June 2021 – A warm and quiet month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

June 2021 is already over. It went very fast! After the crappy weather of May, we finally got some better weather, although it was crazy hot. And then we went back to the crappy weather. But overall, it was a good month. We even had a nice short vacation in Thun.

Financially, it was an okay month, despite large expenses due to the vacations, the blog, and some shopping for the house. Overall, we still managed to save 53% of our income this month.

June 2021

June 2021 was a good month for us overall. The beginning of the month had some nice weather again. Unfortunately, the end of the month was back to bad weather with thunderstorms almost every day. Our vegetable garden was almost destroyed by hail! It was great, for a change, to be able to go back outside on the terrace.

On a personal note, we had a vacation for a few days in Thun. It was terrific to enjoy some time off. And Thun is a really nice city with a prime location. There are many things to see in the city and even much more things to see around it.

Of course, the vacation made the month more expensive, but in total, we did not even spend 1000 CHF. However, we went to IKEA on the way to furnish one of the rooms we had not finished yet. So this added a large bill to the month. On top of that, there were many yearly or quarterly bills: AVS for the blog, power for the house, household insurance, …

So, we ended up with large expenses this month. However, we still managed to save 53% of our income. So even though we probably spent too much, it is still a good result! We got some dividends and some reimbursements from the health insurance that bumped our income.

Expenses

Let’s see the details of our expenses in June 2021:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 1186 | Above average | Health and household insurance |

| Transportation | 88 | Average | Bus, Fuel, and one Ship Trip |

| Communications | 87 | Average | Internet, refill of my prepaid |

| Personal | 2767 | Well Above Average | Holidays, large blog expenses, some furniture |

| Food | 778 | Well Above Average | One extra trip to Aligro and several times eating out in Thun |

| Housing | 909 | Above average | Heating, mortgage, and power bill |

| Taxes | 2095 | New average | Canton and commune bills |

In June 2021, we spent 7914CHF in total! That’s significantly more than we are used to spending. Without taxes, we spend 5818 CHF, and this is also significantly higher than what we try to achieve.

For the blog, I had one yearly expense and the quarterly AVS bill. This makes a significant difference. I may account differently for the blog expenses next year.

On top of that, we spend about 1000 CHF on our vacation in Thun. The hotel made a significant difference, and eating out was more expensive as well. But overall, we were quite reasonable, I believe. We also made another trip to IKEA to finish furnishing one room.

So, many of the expenses will not repeat themselves. And looking at these expenses, there is not much I would have done differently. Therefore, I am satisfied with these expenses.

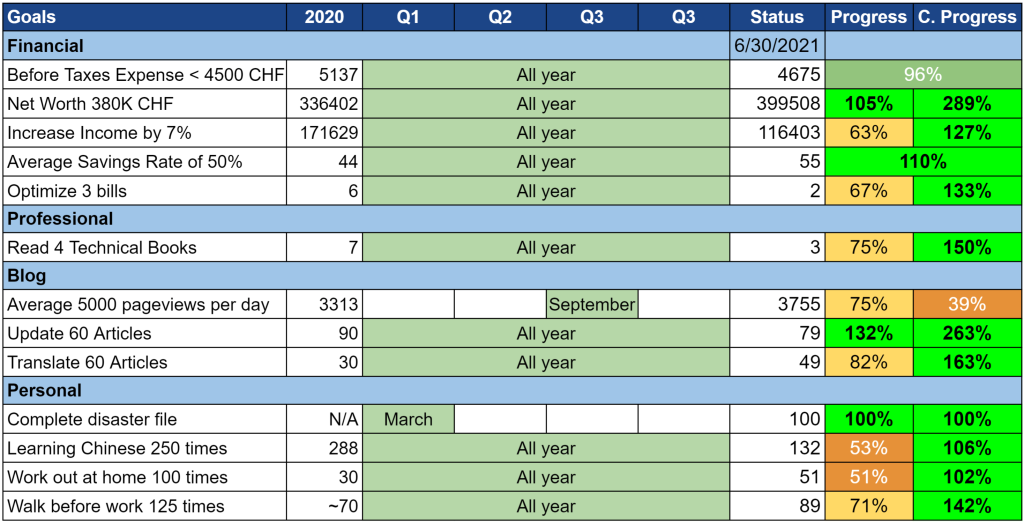

2021 Goals

Let’s take a look at the status of our 2021 goals at the end of June 2021:

Overall, our goals are doing great. There are just two goals that are not doing well.

