December 2020 – Moving to the new house

| Updated: |(Disclosure: Some of the links below may be affiliate links)

December 2020 and 2020 is now behind us! And what a weird year it was. But I will reflect on this year later. Now, we can reflect on December 2020! I hope you all had a good time despite the weirdness that is going on.

In December 2020, we finally moved to our new house! This was definitely the main event of the month. And to be honest, it dwarfs the financial aspects of the month.

Our move was quite successful. We managed to get most of the moving, mounting, and unpacking in three days. We still had smaller things to do after that, but it was an efficient move.

On the money side, it was an expensive month, like every December. However, our income was good and our ordinary expenses this month were very low. So, we still ended up saving 45% of our income in December 2020!

December 2020

We are finally in our new house. We have been waiting for that for many months now. Our previous apartment was a bit of a mess because of having many new furniture pieces waiting to be unpacked in the new house. And we were tired of it.

We moved into the new house by ourselves with the help of our friends and family. We moved on one day and finishing the mounting of furniture the next day. We wanted to avoid having too many people because of COVID.

And then, we managed to finish all the unpacking on the third day. Of course, we still had some things that had to wait. For instance, not all my computers were properly set up, and our TV home cinema was not set up either directly. But these are small things.

We even managed to get a Christmas tree decorated before long! So, I think our move was quite successful.

So far, we are delighted with the new house. We still have some things to tune out. But overall, almost everything turned out great. We cannot complain!

From a financial point of view, it is the typical end of the year month. Many bills are due in December, and this makes it a costly month. Unlike most Swiss, I do not have a 13th salary paid in December. So, this means that my income in December is standard. But my bonus around March compensates for this.

For our finance, December 2020 was not too bad. Our expenses are definitely on the high side of things because of the yearly bills coming at the end of the year. We still managed to save 45% of our income this month. All things considered, this is a good month!

Expenses

Let’s see the details of our expenses in December 2020:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 1157 | Above Average | Health and legal insurances |

| Transportation | 879 | Above average | Renting a truck and car insurance |

| Communications | 137 | Above average | One yearly service fee and internet |

| Personal | 1698 | Above average | A big health bill for my knee, many expenses for the house |

| Food | 250 | Below average | We went down through our reserves before moving, hence lower bills |

| Housing | 1905 | Above average | Apartment, house, and power bill |

| Taxes | 1596 | Average | Standard taxes |

In total, we spent 7626 CHF in December 2020. It is not that bad for an end-of-year month. We had many insurance bills coming this month. And we had to pay a big 700 CHF bill for the physio for my knee, which was totally useless. I am pretty pissed about that.

On top of that, we also had some house expenses, like buying the necessary lamps. Normally, these expenses should be more or less a one-off thing.

For now, we are still paying for the old apartment as well as the new house. So, for a few months, our expenses are expected to be higher. We will see how it goes once everything settles down and we get rid of the old apartment.

I am still hopeful we could lower our expenses slightly next year. We will see in 2021 if that is too optimistic.

