Frugal Living in Switzerland Interview 2 – Mr. Road To Fire

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Last month, I started my new interview series: Frugal Living in Switzerland. The first interview with Janet was very well received by my readers. In this series, I am interviewing people that manage to live frugally in Switzerland, one of the most expensive countries in the world.

Today, I am going to interview another frugal person living in Switzerland, Mr. Road To Fire. He is a young manager, saving more than 55% of his income! It is another great example of how you can live very frugally in Switzerland.

Without further ado, here are the answers of Mr. Road To Fire to my questions!

1. Tell us about yourself?

Hi, dear reader of The Poor Swiss! I’m Mr.Road To Fire (RTF), a 27 y/o manager living in the french part of Switzerland. I just moved in with my wonderful girlfriend, and we do not have any kiddos. My main hobbies are spending time with my friends and family, working out, and my blog.

2. How much of your income do you save each month?

My monthly expenses amount on average to CHF 3.3k, and my net income is currently CHF 6.9k. My best month this year was April with a whopping 87.60% saving rate, and my worst one was October with a disappointing 24.19%. Both of the time, non-recurring income/expenses were at play.

So far this year, I managed to keep my savings rate at a sane 57.68%.

3. How do you compute your savings rate?

My saving rate = (net income – total expenses)/net income

My definition of the net income = gross salary – social deductions (incl. AVS, Pillar 2,etc…). It reflects the amount I receive on my bank account every month (=take home pay).

My total expenses include taxes, health insurance, and all other expenses. I do believe that by including all expenses in my calculations except the social deductions, I do incentivize myself to optimize every expense.

Keep in mind that taxes are in no way an un-optimizable expense, even if you are subject to the source tax.

4. Do you consider yourself a frugal person?

Well, even though I am saving a large portion of my income, I do not consider myself an extremely frugal person, rather as a moderately frugal one. I do not aim to be frugal. I just cultivated the habit of buying things that add value to my daily life. This attitude toward spending drastically decreased my level of consumption without decreasing my perceived level of happiness.

I do believe that each cent we spend should buy us at least a tiny bit of happiness :)

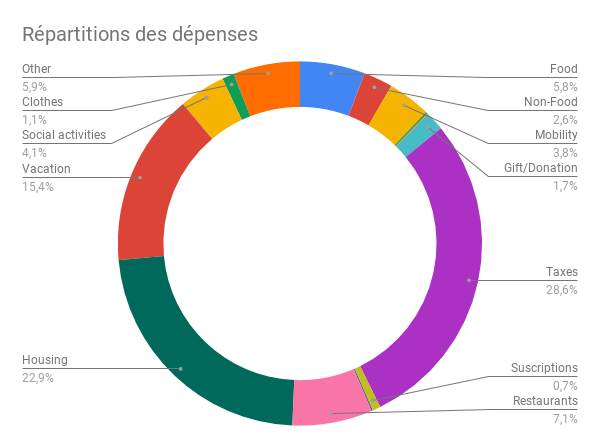

5. Can you give us the breakdown of your expenses?

I hope you like graphs as much as I do! Please find below my year-to-date number for 2019 as well as a visual recap:

| Total effective expenses | YTD |

| Food | CHF 1,340.45 |

| Non-Food | CHF 634.20 |

| Mobility | CHF 1,109.50 |

| Medical | CHF 52.25 |

| Vehicle | CHF 29.00 |

| Gifts | CHF 539.50 |

| Taxes | CHF 8,783.85 |

| Subscriptions | CHF 250.00 |

| Mobile phone | CHF 35.00 |

| Restaurants | CHF 2,327.15 |

| Rent/Apartment | CHF 6,763.20 |

| Internet | CHF 0.00 |

| Services | CHF 0.00 |

| Holidays | CHF 5,289.84 |

| Activities with friends | CHF 1,401.15 |

| Clothes | CHF 280.25 |

| Others | CHF 1,900.59 |

| YTD variable expenses | CHF 30,735.93 |

| YTD fixed expenses | CHF 2,841.30 |

[Mr. The Poor Swiss: Keep in mind that he is only paying for half of the rent and food]

6. Which expense category are you the proudest of?

I’m particularly happy with the amounts I spend on mobility and housing so far. Basically, I do not over-optimize my spending. My motto is to focus on the big three:

- Accommodation

- Mobility/Transportation

- Food

Keep these three expenses at a reasonable level, and you will be fine!