Our before taxes expense goal went back below 100% because of the expansiveness of this month. I still think we can meet this goal by the end of the year. But it will not be easy, as we knew when we started. Hopefully, next year once the house expenses as settled, we will have a better average.

The other goal is the page view goal for the blog. I am almost back where I started, only 39% of the way to the goal. It seems that nothing I do on the blog increases the page views per month. I do not even manage to keep the same page views monthly. This month the traffic is down almost 10%. This is quite discouraging.

Other than these two goals, the other goals are doing well, and there is not much to tell.

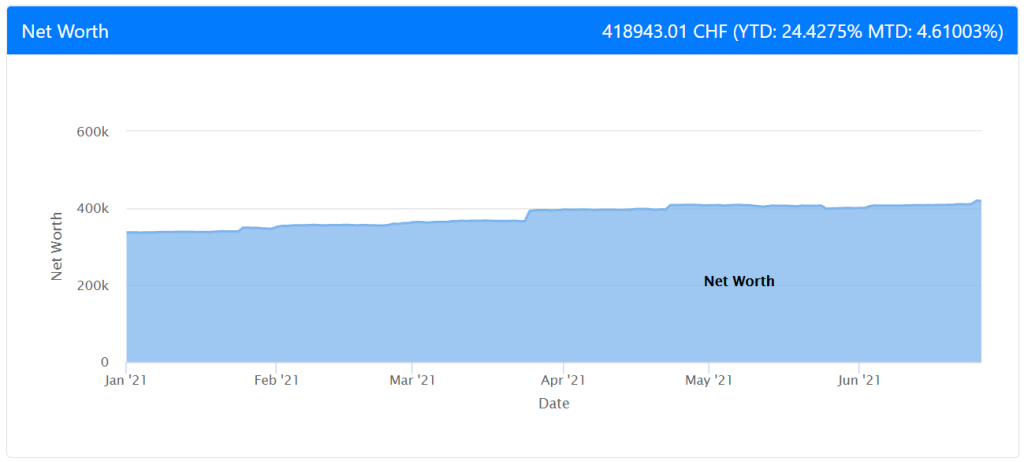

Net Worth

Let’s take a look at our net worth as of June 2021:

We regained this month what we last month with good savings and very nice stock market gains. Also, the USD appreciated against the CHF, helping our recovery too. So, we reached 418K CHF this month.

I am quite happy about this result. There was nothing special that happened to our net worth, but it is good to see the growth of the stock market is starting to help. We also got almost 500 in dividends this month. Now that we are almost fully invested again, it is good to see the dividends coming back.

Next month, the net worth should have a nice bump again with my ESPP shares vesting. But this will highly depend on the stock market before they vest.

The Blog

I had so many things during the month that I did not do much on the blog. I still did some translations and some updates, but fewer than usual. And seeing that the traffic is still declining after the hard work on the previous month does not motivate me to do more.

Next month, I do not have much planned for the blog. I will try to keep it easy.

If you had to read only one article from last month, I would recommend my article about choosing a safe withdrawal rate.

Next Month – July 2021

From a personal point of view, we do not have much planned for July. We have a few events planned with friends and family, but that’s about it. Hopefully, the weather will be more stable.

Financially, it will be bad. We just received our tax report for last year. And as we already knew, we have not paid enough. So, we will have to pay more than 10K CHF in taxes next month. So, we are looking towards a 0% savings rate again next month.

What about you? How was June 2021 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

How do you manage to spend so little on food in Switzerland for two people? I almost spend that much (average around 600 CHF) for myself. Do you never go out to eat and tourist-shop groceries in Germany?

Also, if 1100 CHF in insurances are above average for you two, then you don’t have a lot of them, do you? Do you have anything beyond health and household insurance? Personal liability, legal, car, any provision if you become invalid tomorrow and can’t work anymore?

All in all, your expenses are really low for a couple living a comfortable life in their own house in Switzerland. Do you feel it’s worth it, to constantly worry about not being “frugal” enough just so you can (theoretically) stop worrying at 40? I don’t understand this movement at all, that encourages you to question every single expense and try to force every last penny possible into a savings rate. I prefer to actually live the whole time and not just starting at 40. That includes buying what I Want and not just what’s necessary. If working until retirement age is the price for that, it’s worth it.

Hi Barbara,

We really go out to eat indeed, we don’t drink any soft drinks. But we only shop in Switzerland. I hate driving too much to go all the way to Germany or France :) We have a guide explaining what we do for our food budget.

This month, we had our health insurance and household insurance together. Most months, we only have health insurance. We also have property insurance, legal insurance, and car insurance. OUr personal liability insurance is bundled with household insurance. In Switzerland, we have disability insurance. I don’t insure more than that.

