What is long-term investing?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

If you are investing in the stock market, you have probably heard about long-term investing. I always recommend investing for the long term. But what is long-term investing?

And how long can it take for the stock market to become worth it? This article will answer these questions. We will examine the different investing horizons and what to do for each horizon.

Why does it matter?

First, the term (or horizon) of your investing means how long you have before you need the money. If you are investing to buy a house in 1-3 years, your investing horizon is 1-3 years. Or, if you are saving for retirement like me, your investing horizon is likely more than 20 years.

This matters greatly because you cannot invest the same way for the short, medium, and long term. The reason is volatility. Stocks have high returns, but it can take a long time for them to happen on average. So, there could be some long periods (years) during which your returns are negative.

Therefore, you may lose money if you are forced to sell (because you need the money). You would have been better off with a simple bank account.

There is no single definition of these different terms. Here is what they mean to me:

- Short-term is anything below three years

- Medium-term is any period between three and ten years

- Long-term is any period above ten years

Short-Term Investing

When you invest for anything in the next three years, you are investing for the short term. This could be saving for a house, a vacation, or a car.

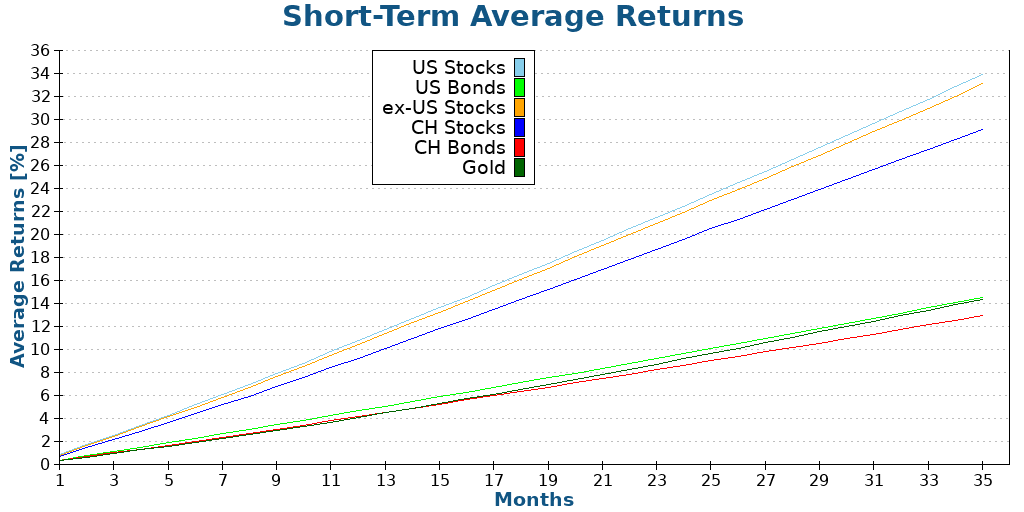

We can look at their average and worst returns over time to see how different asset classes would perform. Best returns are not very interesting because they are too far from the average. I want to reach average returns with my strategy as a passive investor.