7. What is the main difficulty for living frugally in Switzerland?

I think that an obstacle for living frugally, in general, is the social component. If your friends live a decadent lifestyle, it will be hard for you to live very frugally as you will mainly spend your free time with them.

In Switzerland, lifestyle inflation is vastly prevalent, so that a very large portion of the people that you will encounter will be big spenders. You either have to reduce the amount of time you will spend with them, show them the path to more meaningful spending or find new frugal friends.

I am convinced that the basis for a sane and long-lasting friendship is to accept the other person as she/is. Time is a scarce resource, and I don’t have time to try to change the mindset of my friends completely, or maybe I am just too lazy!.

My friends know that I won’t come to a splurging party (e.g., going to a *****restaurant) with them, so they don’t ask me to come. I accept them the way they are and expect them to do the same about my weirdness :D

8. What is your best tip for frugal living in Switzerland?

The most impactful change I experienced was to switch from a “price” perspective to a “value” perspective. I really think about the potential added value of stuff I wish to buy. Cheap ultimately does not encapsulate value. As Warren says: “price is what you pay, value is what you get”.

As a result, I buy less stuff, and sometimes I choose the more expensive alternative because it is a good value for me. I think that cultivating this spirit will yield far greater results than saving CHF 5 on your next phone plan.

9. Why are you saving so much money?

I definitely save to invest the maximum amount I can and thus generate more wealth. I want, in a first step, to achieve financial serenity, and in a later stage, to reach financial independence. My ultimate goal is being able to organize my life as I wish to, without financial constraints.

10. If you had more income, would you spend more?

If I get a raise at work, I mentally allow myself to increase my spending by 20% of the amount of the said raise and save the remaining 80%. That’s the simple rule I set for myself.

Notwithstanding the above, it would currently be pretty hard to increase my spending, since I consider I already have/possess everything that could bring me long-lasting happiness. Therefore, an increase in my spending wouldn’t translate into an increase in my quality of life.

11. Do you ever feel you are sacrificing something by living like that?

Never, ever. I think I reached the frugal zenitude :D

12. Do you splurge on anything?

I have to admit that I could spend a rather unreasonable amount of money on wine, but so far Mrs. RTF is doing a great job keeping me away from wine tasting and vineyards ;)

13. Do you have a budget?

Yes, I find budgeting to be very useful for optimizing my spending. I budget my spending categories for the whole year, and then at the end of the year, I undertake an “effective versus budgeted” analysis. This allows me to reflect on my spending habits and try to find further ways to reduce my spending.

I created my own spreadsheet, feel free to give it a look, and to copy it. Any feedback is welcome. I am working toward a new version.

14. Are you setting aside some “fun money” each month?

No, not really.

Thanks a lot to Mr. RTF for answering my questions. He is saving more than 55% of his income! It is great! I need to improve my savings if I want to compete with the persons I am interviewing.

If you want to learn more about Mr. RTF, he is blogging at Road To FIRE (in French). He has some really good articles I would encourage to check out!

If you want to learn about frugal living in Switzerland, you can read the interview with Janet, a Ph.D. student saving more than 60% of her income. Or, you can read the interview of Thomas, saving more than 80% of her income.

If you are living a frugal life in Switzerland, I would love to interview you! Let me know in the comments below or via the Contact page. It is not only for bloggers!

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Money-Saving Tips

- More articles about Save

- Fight Food Waste with Too Good To Go

- Frugal Living in Switzerland Interview 4 – Mustachian Post

- 8 Frugal Tips to Ski For Less in Switzerland

Very interesting to find so many FIRE people in Switzerland. I have read a lot of books and watched videos about investment and FIRE, but most of the resources are largely US oriented. I find it not 100% applicable to Switzerland, especially the investing part.

Happy to read about all the blogs and gain some insights. Thank you.

Hi Yasi,

Yes, books are heavily U.S. oriented. A lot of the advice is not really applicable.

Hopefully, you can find something more applicable on my blog :)

Thanks for stopping by!

Ahoy!

Thank for the interesting questions and the interest showed to my current situation. I just want to highlight that the figures presented were my YTD numbers as of mid November, thus they do not represent my total expenses for the whole 2019 year.

