The stock market and the economy: They are not the same

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Many people wonder why the stock market is going up so high. Indeed, at the same time, most world economies are in trouble. But the stock market keeps going up.

While they are sometimes correlated, the stock market differs from the economy. It is essential to realize that the stock market and the economy are different. So, we must go over why the stock market is not the economy.

In this article, I describe both concepts and then try to pin the main differences between the stock market and the economy.

The Stock Market

We should start by defining what the stock market is. The Stock market represents all the publicly-traded companies. A stock exchange is where we can trade shares of these companies.

So, the value of these shares represents the value of these companies and hence the value of the stock market.

We generally measure how well or how bad the stock market is doing with stock market indexes. For instance, we typically evaluate the performance of the American stock market with the S&P 500 index. And in Switzerland, we use the Swiss Performance Index (SPI) to talk about the performance of the Swiss stock market. A high value indicates a good performance, while a lower value indicates a lower performance.

The stock market is based on demand. Investors like you, and I are investing in companies to get a return on their investments. Investors are buying shares of a company to participate in its future profits.

So, expectations about the future are driving the prices of the stock market.

The Economy

The economy represents how well the economy of a country is doing. The value of the economy is a measure of the entire economy, of all the businesses of a country or region.

There are many possible measures for how well or how bad an economy is doing:

- The production of goods

- The consumption of goods

- Employment rate

- Rate of creation of new jobs

- Gross Domestic Product (GDP)

- GDP Growth

So, there are many metrics for the economy. All of these metrics can show how good or how bad the economy is doing. For instance, during COVID-19, the exceptionally high unemployment rate was a bad sign for the economy. In general, the most used metric for the economy is the GDP Growth of a country. For instance, the U.S. uses this metric to evaluate when a country enters a recession.

So, many economic factors about many businesses are driving the value of the economy.

Now that we define both concepts, we can see what makes the stock market and the economy different.

The economy is bigger than the stock market

One big difference between the stock market and the economy is simply that the economy is bigger than the stock market.

Many companies are not listed on the stock market. It means many people are employed by companies, not in the stock market. In most countries, there are many very small companies. These small companies contribute to the economy but not to the stock market.

When many companies outside of the stock market go bankrupt, this can have a large effect on the economy but not that significant on the stock market. This fact is fundamental because it shows that different factors affect the stock market and the economy.

Sometimes, it is more complicated because a small company could consume goods from a bigger one. As such, many small bankruptcies could have a ripple effect on the stock market as well. But in general, very small companies do not affect the stock market.

Another difference is that some huge companies often drive the stock market price. For instance, Apple represents about 7.5% of the S&P 500 index. One company represents 7.5% of 500 companies. So, a change in Apple can change the stock market. But the economy itself would not be impacted.

Looking forward or looking back

There is something fundamental about the stock market: it is looking forward.

The stock market reflects the possibility of future earnings. If investors expect companies’ future to be good, the stock market would be good. A good stock price can happen even with the current state of a company being bad.

On the other hand, the state of the economy is backward-looking. When information about the economy is released, it is already outdated. For instance, the start of a recession is announced several months after the event.

So, when an economic event occurs, it should already be priced into the stock market. We observed this forward pricing during the stock market crash of 2008. Indeed, when the National Bureau of Economics (NBER) announced the start of the recession, the stock market was already crashing down. And when the NBER announced the recession’s end, the stock market had already been recovering for months.

If investors are optimistic about the future, the stock market will go well even if the economy is doing badly now. The direction they are looking to is an essential difference between the stock market and the economy.

The economy is about real results

The economy is good when people are spending money and companies are selling stuff and services.

But since the stock market is looking forward, a company does not have to sell much stuff now to be highly priced. It is enough that investors think that it will sell more in the future. For instance, Tesla started being very valuable in the stock market before it sold many cars. But its contribution to the economy at this point was very low.

So, the stock market is about expectations. And what is important is that the stock market will react based on how expectations are met. If the results are better or worse than expected, the stock market will react. These are not the same signals that are impacting the economy.

Since the same values do not drive the stock market and the economy, we cannot expect them to correlate fully.

Giant companies drive the stock market

The stock market is very skewed towards giant companies.

For instance, even in the Russell 3000 index (the 3000 largest publicly-traded companies in the U.S.), 24% of the value is concentrated in the ten largest companies. In Switzerland, this is much worse: three companies make up more than 50% of the Swiss stock market.

But these companies represent a much lower percentage of the economy itself. For instance, Apple, the biggest company in the U.S., represents about 5% of the entire stock market, but it contributes to less than 1% of the GDP. So, if Apple does well, it will impact more the stock market than it will affect the economy. This difference is fundamental.

In 2020, a few giant tech companies, such as Apple, Amazon, Microsoft, and Google, dominate the U.S. stock market. But the entire economy is not as much dominated by them. During COVID-19, the tech giants did very well and helped drive the stock market. But this did not affect the economy so much.

So, this skewing towards huge companies is another important difference between the stock market and the economy.

The stock market can be irrational

The stock market is also driven by demand. And investors are not always rational.

When there is a lot of irrationality in the stock market, it creates bubbles. And when the correction comes, the bubble bursts. There have been many stock market bubbles in the economy. And frequently, during these bubbles, the economic impact is much lower.

The reason is that bubbles in the stock market do not always translate into the economy. Or at least they do not have as much impact.

For instance, the dotcom bubble is comparable to the housing crash 2008 in terms of stock market losses. However, the first one led to a mild recession, while the second one led to the so-called Great Recession which was much stronger.

So, the irrationality of the stock market is one of the significant differences between the stock market and the economy.