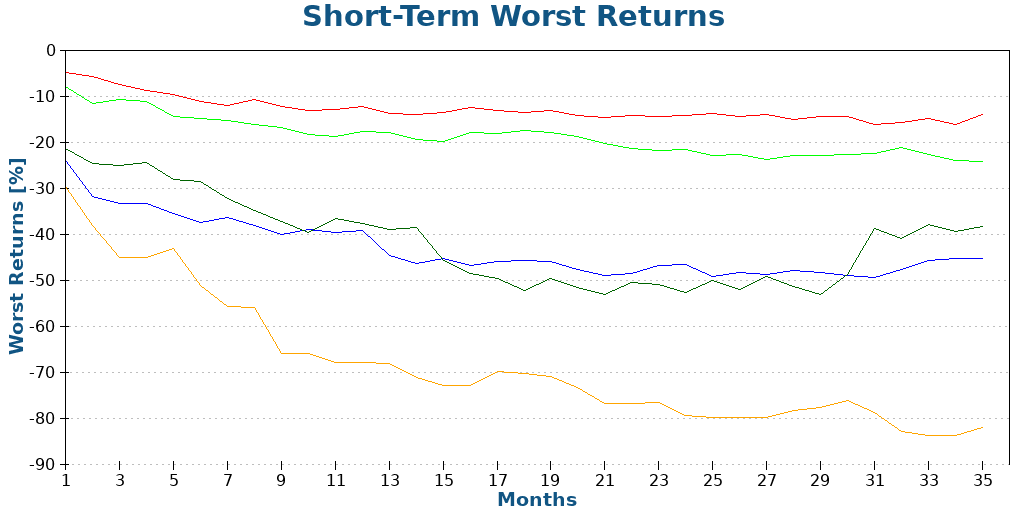

While the worst returns are also somehow extraordinary, like the best returns, they are more important because they show how bad they could become in given periods. This is where the difference between different terms will be significant.

So, let’s start with our returns from 1 to 35 months (the period I consider short-term).

Average returns paint the picture we expect: investments go up on average. This is important because an investment that would, on average, go down would be a bad investment.

If you have a keen eye, you will have noticed that US stocks are not visible on this graph. The reason is that ex-US stocks before 1970 have the same returns as US stocks in my database. And it turns out the worst short-term periods are all before 1970.

These exciting results show that all our asset classes can be negative below three years. Even bonds are likely to perform poorly in the short term. The safest investment would have been Swiss bonds, but it could still have lost more than 10%.

In the worst case, with US stocks, you could have lost more than 80% in three years. If you had 1000 USD initially, you would have less than 200 USD after three years.

This shows that in the short term, no investment is safe.

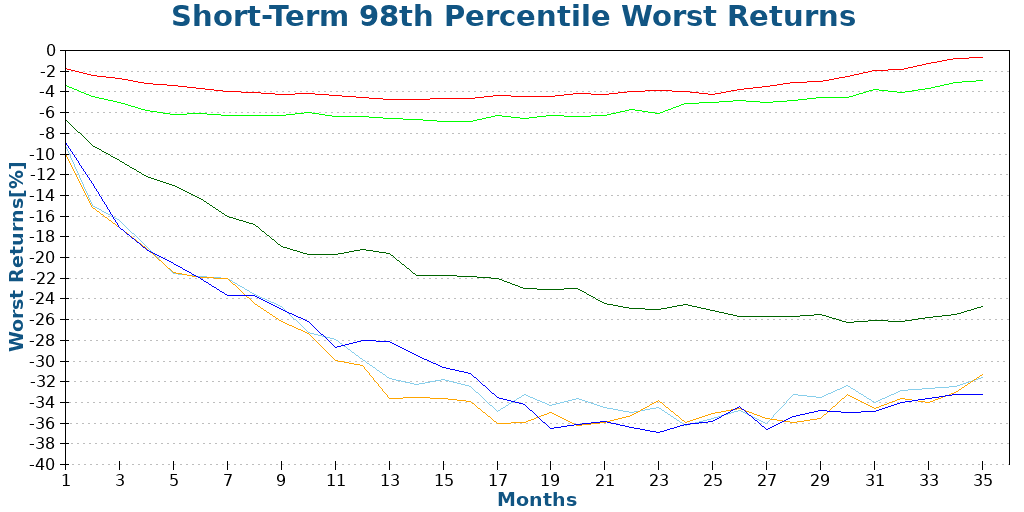

Some people may argue that the worst case is extremely unlikely. So, we should expand on our research. One way to do that is not to consider the worst results. For this, we can eliminate the 2% worst results and keep the worst results of the 98th percentile.

Eliminating the 2% worst outcomes already makes a big difference. The worst results are much less extreme in this case. But people still need to be careful. This means that historically, there was a 2% chance to get lower returns than that. So, people should use a given percentile based on their risk capacity.

Even when eliminating the worst 2% of outcomes, we still do not get any positive returns in the worst case. It means that all situations would have been able to lose money.

