The 6 Biggest Problems of Investing in Cryptocurrencies

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Recently, we talked about how cryptocurrencies worked. Then, we looked at the history of cryptocurrencies. Finally, I discuss what I think is wrong with them.

Cryptocurrencies are not an investment. When you buy a cryptocurrency, you do not buy any value. You speculate that other people will later give a higher value than what you paid. This speculation, or even gambling, is not investing. Moreover, there are several problems with investing in a cryptocurrency that you do not have with stocks. So, we will see what these problems are!

1. Cryptocurrencies have no real value

I am not saying you cannot buy things with cryptocurrencies because you can. You can also exchange them for standard currency and do what you want with them.

However, as an investment, they have no real value. When you invest in a company by buying stocks, you buy a part of the company. This company has assets and generates earnings. Your shares represent a part of these assets and earnings. They may even grant you some dividends.

But when you buy some cryptocurrencies, you do not buy any value. You buy a coin with some currency, and you hope to exchange the coin for more currency later.

This lack of value is also the opinion of Warren Buffett, who said, “You are just hoping the next guy pays more. And you only feel you will find the next guy to pay more if he thinks he will find someone that will pay even more”.

Investing in something without value is not an investment. It is speculation! There is nothing wrong with speculation. You need to be aware of what it is. And you should be mindful of the risks. You should not treat cryptocurrencies like you treat stocks.

2. Cryptocurrencies are highly volatile

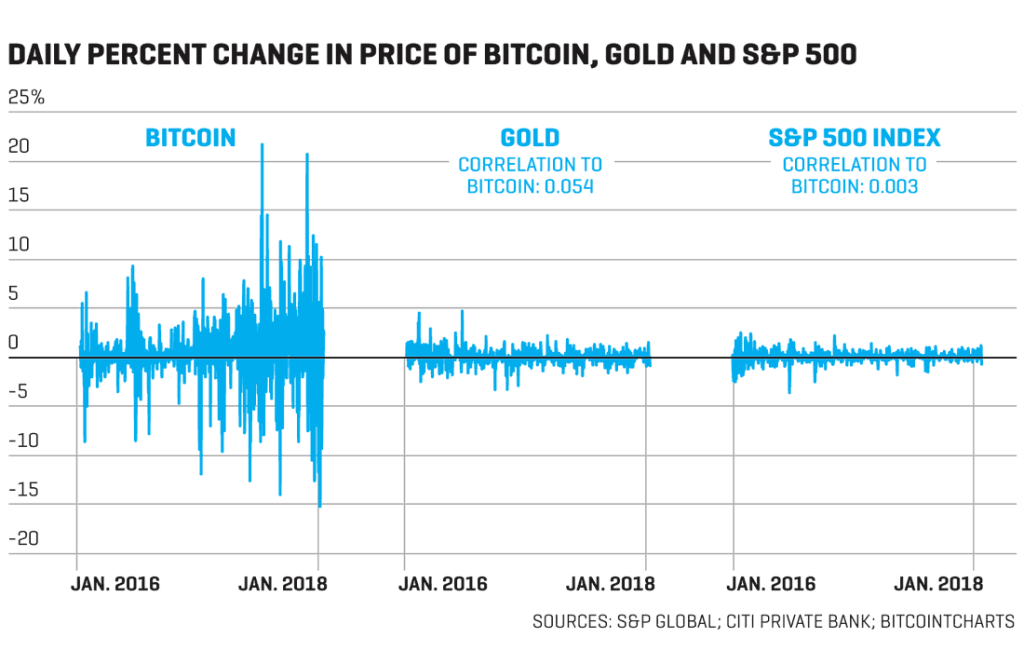

Bitcoin’s price has been highly volatile since the beginning. And it has been the same for most cryptocurrencies. Just take a look at the chart above. It is very easy to see that daily volatility in the last two years has been much higher on bitcoin than on gold or stocks.

Moreover, the price of a cryptocurrency is not tied to any value like the price of a stock. So they mostly react to news and investor appeals. There is an extreme herd mentality with them. And this can change very fast. It is not uncommon to have a daily change of more than 10% with cryptocurrencies.

On the other hand, this is very rare for stocks. But not impossible for stocks either. You need to remember as well that stocks can be quite volatile!

