Our Savings Rate

(Disclosure: Some of the links below may be affiliate links)

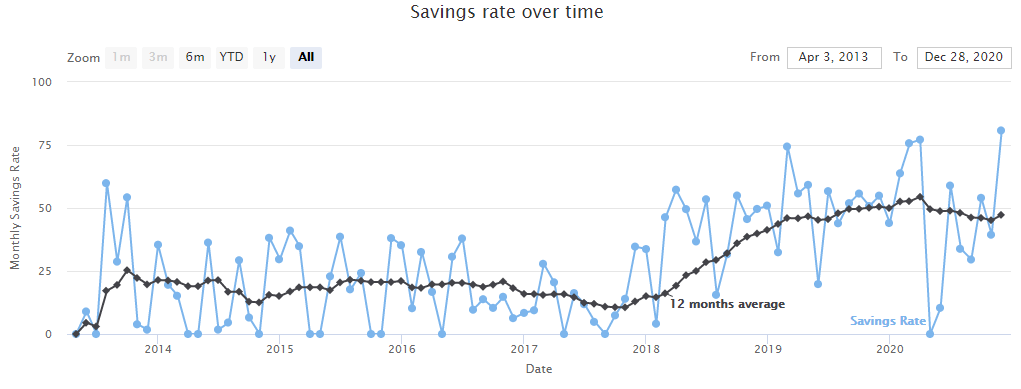

Every month, I verify the status of my budget and investments. For me, one of the most important metrics is my savings rate. Your savings rate is simply your savings divided by your income. At the beginning of this journey, my goal was to have an average savings rate of at least 25% savings.

Now, I am able to consistently save 40% of my salary. I am very likely to increase this goal soon. I think we should be able to save 50% of our income every month, on average. If you want more information, you can read how the savings rate is related to Financial Independence.

Now, I want to explain exactly how we compute our savings rate. Many online people compute their savings rates in order to make it as high as possible. On the other hand, I am trying to make it as fair as possible. For me, our savings rate is (Net Income – All Expenses) / Net Income.

I do not do anything fancy with my savings rate: I do not remove taxes from my expenses, I do not remove my health insurance, I do not add retirement contributions… These are all things that would simply make my savings rate larger without any value! I want to be honest with myself and with you! Inflating my savings rate for showing off would be a disservice to everybody!

On this page, you will find the history of all my savings rates since I have kept track of it. You can also find all my monthly updates in which I share the details of my expenses for each month.

If you want to know even more about us, read more about our numbers.

History

Here is the history of my savings rate over the entire time I have kept track of this important metric:

You can also see the 12-month average over time, in black. As you can see, before I started my journey towards Financial Independence, in late 2017, I was not saving a lot of my income. And worse, my savings rate was decreasing over time. After I improved my finances, I was able to greatly increase my savings rate! My savings rate is now twice higher than when I started to improve it. And I hope to continue to improve it as much as I can.

If you want to follow it month after month, you can read our monthly updates.