To learn more, read about recessions and stock market crashes.

COVID-19: The Stock Market vs The Economy

The recent crisis due to the COVID-19 is an excellent example of a disconnect between the stock market and the economy.

Here is the graph of the S&P 500 Index for 2020:

In late February, the stock market started plunging after the virus began to hit the U.S. hard and took them unprepared. In one month, the stock market lost 35% of its value. But in less than five months, the stock market recouped all its losses and reached new highs. Both the downfall and the recovery were swift events.

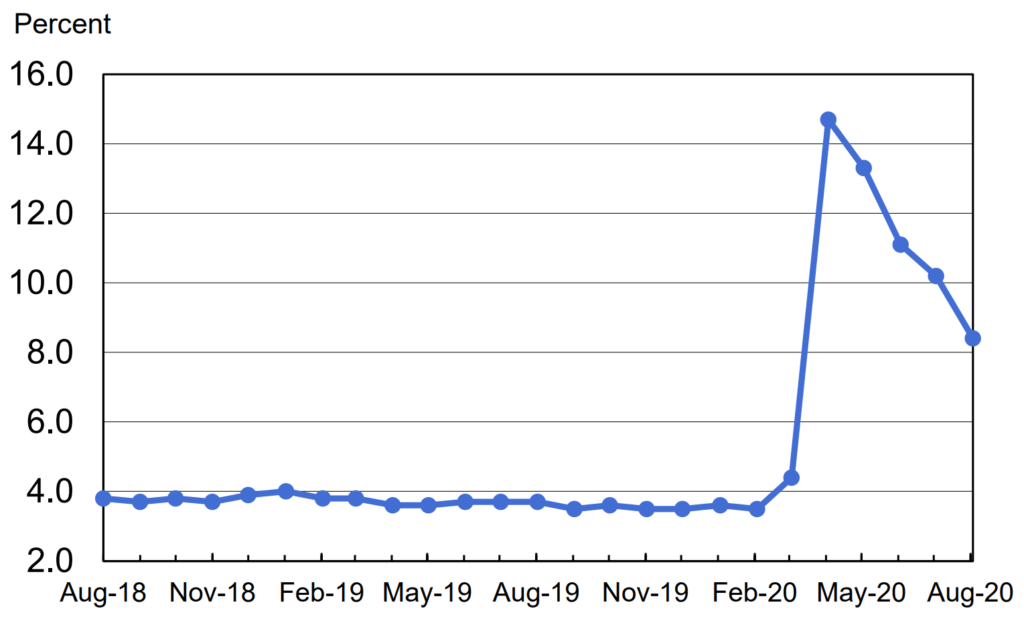

Now, we can look at the official unemployment rate from the U.S. government:

Even in August 2020, more than 8% of U.S. people were unemployed. And the peak of COVID-19, more than 14% were unemployed. The last time the U.S. saw such numbers was during the Great Depression in the 1930s. But simultaneously, the stock market is recovering at record speed.

We can also look at the U.S. GDP for 2020. We do not have official numbers because official sources take their time to announce the results. But current estimates give -5% GDP in the first quarter of 2020. And current estimations are about -32% for the second quarter. A -5% is not that big of a drop, but a decline of 32% is enormous. Since GDP is reported for the U.S., it never dropped that much in a quarter. And yet, the stock market is at an all-time high.

Many things can explain the differences between the stock market and the economy during COVID-19, and several of these reasons have already been covered in the previous sections.

But there are a few more interesting facts about this crisis. For instance, the Tech Industry did very well. Since everybody was at home, everybody was online! And when many people are online, the tech industry generally does well! So, the recovery of the stock market was mostly driven by the tech sector.

The stock market has also seen an afflux of new investors. Many people locked at home tried stock market investing for the first time. So this drove a new afflux of money into the stock market and helped drive the prices back up.

Also, the fact that the yields were set to zero made stocks more attractive. People do not want to store their money in a bank account at zero interest rates. Instead, they prefer investing in the stock market to increase their returns.

Finally, the Fed injected a ton of money into the stock market. They have been buying bonds from banks. And banks now have more money to lend to people and to invest in the stock market. And the U.S. government has also distributed stimulus checks to many people in the U.S. These checks helped people during the crisis. So, compared to other crises, people could spend money during the crisis.

The COVID-19 crisis is an excellent example of the disconnect between the stock market and the economy!

Conclusion

To conclude, the stock market and the economy are different. As goes the famous saying, the stock market is not the economy. There are cases when these two concepts are correlated. But generally, they do not represent the same thing. As such, it is usually better to ignore news about the economy when investing.

During the recent COVID-19 stock market crash and recovery, we have seen this disconnection comes into play. While the economy still has not entirely recovered, and many people are jobless, the stock market has been reaching new highs.

Different factors drive the stock market and the economy. The economy represents the current state of an ensemble of economic factors, and this state is often delayed (looking backward). On the other hand, the stock market is driven by future expectations (looking forward).

Now, both the stock market and the economy are important. Nobody wants an economy that is not doing well. People want jobs, and the economy will provide it to them, not a bull market. But it is important to be able to distinguish these two concepts.

To learn more about the stock market, read about the biggest myths of the stock market. And to learn more about the economy, read about recessions and depressions, it is a timely subject.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- What is the Modern Portfolio Theory?

- Swiss Investors May Lose Access to US-Domiciled ETFs

- Financial advisors – Do not get ripped off

Article très informatif, merci pour ton travail.

Merci :)

Thank you for the extremely clear explanation and for the great content!

Hi Hector,

Glad you liked it!

Thanks for stopping by!