April 2020 – A month at home

| Updated: |(Disclosure: Some of the links below may be affiliate links)

April 2020 is now over! That was one of the weirdest months of our life. We spent the entire month in our village, mostly at home. We only went out to buy groceries and help some of my relatives.

Fortunately, we have a large backyard, so we spent a lot of time outside. And Switzerland is not in full lockdown, so we still went out for walks. But we respected the two meters distance and almost did not talk to people. This is quite weird.

I am getting used to working at home. And I am starting to enjoy it. I save time on the commute, and I spend more time outside.

From a financial point of view, this was an uneventful month. We managed to save a large portion of our income again. This was a good month overall.

April 2020

I do not have to tell you about COVID-19, we have all heard way too much about it.

I worked at home for the entire month of April 2020. And I will probably work at home for the next month as well. I am getting used to working at home. It is actually starting to be enjoyable. I save time on my commute, I spend more time outside, and I take longer pauses than when I was working in the office.

The isolation itself is not so bad either. I am more of an introvert. But I would still prefer meeting more of my friends and family members. It is more difficult for Mrs. The Poor Swiss who like people and going out more than I do. But for now, we are okay.

I managed not to get more weight this month. But it has been difficult. We are eating a bit more since we are always at home. And we are definitely doing less sport. I am pretty sure I am losing muscles quite rapidly. I need to work on improving my routine to add some sport to it.

The one thing I need to find out is how to keep in shape at home. We are going on a few walks during the weekends. Mrs. The Poor Swiss is doing some exercise at home. But I am having a hard time getting motivated doing something at home.

I was finally able to see a specialist for the pain in my knees and back. They did a few more radios, but they did not find anything out of the ordinary. I do not know if that is a good thing or not. I have to do physiotherapy a few times. And if this does not fix the issue, I will have to do an MRI scan to see if this is something to do with the cartilage in the knee.

So, for now, I still do not know what is going on. And the pain has been increasing in both the knees and the back. But it is still bearable.

From a financial point of view, this was a very simple month. Nothing out of the ordinary happened this month. So, we have been able to save 76% of our income this month. This is a great result. But staying at home is not very expensive. So it is not very difficult to be frugal! And we had some extra income since some RSU from my company vested.

Financial goals and the future

Even though our financial situation is good, I am starting to feel a bit depressed regarding our financial future and goals. When I compare our household with others that are aiming for FI, we are earning a small portion of what others are making.

Until now, I was thinking I was earning a high income (and I do). But I did not think that having a single income could be a barrier. But now that I see that we struggle to get a house with my income, I realize it could be a problem in the future.

This is a mistake on my side to compare single incomes to single incomes. Household income is what matters. And ours is just a little above average, really nothing spectacular.

I am not really complaining. I have a good job and a good salary. A lot of people are struggling with much less. This is just a realization that our financial situation is not as great as I thought. But we will see how that goes.

I guess this was just my rambling of the month.

Expenses

Here are the details of our expenses in March 2020:

- Insurances: 795.35 CHF. Average. This is our health insurance.

- Transportation: 60 CHF. Below average. Just our parking for this month. Due to isolation, we did not even have to buy gas this month.

- Communications: 104 CHF. Average. Internet and Phone plans.

- Personal:684.10 CHF. Average. I bought a new tablet, and we had to renew Mrs. The Poor Swiss residency permit.

- Food: 297 CHF. Slightly below average.

- Apartment: 1247 CHF. Average. This is just our rent.

- Taxes: 0 CHF. Below average. This is a month without taxes.

Overall, we spent 3188 CHF. This is an excellent result for us. We managed to spend very little this month. This is great since we try to spend less than 4000 CHF per month (not including taxes).

One of the large unexpected expense was that I bought a tablet for myself. This is something we had been discussing for a while. Having a tablet at home allows me to work outside from time to time. I am really enjoying answering emails in the backyard or writing articles for the blog in the sun. And this will be very practical when we are traveling.

The isolation did not change our expenses much. We saved money on gas and on outside events. And we would have bought some more things. But expect from that, I do not see significant changes here.

Since this is a month without taxes, our overall expenses are really low this month. This is great for our average savings rate. But this is only happening two to three months a year.

