December 2023 – Expensive but nice

| Updated: |(Disclosure: Some of the links below may be affiliate links)

December is over, and so is 2023. These last few months flew by quickly! It is hard to believe the year is already over.

December 2023 was an excellent month, with a few family parties. On the financial side, it was a costly month because we paid for our boiler, replaced two months ago.

In this article, we go into the details of everything that happened to us in December 2023.

December 2023

December 2023 was a nice month. We had significantly fewer events during the weekend than the previous month, which allowed us to rest and enjoy time as a family.

My wife and son went on a four-day trip to Malaga. They had a lot of fun, and I could rest and get a head start on many projects. This was great.

Christmas was kept to a minimum this year, with a party with my dad and another with my mom. Both events were significant, and this was the perfect amount of parties, mainly since we spread them around this year.

Financially, it was pretty expensive because we paid for the new boiler. On top of that, several bills are due at the end of the year. But we still managed to save a tiny amount of money (less than 2% of our income).

Expenses

Here are the details of our expenses in December 2023:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 776 | Average | Our three health insurance policies |

| Transportation | 543 | Above average | Fuel once, some parking, many buses and trains, and the car insurance |

| Communications | 104 | Above average | Phone plan and a yearly subscription |

| Blog | 899 | N/A | AVS |

| Personal | 1941 | Above average | Many small expenses, some holiday shopping, Christmas gifts, … |

| Food | 1465 | Well above average | Very expensive groceries, Aligro, some lunches out |

| Housing | 7528 | Well above average | Usual expenses and the new heat pump boiler |

| Taxes | 6027 | Average | The usual taxes |

In total, we spent 19261 CHF. Without taxes, this amounts to 13233 CHF, which is a very expensive month. Removing the blog and the boiler boils down to 5522 CHF, which is not great.

This is the most expensive month of the year. The main difference from the previous months is that we paid for the boiler and its installation. This costs us a total of about 6800 CHF this month. The price seems reasonable since the old one was over 25 years old, and we got a heat pump this time. This should save us a little money in power bills over the years.

Our food expenses are entirely out of control this month. On the grocery side, we had to return to Aligro to restock. We almost finished the meat from the pig we bought. We also had quite a few meals out. And on top of that, our standard groceries are more expensive every week. We need to be much more careful about that next month.

By switching over from Assura to Concordia, we have paid only 12 CHF more per month than last year. If we had stayed with Assura, we would have spent about 50 CHF per month more. Fribourg was one of the cantons with the highest increase in premiums. We still have some complementary insurance policies at Assura, which we may move or cancel later, but that will have to wait until the middle of next year.

We also have some yearly bills like the car insurance or the firefighter’s bill that popped up this month. More of these bills will arrive next month.

Our personal category is a classic example of small expenses piling up to a considerable amount. There is nothing really significant on our list, but all the small expenses are piling up quickly.

Overall, it is not the end of the world since we still finish with a tiny savings rate. But it is something we should not reproduce. And it is not the greatest way to end the year.

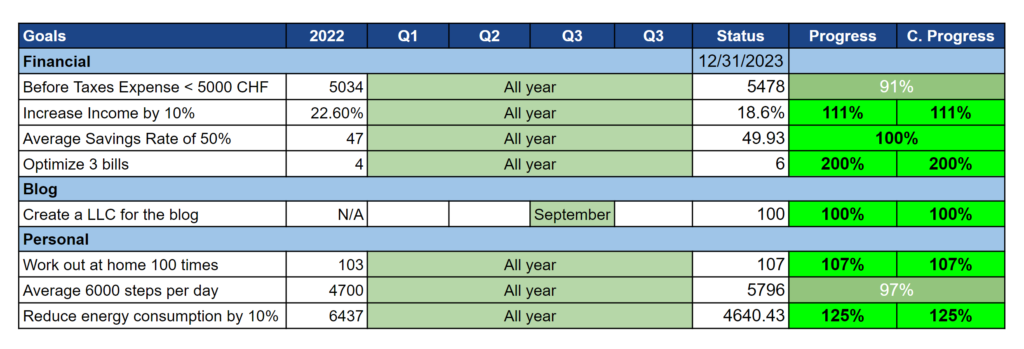

2023 Goals

Here is the status of our goals by the end of December 2023:

Overall, we did really well on our goals in 2023. And December was alright.

While I thought we could improve our average expenses, the opposite happened, and we spent even more than the year’s average.

This also caused our average savings rate to go down significantly, but with 49.93%, I still feel we passed the goal.

My workouts were below average this month, but my steps were above average. So, overall, for December month, I did not do too badly.

Looking at the picture, we can still see that we did pretty well during this year. We only failed two goals this year. I am not too disappointed about the steps goal because I still walked more than last year, which is a nice improvement. On the other hand, we spent significantly more each month than last year, which is not great.

I am pleased about our power consumption reduction this year. We reduced our power consumption by 28% in a year! This is a very good result.

I do not want to delve too much into our goals because I will soon write a full review of the year. I will also soon release our 2024 goals. Stay tuned if you are interested!