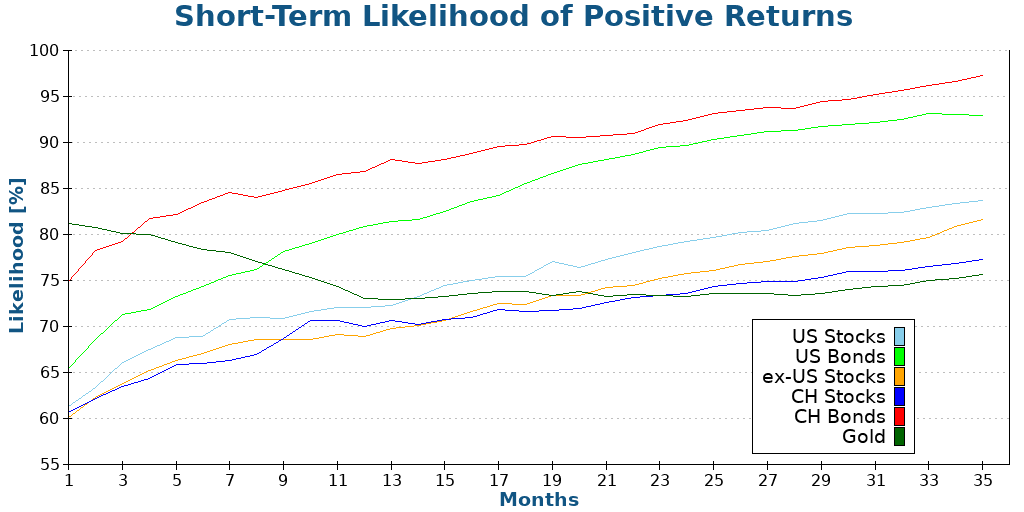

Finally, look at the probability of a positive return in each period. This is very interesting because it gives an idea of the outcomes.

The good news is that you generally have a good likelihood of a positive return. US and Swiss bonds have more than a 90% chance of a positive return after 35 months. The worst place is for gold, which is often seen as a refuge, so it’s interesting.

So, what can you do in the short term? There are still a few options:

- Cash in a bank account (ideally interest-bearing)

- Certificate of deposits from your bank

- Fixed-term notes

If you want, I talk more about the five main short-term investments.

Medium-Term Investing

You are investing for the medium term when you are investing in anything in the next 3 to 10 years. For most people, this term is about saving for a house or shortly before retirement.

We can draw the same graphs for the periods between 36 and 119 months and see how our asset classes perform.

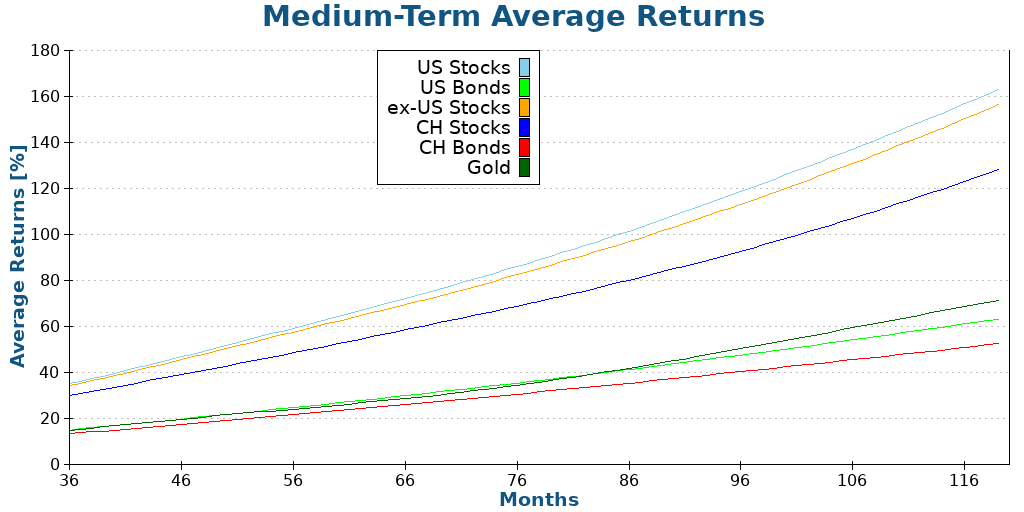

As expected, average returns are going up with time. Over the past ten years, US stocks have already had an average return of 160%, about 10% annualized. But we are more interested in the worst returns.