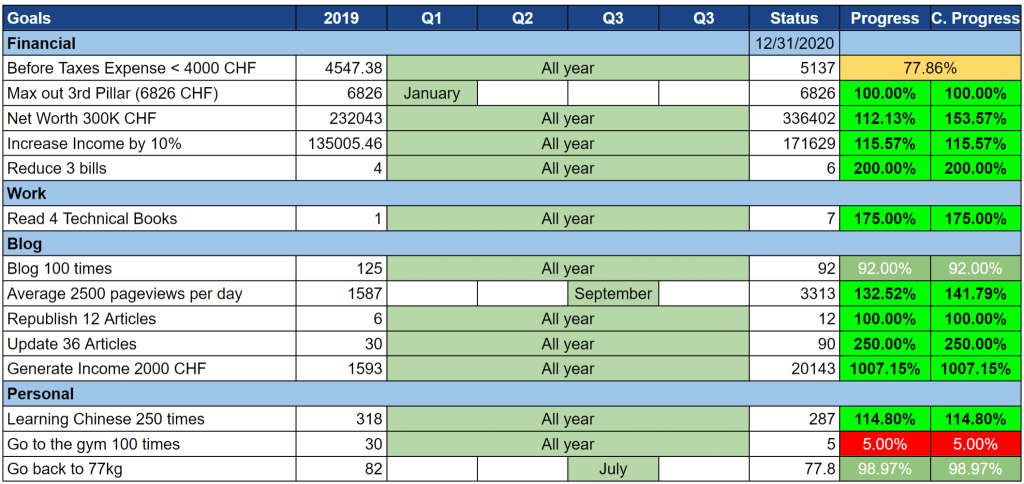

2020 Goals

Let’s take a look at our goals by the end of December 2020:

This is already the last month for our 2020 Goals. Overall, our goals are doing good. We did not reach them all, but most of them are close to completion.

The only one that is very far from completion is my gym goal. It started well, but then COVID-19 and remote work hit, and my goal was annihilated. I do not feel bad about that since I have been going on walks every morning before work. But it is not the same, and I can feel my strength went down this year. I will have to work on that next year.

I do not want to delve too long on our goals now. I will do a full review of our goals in early January. And I will also publish our goals for 2021.

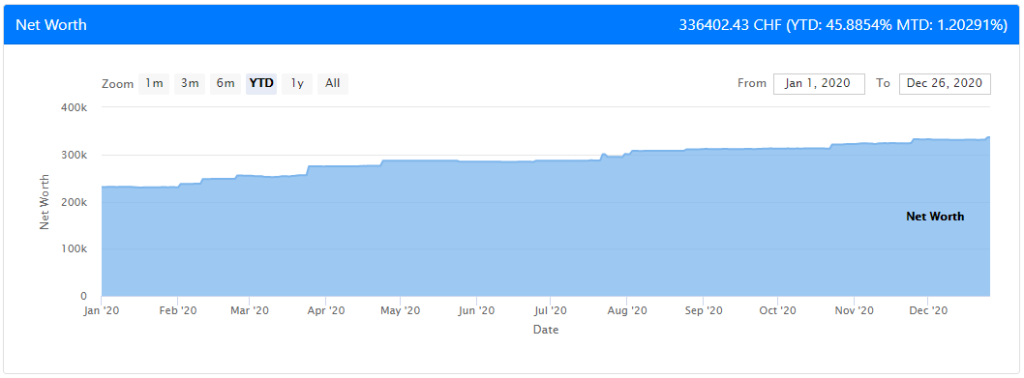

Net Worth

Let’s take a look at our net worth as of December 2020:

We managed to increase our net worth to 336’000 CHF this month. The markets are making a good recovery, but the dollar is still losing value, which hurts our net worth. Without our savings, our net worth would have been down this month.

Except for this, there was really nothing special about our net worth. The composition of the net worth now is very different. We added a large debt for the mortgage of the house. And we added a large real estate position as well.

Now, we need to work on increasing our stock position again. We still have too much cash since we are expecting some large bills for the house. Our second and third pillars have gone down significantly now. We will rebuild the third pillar slowly over time.

The Blog

In December 2020, the traffic on the blog went down. I am not worried about that since the end of December is always slow on that blog. And I did not write any seasonal posts. We will see if it recovers well in January or not.

Also, I did not post between December 24th and January 5th. I do not think most people want to read posts during that time, and I wanted to have some margin for the new house. I think it turned out well.

Seeing that the numbers for the French articles of the blog have been going up, I have decided to push the translation further. I still have many articles to translate. But I have translated all the important pages. It means that the site should be fully functional in French now. We will see in the future if this was a good move or not. If the French version does really well, I will consider a German version in the future. The problem is that I cannot translate to German myself. So, this will not be free.

2020 has been a great year for the blog. Let’s hope 2021 will be even better for the blog.

If you had to read a single post this month, it should be my article about the dangers of depreciating assets.

Special Offer – Win a book

I have recently had contact with Thomas Walke, author of books on Personal Finance in Switzerland. He offered a contest for you, my readers, to win 5 copies of its latest book (in German) Mehr Geld Zum Leben (more money to live). This book recently jumped to the Number 1 bestselling book in Economics!