We actually don’t worry about any of our expenses. We are naturally frugal, both of us. We buy everything we want and there is really nothing that would make us happier by spending money on it. But it’s entirely personal and some people need more for their life than others.

Going strong!

cool ++

keep going on ++

Hello TPS,

How do account for your house in the net worth ?

Purchase value ? Market estimation ? not included in the net worth ?

THanks

Hi Steve,

Currently, I use purchase value, because we just bought it. And I plan to get it evaluated every 5 years or so.

And of course, I remove the value of our mortgages, so the real estate value in our net worth is currently only the downpayment.

I think your blog rocks and recommend whenever I can. Keep up the good work !

Thanks a lot for your kind words :)

Hello Mr. Poor Swiss,

thanks for sharing these info, it’s interesting to compare with our situation, even if it’s much different. I have a couple of questions and comments for you, as I have recently started (or re-started) a blog as well.

1) What do you mean by AVS bill for the blog? It’s your hosting cost or something different? I’m self hosting my blog at the moment, so I have almost no bill for it beside domain name but I’m wondering until which daily traffic it would be sustainable and then what cost I would have to plan for it.

2) Why did you set a target for page views? first I’m not sure how reliable it is, does bots indexing the site being counted as well? how to be sure that it’s real reader and if it’s not the same person opening the article twice (on mobile to quickly have a look at a new article, then on PC to read it fully, what I do quite often)? And at the end does it really matter how many views a blog have? I don’t think the view count reflect the quality of the articles, it’s more the resources put on promotion, and retain of follower base the influence the view. When I write, I do it because I like to write, and to share it with others but I would not set it as a target. Unless it’s starting to be business and the blog owner is counting on the revenue generated by the blog, but then you have a risk to be biased and target your blog and articles (title of post, content, subject, length…) toward what earn more and here it would clearly impact the quality of the articles negatively.

No offense in my comments, just open discussion as I’m thinking about it myself. Should I have affiliate links? If yes, should I subscribe to services I would not necessary use to have more affiliate link? Then would I be intensive to write article in priority about services or product that have affiliate links? Or at least, even if I can stay as neutral as possible myself, would I suggest to my reader that I might be biased in anyway just by using affiliate link?

Should I put a donation button or crypto address?

I might be too early to think about that in my blog but I will have eventually if I continue and it grows.

If I can give a direct feedback, as I think it’s infinitely more valuable than any metrics, I really like your blog, the content and frequency of articles (I have stop reading blogs or news site because they started to have dozens and dozens of articles per days and I couldn’t keep up with them or sort the interesting and no-interesting one easily). Thanks again and continue the good work.

Hi Eluc,

1) If you make more than 2300 CHF per year on your side hustle, you have to declare this at the AVS and you will be a portion of your revenues. You can read this article for more details. My hosting is quite cheap currently, about 250 USD per year

2) Simply because it’s a simple goal :) It’s very difficult to quantify readership and impossible to quantify quality. I could have used unique readers per month, but page views and unique readers are still highly correlated. I probably won’t keep this goal. But I wanted to have a goal for my blog and I couldn’t do better. I could have use number of newsletters subscribers instead.

My rule for affiliate links is that it does not impact which service I consider the best. I’d recommend a service with no affiliate link if it’s better than the others. And if the best service has affiliate links, then it’s a bonus for me. Most of the feedback on that is positive and some readers even ask me if I an affiliate link for other services when they open them. But I am sure that some other readers do not like the fact that I am getting some money from the blog and that’s alright by me.

A donation button could work. Many people recommend it to me, but I have never tried.

But in any case, before you get enough trust from your audience (it takes time), affiliate links and codes do not work well.

Thanks a lot for the feedback and discussion, this is great :)

Hello Mr. Poor Swiss,

thank you for your replay and the link to the other article. I wouldn’t think you have to declare already from 2300CHF a year, that’s quite low.

Regarding the metrics, I’ve just started, I see like 20 to 50 views per article. It’s quite low but still more than just my friends and family (and most don’t know about the blog anyway), so I’m wondering if it’s actual reader or not. I didn’t promote much either, just a couple of Tweet and Toot but I don’t have much follower there either.

As you say, it will take time and I have to see if I keep going for some months and if view counts increase depending on the kind of promotion I might do or not.

Hi,

Yes, I was really surprised myself.

If you have Google Analytics, you can see where the readers come from (organic=Google, social, …). Maybe some of your articles are already ranking on Google :)