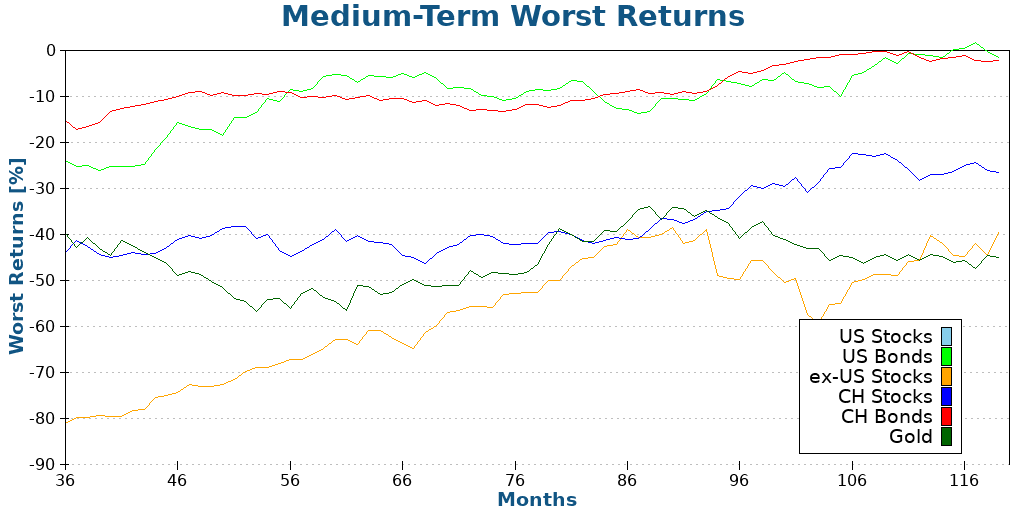

The results are very interesting because only two asset classes come close to being positive: US bonds and CH bonds. And even for these two asset classes, reaching that line takes almost ten years.

US stocks and gold are still very volatile. After ten years, you could still end up with 40% less money than when you started! We must consider the medium term differently than the long term.

It is interesting to note that the worst outcome for Swiss stocks is significantly better than the worst outcome for US stocks.

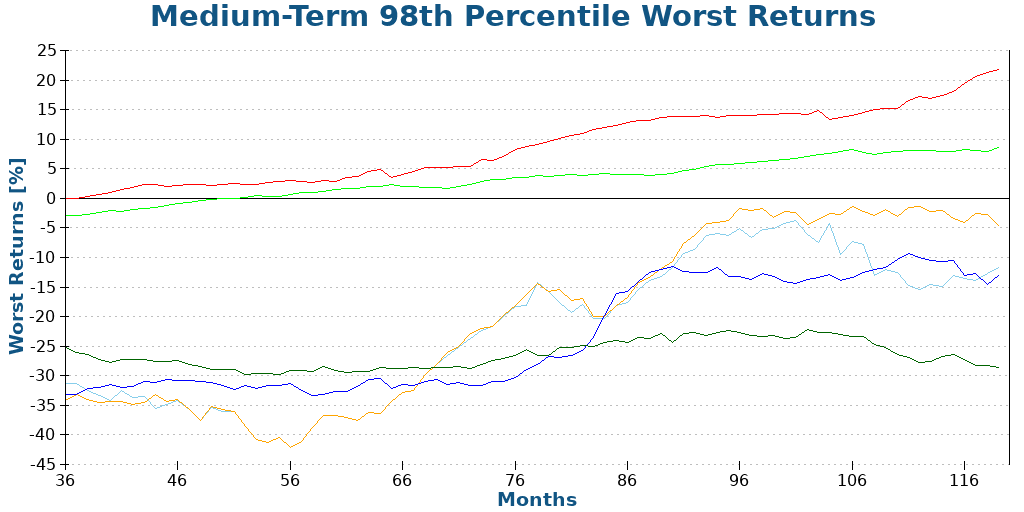

Again, we can eliminate the 2% worst outcomes and see where it takes us.