2020 Goals

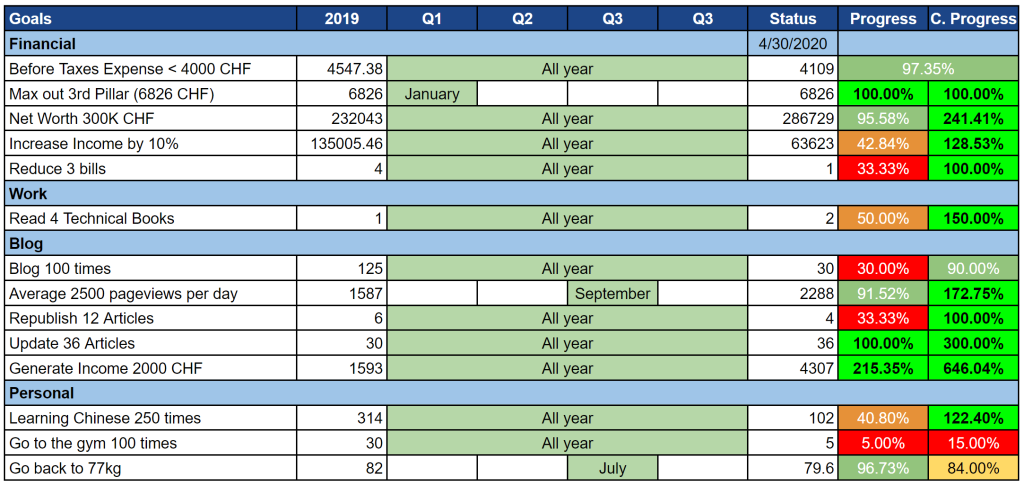

We can take a look at our 2020 Goals as of April 2020:

Overall, the goals are still going great! There are only three goals for which the current progress is lower than 100%:

- I only published 90% of the articles I should have. This is not a big deal since the goal did not account for republishing articles.

- Go to the gym 100 times. This goal is definitely not going to be done by the end of the year. First, my knees are not going better, and second, all the gyms have been closed for more than a month now.

- Go back to 77kg. I should have lost more weight by now. But isolation is not where I excel at limiting what I eat. We have done several cakes and bread that we usually never do. I will have to be careful about that and try to do more sport.

Aside from these three goals, all goals are going well. Some goals are already higher than their goals for the year, and most goals are significantly higher than 100% for their current progress. I have made some of the goals too simple again. But I think these goals are much better than the goals of last year. So, we are definitely getting better at setting goals.

One thing I need to think of is how to find another bill to reduce. I have already reduced my mobile phone bill. But so far, I have not found three others to fulfill this goal. We are going to reduce our rent bill since the interest rate has gone down. But ideally, we would like to buy a house and move, so this is not the best reduction.

A goal that is going to be impacted by isolation is my weight goal. I am having a hard time getting my weight down with so much time spent at home. I really need to find a way to do more sport while at home. I will do start to take walks in the morning before I work. This will already help a little.

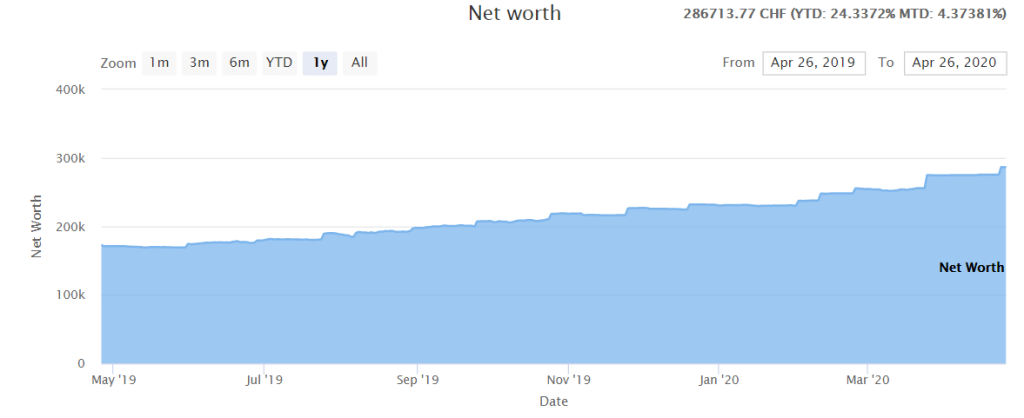

Net Worth

Let’s take a look at our net worth at the end of the month:

Our net worth increased nicely this month. Since we are mostly uninvested for buying a house, we do not fee much the significant market variations due to the coronavirus. So, it is almost entirely up to our savings of this month. And the USD went back up a lot, increasing by about 1000 CHF our net worth in CHF.

We are still able to maintain substantial savings, so this is very good. We also need to work a bit on our income now if we want to accelerate our net worth growth.

Regarding the house, there is nothing new this month. We thought that by April 2020, we would have found a house. But, we could not have planned for COVID-19. And currently, we are focusing on our health and safety rather than on finding a house.

Because of the isolation, we are not really pushing for finding one. And it seems that people are not pushing to sell them either. Hopefully, this situation will cause some people to drop the price. But we are considering this unlikely.

The Blog

April 2020 was not a great month for the blog. The traffic remained the same as the last month when last month was already not great. I published some posts I considered quite good, and I updated a few articles as well. But it did not seem to have much effect.

I was expecting a bit more traffic this month. But I honestly do not know what people are doing during the crisis.

For now, I am putting this on the current crisis. I have seen several other blogs in the personal finance sphere that have lost traffic during these months. A lot of people have other issues than saving money these times. So, we will see what happen to the blog after this is in the past.

I will continue working on updating my older content and writing new content. I do not plan on doing anything special in May.

Here are the three most-read posts of the month:

- Wise vs. Revolut: This article lost some traffic but still did quite well.

- DEGIRO vs. Interactive Brokers: This article lost a lot of traffic, but this is logical since it was published recently.