Should you wish to discover my total expenses for 2019, you can surf on my blog next week as I will publish a financial recap of 2019 incl. my total expenses, revenues,etc…

Regarding the appartment question: My average monthly housing cost for 2019 is about CHF 750. I lived in Zurich 2 months, then the rest of the year in Fribourg, which helps me to reduce this cost significantly :D. Since last November, I live together with my girlfriend and bear 60% of the rent cost (approx. CHF 1.1k per month), which is IMHO far from frugal! Prior to this I was living in a shared flat.

Regarding the food budget: Basically I split my food expenses between meal taken at home (=food) and meals taken outside (=restaurants). The total cost of my food budget amounts as of beg. Nov. to CHF 3’667 or approx. CHF 370.- per month. Given the fact that my girlfriend pays about the same for her food budget, we cumulate more than CHF 700 for food, which seems reasonnable to me :)) Insider advice: Lidl and Aldi are incredibly cheap!

Feel free to get in touch with me should you wish to get further insights on my budget.

I wish to all of you a bright start in 2020!

Hi,

Thank you for this serie of interesting interviews.

I’m surprised by the low annual figure for food expenses, roughly CHF 1500 or CHF 125/month.

If not limited to tin cans, a diversified diet can be an important part of a budget even by consuming seasonal/locally sourced food products and few dairy, fresh meat and fish.

Could Mr. RTF develop more regarding his food expenses ? Buying in bulk package ? Buying groceries in France ? Limited consumption of fresh meat and fish ?

Thank you in advance

Happy holidays season

Hi Guillaume,

Great question! I think Mr. RTF only pays for half of the food budget. This would put at 250 CHF per month. Which is still low but reasonable.

As for the details, let’s see if Mr. RTF can give us some more details!

Thanks for stopping by!

Nice interview. It would be helpful for people looking to safe as much as possible to know the location of the person you are interviewing. I was shocked when I read he spent 6k on the apartment. Then again I live in a very cheap apartment too, but in Zurich which adds up.

Hi doneby40,

This is a great point! I think Mr. RTF is in the Fribourg region.

But don’t forget that he only pays half of the apartment, his girlfriend pays for the other half.

I will add a note in the article regarding this fact.

Thanks for stopping by!

Great interview. Nice job of saving about 57% of your income. I’m definitely not there yet! Keep it up!

Hi Financial Chipmunk,

Glad you liked the interview!

Good luck with increasing your savings rate!

We are not at that level either. But we are getting there. Our 12 months average just reached 50% recently.

Thanks for stopping by!

As a resident in Malta this was interesting to read seeing the huge difference in salary but savings rate in terms of % similar.

Seems to give to a theme that when young live and work in an expensive country whilst remaining frugal to a degree of being able to save and invest to reside in a cheaper country when older to increase lifestyle significantly and spending power.

Also interesting to see similar expense models are similar between very different countries.

Good article, thanks!

Hi Alan,

That’s a good point! It is more interesting to compare the percentages than the absolute values. In the end, it’s all that matters for Financial Independence if you retire where you work.

It Malta a good place to reach FI? I have never been there.

Thanks for stopping by!

Ahoy!

Thanks for the interview, it was really fun to answer your questions! I am looking forward reading the next interview :)

You will definitely be able to compete against my saving rate in the near future. There are some changes in my daily life coming up, which will greatly impact my future saving rates ;)

Hi Mr. RTF,

Thanks again for doing it with me :)

I really enjoyed your answers!

I am looking forward to doing the next interview as well.

Hopefully, we will able to keep our savings rate very high, but I am not sure I can compete with your current level :)

And we also plan on buying a house and founding a family. This won’t help our savings rate, at least in the short-term.

What do you have planned if I can ask?

Thanks for stopping by

Glad to know there is another FIRE enthusiast in town :) I really enjoy reading these frugal living series – they are so interesting and insightful. Keep up the great work Mr. TPS!

Hi Mama Bear,

I am glad you enjoy this series! It has been also very interesting for me!

Would you like to be the next one to answer my questions? :)

Thanks for stopping by!

Haha if course! It would be my pleasure!

Actually I thought about joining your series but got busy lately (holidays) and I also committed myself to doing 2 guest posts on other blogs. I’ll shoot you an email early Jan and we can coordinate from there :))

Awesome!

That works for me!