These results are very interesting. We now have two asset classes for which the worst outcome is nicely positive. Even in the worst case, Swiss and US bonds would have performed well in this situation.

Only Gold is having a tough time in this situation. All stocks are getting close to the positive side.

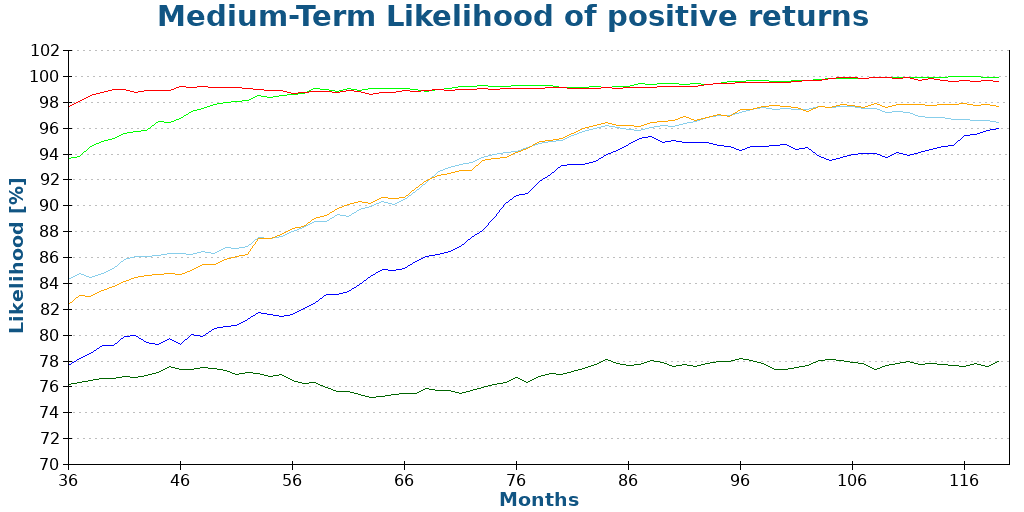

Finally, we look again at the likelihood of positive returns.

Both of our bond asset classes are likely to be positive, and it does not take ten years to reach that point. Stocks are also showing quite a nice increase, getting close to 100%.

With this information, how should we invest for the medium term? Bonds are the safest options. You would get some excellent returns and a high likelihood of being positive. And in the worst case, the negative returns are not too important.

You may also consider stocks if you are ready to take more risks to increase your returns. If you are in the 3—to 5-year range, it is probably best to avoid them. But if you can stomach the risk, it may make sense if you are in the 5—to 10-year range.

A 100% stock portfolio would probably still be too aggressive. However, a combination of bonds and stocks would be good in many cases. As usual, you must tune your asset allocation based on your risk capacity.

Long-Term Investing

Long-term investing is investing in something that lasts more than ten years. This is usually for retirement, but it could also be for a house.