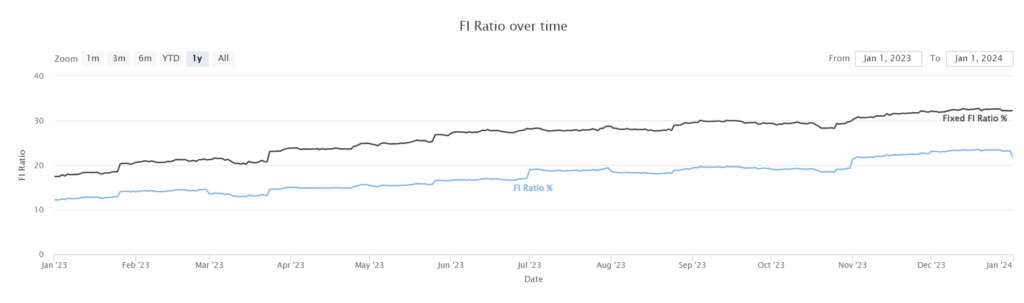

FI Ratio

Here is the progress of our FI Ratio as of December 2023:

Our progress toward financial independence is mixed this month.

- Our stocks increased significantly in value, but only in USD. The Swiss franc became even stronger this month, making us lose money.

- On top of that, we almost did not save money this month.

- Finally, we spent too much, making our average expense go up and thus our target go up as well.

So, overall, we lost 1% during this month. However, we still ended the year with 7% more than in 2022. At this rate, we would need about 12 more years to be financially independent, which is on target with my goal of being FI by age 50.

So, while it was not a great month for our FI ratio, it was a great year!

The Blog

Not much happened on the blog this month. I had a guest post by Dror Allouche, which was nice because I had not had one in a long time.

I was also part of a podcast with Rigby: Setting up your finances in Switzerland, with The Poor Swiss

It had been a while since I did any podcast so it was interesting to do one again. I like the end result, and I think that the focus on expats was quite good. Let me know what you think if you go through it.

I had more time than usual this month. I have been able to write a few articles in advance for January, so I should be good for a few months now.

After a conversation with a reader, the idea of building an online forum popped up again. Do you think there is value in having a Poor Swiss forum? Or maybe even a Poor Swiss community?

Next Month – January 2024

In January 2024, we do not have much planned. It should be a fairly standard month.

Financially, it should also be pretty standard. We will start filling our third pillar accounts as usual. And then, we will continue with the next round of second pillar investment.

What about you? How was December 2023 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste,

Stumbled across your blog a couple days ago, and fell into the finance rabbit hole. Thank you for the incredibly valuable advice, tips and reviews, brings a lot of clarity in a sometime more-than-necessary-foggy world!

– Quick question:

You write of second pillar investment (A “rachat du 2e pillier”, I gather).

Medium term (<5 years), the goal would be to own a house rather than rent, and increasing the 2nd pillar makes a lot of sense in that regard (especially having studied until 27 and only 'really' started working late, it's maybe not where it should/could be).

However, I also started investing in ETFs on Swissquote a couple years ago. Being 30 years old now, I feel I have the luxury of time and think I should take advantage of it to maximize stock investments, which in the long term will bring larger ROI than 2nd pillar investment (and maybe switch the distribution in 15-20 years or so).

Therefore, I am a bit in a conundrum as to where to invest. At the moment, in addition to maximizing the 3rd pillar, I split my savings 50-50% between SQ investments and a savings account (to account for the necessary 10% cash and/or 3rd pillar downpayment for a house).

Until the house is bought, would you recommend to still do additional 2nd pillar investments and less in ETFs and if so what distribution of one's monthly savings ?

Thank you in advance for your precious help, you're distilling gold!

Wishing you a lot of success for your FI! :-)

Thomas

Hi Thomas,

I am glad you appreciate my content!

You are correct that short/mid term, second pillar makes a lot of sense, but not so much for very long term. I wrote about this: Should You Contribute to Your Second Pillar in 2024?

In your situation, it depends on many factors

1. Are you going to use your second pillar for your house?

2. Are you more than 3 years away from your house (contributions are locked for 3 years)?

3. Do you have a very high tax rate (marginal tax rate > 35%)?

3a contributions are not locked, so it always makes sense to contribute in my head. But of course, if your 3a is invested, you may lose before you sell.

If you are less than 3 years away from your house, I think your strategy of 50/50 makes sense. But it may depend on other factors.

Thanks for your quick reply, I’ll have look at the piece you wrote.

1. Yes, I plan on using the 2nd pillar for the downpayment.

2. Yes, depending on market movements, but realistically, I’d say 3.5-4 years.

3. No, but I’d never say no to paying less taxes ;-)

Yes, 3a is invested and diligently maxed out every January!

Thanks for your insight, I know there are more ways than one to skin a cat, but always good to have confirmation from someone with more experience.

I think if you are only 3-4 away from using your second pillar, I would stop already contributing to it and keep it in cash or stocks.

Maxing out 3a and investing 3a makes sense, but keep in mind that if you plan to use your 3a for the mortgage, it may be lower than now if a crash occurs shortly before you buy.

Popping by to reiterate how great a Poor Swiss Forum/community would be!

Thanks for the feedback, Krizel!