- Online Shopping in Switzerland: This article got a lot of new traffic this month. This is because people are shopping much more online when isolated at home.

Seeing as comparison articles do really well, I think I should do more of these. I do not know which one I will do, but I need to put a few more on my list of articles to write.

What about you? What was your favorite post of April 2020?

Next Month – May 2020

We do not have any special plans for next month. I am probably going to have to work at home for the entire month of May 2020. The isolation in Switzerland will slowly be reverted starting May 8th.

If the curve of new cases does not start stronger again, we can expect to be out of this mess by mid-June. But let’s wait and see.

From a financial point of view, next month should be very similar to April 2020. Hopefully, we keep our expenses low. But the taxes could also arrive by the end of next month. And this means a huge bill to pay since I did not pay enough last year. But again, we will see how it goes!

What about you? How was April 2020 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Mr Poor ;),

I was wondering what your thought process is behind buying a home? In my opinion, it risks pushing further away your FIRE date, isn’t it?

From the blog I saw you’re looking to buy a house at around CHF1mm, so you’d have to invest around 200k minimum (2 thirds of your wealth), in an asset that most probably won’t provide as much returns as stocks (though obviously it is less volatile).

Just wondering if you have a different view financially speaking, or if your main idea is more to be a real owner (which I can understand).

All the best,

Another investor

Hi Another Investor,

First, one of the issues in our region is that they are no houses for rent. So buying is also to increase our options. And we also wanted to be house owners ourselves.

We are not considering our house as an investment. If we keep it long enough, we are still likely to get to save money with our house. But it will very close to break-even.

I do not think this will push our FIRE date much, maybe one or two years. Once the expenses for the house stabilizes, this should bring our expenses and so our FI number (and our FI date).

We are currently in the process of buying a house (signed the notary contract already). But we are now looking at lower houses. 1M houses were not possible because of my income that is too low. We are in the ballpark of 700K.

Also, there is one thing about the opportunity cost: half of the money can come from pension funds and this money has very low returns, so this reduces the opportunity cost.

I will run the exact number for our purchase in the future on the blog.

I hope this clears it up :)

Thanks for stopping by!

How can you possibly spend just 300 CHF/month for food for 2 people?

Hi Maciej,

We are doing many things to keep this low: Lidl for most of our things, no prepared food, stock of meat from Aligro, …

You can read about it on my guide to keep your groceries budget low.

Let me know if you still have questions after that :)

Hi there,

I discovered your blog yesterday and got very inspired by some of your ideas. Great blog! Already decided to put in place some changes with my partner yesterday evening :).

I have though doubts I will be able to manage 300Fr. for 2 for food per month if you want:

1. buy as much bio products as you can

2. buy meat/egg/cheese from brand respecting animals conditions (and if possible from Switzerland). Those products aren’t usually the cheapest and hard to find them in LIDL nor ALIGRO. But here I guess, you made the choice to save money before all.

But still… simple equation: 30 days / 3 meals / 2 persons that’s 180 meals (breakfast/lunch/dinner). Of course you don’t spend as much on the three but with your budget it would mean 1.6Fr. average per meal. Difficulties to see how this can be healthy but I am probably missing something :)

We currently cook everything for dinner and weekend. Only working day lunches are not always prepared by us (cantina, prepared salad for 5Fr.). By buying various and fresh food (saturday market, meat, fish, fruits, veggies, drinks) we have a budget of 650Fr. together for common food (evening+weekend+ 1-2 dinner with friends per month) and 200Fr. p.p. for work day lunches (20x10Fr.).

Let see if we can improve this in the coming months without stopping to buy healthy/ethic food (bio, respecting animals..) and without spending 2-3h per day cooking for lunches and dinners (time is money when both are working..).

Thanks again for your blog, some very interesting ideas, even though calling it “poorswiss” for someone having this income is clearly not reflecting reality, “Mr. gooddeals swiss” would be more accurate ;p

Hi Tom,

Thank for you kind words :)

I am very glad it helped you!

300 CHF per month for 2 people if you want bio products and local products is probably not possible, unless you grow and raise them yourself ;)

Yes, I care more about saving money than about buying bio products and local products. For me, they are just too expensive for very little extra value. But that is only my point of view, I understand why people want to focus on them.

Regarding your equation, you can remove the breakfast. I am sometimes eating some oat grains and milk and Mrs. The Poor Swiss is sometimes eating an egg, but most of the time, we do not eat breakfast.

So, 30 * 2 * 2 is more 120 meals at 2.50 CHF per meal per person. I think this is perfectly reasonable and you could make it lower by eating less meat than we do (we eat several kgs per week).

And we cook Chinese food which is pretty fast to cook for most meals, although some take longer to cook, they do not take longer to prepare.

Good luck trying to optimize your food budget :) I think that 650 CHF is already good if you buy organic products, but you can probably take it down a notch.

I would recommend keeping the grocery tickets for an entire month and then putting everything together at the end. You may be surprised by how much you spend on some things you did not expect.

Thanks for stopping by!