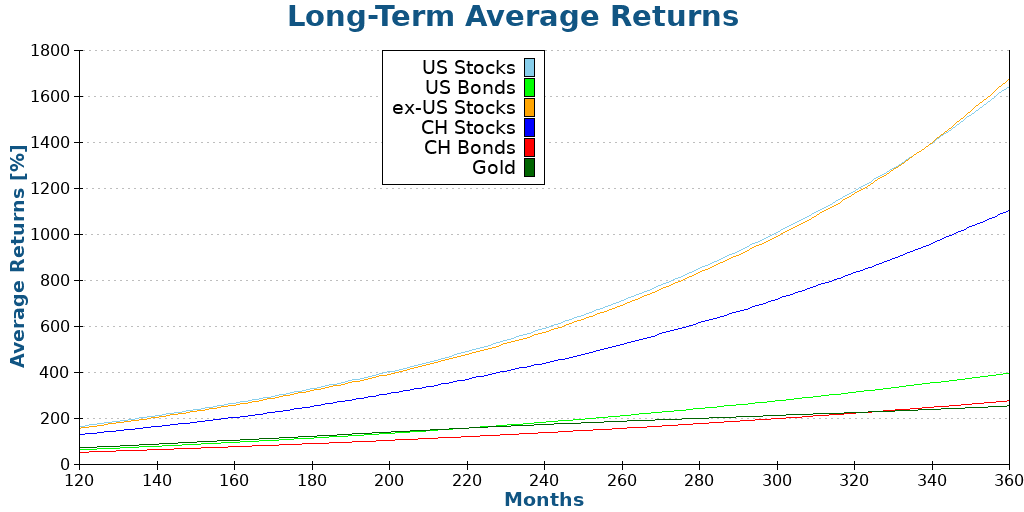

We will generate the same data for 120 months to 360 months to see exactly what long-term investing entails.

As expected, all investment assets are performing even better in the long term. The only interesting information from these results is that after a very long term (320 months and more), Swiss bonds perform better than gold. In fact, for over 30 years, gold has been the worst of our asset classes.

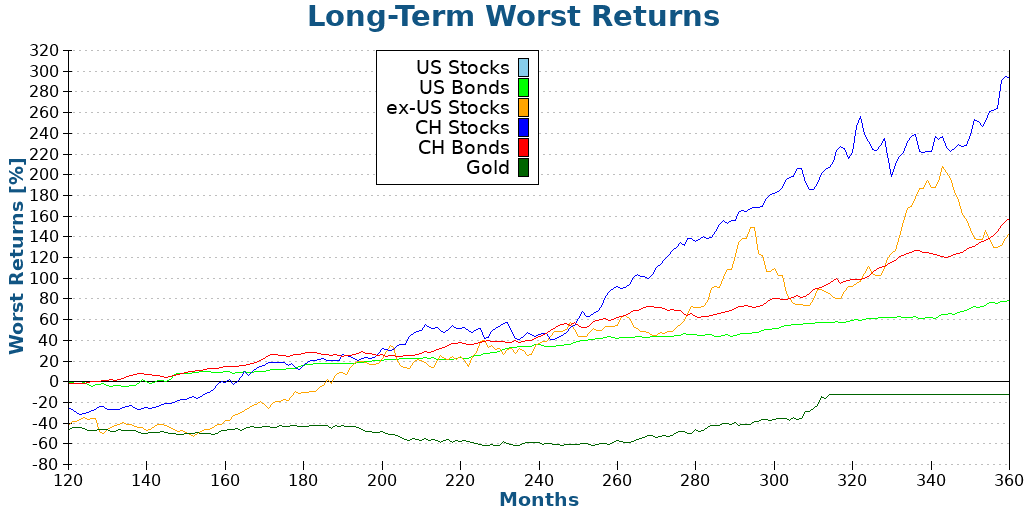

We can now move on to the worst returns of the period because this will be the most interesting in defining long-term investing.

These results show why long-term investing is different. Indeed, all asset classes show a positive worst outcome after about 15 years except for gold. Historically, there were no 16-year periods where stocks were not positive. This is important because it makes us confident that when investing for the long term, we can rely on stocks.