If you are interested in trying to win a copy, you can register on this online form, until the 15th of January 2021. The winners will be contacted by email by Thomas! If you want, you can also purchase the book on Amazon.

Thansk Thomas for this kind offer!

Next Month – January 2021

In January 2021, we expect a few bills, but nothing really out of the ordinary. We do not have any big plans. We will focus on enjoying ourselves in the new house. We will also have to finalize our 2021 goals (more on that later).

Some bills for the house may start coming already next month. But we are mostly expecting them around the end of the first quarter.

I am not expecting the situation to be over until at least this summer. So, we will still live slower than usual. But it is not that bad. Living in the new house will definitely for future lockdowns (if any).

What about you? How was December 2020 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Mr. The Poor Swiss,

Congratulations for the new house! It must be a more than excited moment to move in!

I have a question on your net income o f 171k. Have you included the tax payment to etat/canton/commune which happen only the year after?

Thank you!

Hi,

Thanks :) Yes, we were really excited and still are :)

That’s only net of direct taxes (first pillar, second pillar, disability insurance, …). Basically, what I call my net income is the amount of money that ends in my bank account :)

My after-tax-income is much lower.

Cheers

Oh pity, that I discovered the contest now, 2 days after the deadline!! :-/

I will check the Amazon link then :-)

Michala

Hi Mr Poor Swiss,

I was wondering about your calculation of income goals: If previous income was 135k and now you have reached 171k for 2020, the goal is much more achieved than ‘just’ 115%. Also, is this net or gross income?

Thanks and have a good start into 2021!

Hi Alex,

I always count my net income, which is the income that hits my bank account.

Yes, there are several ways of computing this :) I made my spreadsheet compute the percentage based on the goal (135k*110%) and not based on the percentage of increase:

* My achievement is 115% to reach 135k*110%

* To aim for 10% and reach about 26%, my achievement would be 260% indeed.

Both way to compute it make sense indeed :) I will have to think about which way I choose for my 2021 Goals. I actually did not consider this! Thanks for pointing this out!

Have a good start into 2021!

Wish you a happy future in your new home. All the best for 2021!

Thanks Doods! Happy New Year to you too!

Congrats on the new house. Keep up with the good work on the blog!

Thank you very much :) We already like it a lot!

Happy New Year!

Congratulations on your new home! Wish you many great memories in it!

Thank you very much :)

Happy New Year!

I am very inspired by your goals, they are broken down by categories and by month. it is a perfect SMART goal example.

Congratulations on achieving and overachieving most of your goals, the gym goal looks like the most deprioritized one LOL

I need to consult you about the blog part.

Thanks for sharing, it is helping me to stay on track.

Hi Yasi!

Thanks for your kind words :)

I am quite happy about our goals (review coming this month), but we will need to make next year’s goals a little more ambitious I think.

Yeah, I could have switched to working out at home. But since I hate working out, it was not difficult for me to give it up because of COVID :P

Thanks for stopping by!

Hi PS,

With the dollar still losing value, are you at all phased by this? Do you continue to put money into VT with the idea of buying low and hold, knowing that it will eventually balance itself out and gain in value?

The markets are making a good recovery, but the dollar is still losing value, which hurts our net worth. Without our savings, our net worth would have been down this month.

Hi Jimbob,

I’m a little concerned about that, but I am not going to make a significant change in my investing because of that.

The problem is that all companies are concerned by that. Big global companies are concerned as well even in Switzerland if they export or import to and from the U.S.

So, investing more in CHF can help and currency-hedging could be the solution if you are worried.

But my investing term is very far, so I am thinking that this will average out in the future.

But I am in the same as you, my stocks went up a lot but they are worth less than before in CHF no. It sucks, but I do not see much we should do or can do at this time.

Do you include your II pillar in your Net worth calculation

Hi Enguerran,

Yes, it’s included. But currently, it’s been almost depleted by our house purchase, so it’s very small.

Thanks for stopping by!