this means the project is completed one month ahead of schedule. I wish it would have been faster since several steps required a long time. Some expenses are still not correctly sorted, but this will be fixed over time.

Overall, I am pretty satisfied with our goals.

FI Ratio

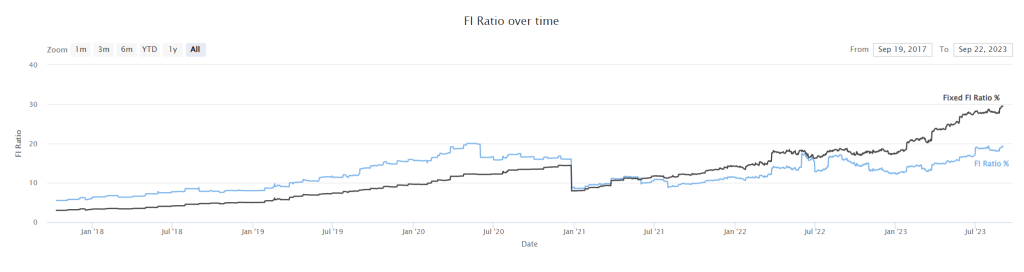

Here is the progress of our FI Ratio as of August 2023:

Again, we can see the change in our average expenses in the blue line. We still have significant variations in the 12-month average. I wonder whether I should switch to a 24-month average for less variation and more precision.

Overall, our FI net worth went down on the stock market. The stock market and the CHF/USD exchange rate decreased during the month, hurting our net worth.

However, even though we had more savings than a net worth increase, we still got extra shares because we could invest. So, we have more potential for growth.

Overall, our FI ratio is doing well. If our expenses do not stabilize, we can switch to a 24-month average to have something more stable.

The Blog

I did little on the blog this month. Many days, I was too tired; other days, I did not have the motivation. It is getting hard to prioritize the blog these days.

Fortunately, I had written many articles in advance for August, so I did not have to write much this month. I have two articles ready for this month, but after these two, I have nothing planned for the blog.

This month was also the first month we paid a salary from the blog. Except for figuring out how much is the net salary from the gross salary, there is not much to it.

Almost all the income of the blog is now going to the LLC. A few people are still using old codes, but it is dying down. Only one expense went through the wrong account, but I will fix it. Since it is a yearly bill, it will only be fixed next year. I am sure there will be others coming.

Next Month – September 2023

I hope that we will not get another heat wave in September. And I also hope our son’s new sleep schedule will start bearing fruits. We could do with better sleep and health.

Financially, there should be nothing special in September.

What about you? How was August 2023 for you? Do you have any big plans for September 2023?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

511 CHF for daycare is a bargain compared to the US. In San Francisco 🌁 it’s around $100/day per baby so figure CHF 2000 per month per baby. Once you have two toddlers its preferable to hire a nanny for $60k-$80k/year.

It’s actually for a single day a week :) We would pay more than 2500 CHF per month if we put him there every day :)

Hello!

I am confused with the amount you pay in taxes. What is this consisted of? Income, wealth and property tax? What is your houshold income then?

Hi ivmii

It’s mostly on income, we have a negative taxable wealth and the property tax is low compared to the income tax. Last year, I believe we were taxed on about 200’000 CHF of income. Keep in mind that we live in Fribourg, a bad place for high income earners.

Out of curiosity, can I ask what the source of the income is? Is there a post somewhere I could read? Do you work for a US company?

My work as a software engineer made about 85% of the income last year. I do indeed work for a US company. I’d rather not write it down here, but you can find easily which one.

Thanks for the post & blog.

As a keen cyclist, I don’t recommend any indoor cardio exercise during extreme heat. It’s super painful. Unless you have AC. ;)

Hi Jo,

Fortunately, I work in the basement and manage to keep comfortable temperatures there for a while. So my thinking was to have a cardio exercise here.

Hopefully, it won’t come to have AC, but seeing these heat waves, I am thinking we will not have a choice (and this will make the situation even worse).

Hi the poor swiss, when you write “I received some RSU at work” do you mean vested that you were excepting so already budgeted or new RSU offered that will be available in the future ?

Curious to hear how it is working in your company, do you get only RSU when joining or also later.

Thanks

Hi norge,

I don’t budget for RSU before they vest. So, they vested this month and I have now access to them in the account.

We can receive RSU when joining and also later based on performance.

As always, thanks for the detailed report! Those daycare expenses make me want to never have kids! I didn’t realize it’s so costly!

As for working out in summer, have you considered swimming? Its free or almost free and refreshing and a great workout!

Hi Eli,

It’s not so bad and it’s only for 4-5 years :) The main problem is that it discourages mothers from working.

No, I did not consider swimming because we have nothing available close to us (and I don’t like driving). But it’s indeed a great idea given the weather.