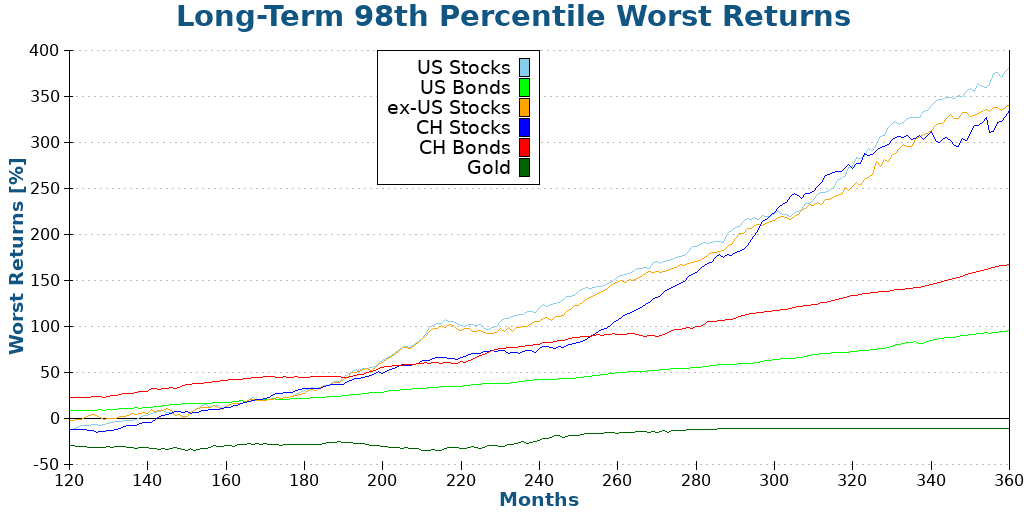

For consistency, we can also eliminate the worst 2% of outcomes to avoid some extreme cases again.

It only takes about 12 years to turn a profit on the worst outcome for most asset classes (but gold). If you are wondering about gold, you should read about the historical returns of gold. Gold had some very long flat periods in the past.

These results are why some people consider starting long-term investing at 15 years. Indeed, after around 15 years, you should no longer see any negative outcomes.

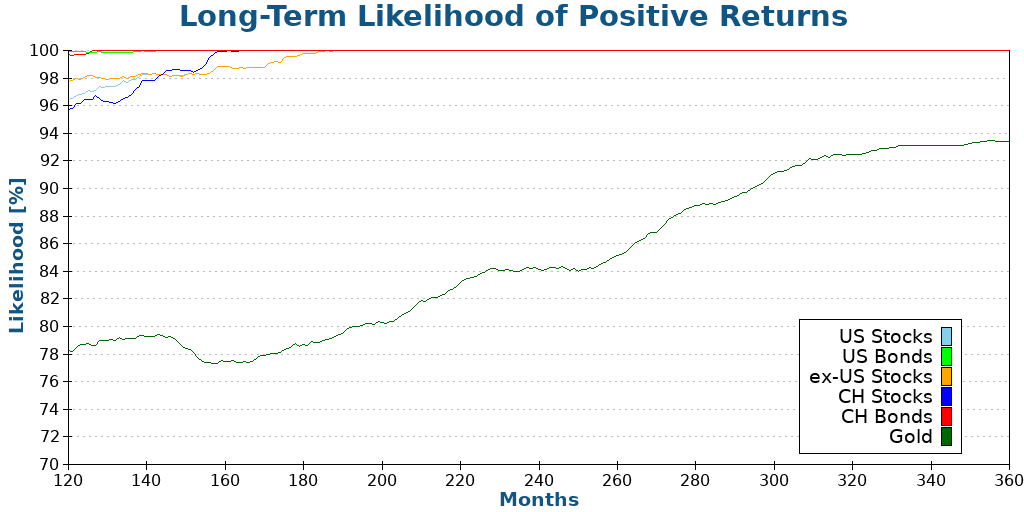

We will also look at the likelihood of positive returns for completeness with the other terms.

This does not say anything interesting except to confirm what we saw in the previous graph. Starting from about 15 years, all asset classes (but gold) have a 100% historical chance of positive returns.

What does it all tell us about long-term investing? It tells us mostly that stocks take a long time to become safe. However, once they become safe, stocks become a potent long-term investing tool.

Should we only use stocks for long-term investing? No. As with everything, the proper allocation of asset classes depends on your risk capacity.

Flexibility

Some people want to be more aggressive even when investing in the short and medium term. Two ways may help with that.

It makes little sense to be 100% in stocks in the short term. However, it could make sense to have some allocation to stocks in the portfolio. We should consider entire asset allocations, not individual assets.

The other way is to accept being more flexible. If you are investing for something in 4 years but are ready to accept that it will take 5 or 6 years, this could allow you to invest more aggressively.

Of course, you have to be realistic about your expectations. You should not invest 100% for a target of 2 years and think you are flexible enough for three years.

However, some flexibility may allow you to invest more aggressively, which may better suit your investing style as long as you are prepared for the worst outcomes.

Conclusion

We cannot invest in the same way whether we are investing in the short term, the medium term, or the long term. Indeed, asset classes perform widely differently over time.

Only for the long term can we invest aggressively and principally in stocks. Any shorter period requires more conservative investments.

Of course, all of this analysis is based on historical data. Although these results are based on more than 150 years of history, we still have no guarantee that something very different will happen in the future. Nevertheless, these results give us a good idea of what could happen.

For me, this comforts the idea that long-term investing should mostly be done with stocks. If you are investing for more than 15 years in the future, we have a strong likelihood of a positive return.

Long-term investing is one of the pillars of my plan for early retirement. Since I know I will not touch this money before retirement, I can invest aggressively.

What about you? For what term do you invest?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- My Investor Policy Statement – You Need One Too!

- Should you use currency hedging in your portfolio?

- How to Choose an Index ETF Portfolio?

Hi Baptiste, recently I started taking care more of my finances after almost 10 years of almost just investing in my job. I had setup a pillar 3a first at my bank but it has nowadays only a mere 1% yearly interest. Now I set up a new pillar with Finpension and moved there also my vested benefits account, so far so good. My bank unfortunately does not have very competent advisors and tend to try to sell their products that mostly are bond based. For the long term I was tempted to make my portfolio more stock based (now is mostly bonds and is quite underperforming). As I can understand from you explanation, since my horizon is around 20 years or so seems a good option.

Cheers

Hi Federico

Thanks for sharing! Banks are indeed not the greatest advisors. This is quite unfortunate because most people trust banks with their money.

Well done already to move your 3a and vested benefits to a good place!

As for your asset allocation, with 20 years, you should probably have a significant allocation to stocks. If you have a good risk capacity, you can go very high with this period. However, if you have a low risk capacity, even with 20 years horizon, you should not be 100% in stocks.

Hello,

Firstly a massive thank you for all your research and suggestions. So far I have set up a pillar 3a with Finpension and an IB account. I hope you received the benefit as I used your links. I have a question regarding holding stocks that have run their course. Over covid, we invested in some blue chip stocks that we expected to recover strongly covid e.g., Hilton Hotels, Restaurant Brands etc. We managed to triple our investment but it ties up quite a lot of cash. The big gains have slowed down now. Are we better to pull out of these stocks and place in other stock opportunities or hold the stocks? So is holding for the long term, really holding for the long term -> as in, no selling just buying and holding. I would appreciate your view on this.

Thanks for all you do!!

Denise

Hi Denise

Thanks for using my links.

I can’t provide personal financial advice, especially in single stocks.

You have to know whether these stocks have value or not for the long term. If you think Hilton will grow for the long-term, then you can keep. If you bought it to make a quick buck, you should likely take your profits.

That’s the advantage of passive investing, I don’t have to worry about these questions.

Thank you for your response. I think I need to do a bit of rebalancing as I was too long in some stocks and need more diversification.

Excellent article!

I expect you took into account inflation and for this reason we get negative returns on bonds?

Hi,

No, I took pure total returns into account, not real returns (adjusted for inflation).

The bond index can definitely go down even without inflation because bond values go up and down as rates go down and up.

Thanks Baptiste as ever for this thought provoking reflection.

When I started saving for early retirement, this was a number of years ago so I was definitely in a long term perspective and thus I invested around 95pc of my savings in ETFs and I’m very happy with their performance.

However, as I’m between 3 and 5 years before I retire early, from your article, I’m wondering if I should continue with the same strategy (in a way it’s a continuation of a long term investment based on dollar cost averaging) or whether any money I invest from now on should follow what your describe as a medium term investment strategy.

Thanks for any ideas on this.

Best regards

It depends :)

If you are going to sell everything in 3-5 years, then you should definitely not invest 95% in stocks.

If you will live off your retirement for a long time, you won’t sell everything and will sell stocks slowly. In this case, you need to reach your retirement allocation and then stick to it.