An extreme example is the TerraUSD currency which lost 90% of its value in one week. It is currently almost worthless. In one month, people lost 99% of their investment. About 60 billion USD has been erased in the crash.

3. Cryptocurrencies are too anonymous

Cryptocurrencies are highly anonymous.

I believe they are too anonymous. There is a record of all the transactions. The record is the base of the blockchain. But the only thing recorded is your public key or your user name. If you know the public key of someone, you can know how much he got in the public information. However, typically, you do not know who is behind the public keys. That means you can send money to someone, and nobody will know that the money is coming from you if they do not know who is behind your public key.

This total anonymity is a severe problem, in my opinion. It is too easy to use cryptocurrencies for criminal activities. While they could do the same with cash, now they can instantly send money from one account to another. And all this in total anonymity. Criminals can also use this for tax evasion.

Bill Gates also shared this concern in a recent Reddit Ask-Me-Anything (AMA) by saying, “The main feature of cryptocurrencies is their anonymity. I do not think this is a good thing.”.

I think cryptocurrencies need more regulations and security before they can become mainstream.

4. Cryptocurrencies have a terrible environmental impact

The mining of cryptocurrencies, which is at their heart, consumes a lot of energy. As of 2022, we estimate that the bitcoin network consumes about 150 TWh per year. This consumption is more than the energy consumption of a country like Argentina (45 million people)!

Some miners use renewable energy for their operations. However, most of them are in rural areas where cheap energy is. For instance, there are many of them in China, where the primary energy source is coal, which is hugely environment-unfriendly!

You can do what you do with cryptocurrencies with other currencies. But without the extreme energy consumption. It does not make sense to consume so much energy for a simple currency. Something should be done to reduce their energy consumption in the future. We already have enough environmental concerns in the world without this one!

5. Cryptocurrencies lack protection

There is much less protection when you trade cryptocurrencies than when you trade stocks. First, there is no protection against insider trading. In stock trading, insiders from a company are prohibited from using the internal knowledge of the company to make a profit on the stock market. There is no such thing in the cryptocurrency market. If an insider has more information than the others, he can still do what he wants.

Another lack of protection is in the guarantee. If you invest 100’000 dollars in cryptocurrencies and keep your coins on the exchange website, nothing is protecting you against the exchange’s bankruptcy. If the exchange closes down, you lose everything. Stocks and cash are insured in most countries (by FDIC and SIPC in the U.S., for instance).

There are also some guarantees for the price you pay for stocks. For instance, they are laws that make sure you do not get a worse price than the best offer there is at that time. But there are no such things for cryptocurrencies. As such, different exchange websites can have a large difference in price.

6. Cryptocurrencies encourage criminal activities

Since transactions on a cryptocurrency exchange remain anonymous, many criminals use cryptocurrencies to get money.

On top of that, it is a global network without any borders. So, it is easy for a criminal in Russia to ask for money from someone in Switzerland, for instance. And since it is not regulated, nobody will go and block you from using the crypto exchange.

For instance, in most ransomware situations, the criminals ask for a ransom in bitcoin and give several wallets for the payment to make it even more challenging to trace them.

Overall, cryptocurrencies make it easy for criminals to get or move money.

Conclusion

While I am very interested in the technology behind cryptocurrencies, I am not interested in them as an investment.

Cryptocurrencies are not an investment. They are speculation. When you invest in stocks, you invest in some value, generally the company’s value. Or the future value of the company. However, cryptocurrencies have no intrinsic value. If you want to gamble your money, it is okay. You need to be aware that you are doing it. Do not start gambling a second mortgage on cryptocurrency and saying it is a safe investment. It is not!

For now, I do not want to invest in cryptocurrencies. I already gambled some money into them in the past. And I consider this one of my biggest investing mistakes. In the past, I believed it was an investment. But now I know that they are not an investment. You can use them as your fun money. But you need to be prepared to lose it all!

I am not saying you cannot make money with crypto-currencies. Many people have made a ton of money with crypto-currencies. I am only arguing that they are not a good investment.

What about you? What do you think about cryptocurrencies? Are you speculating on them?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Alternative Investments

- More articles about Investing

- Cryptocurrencies in nutshell – How do they work?

- 6 Good Reasons to Invest in Real Estate

- A short history of Cryptocurrencies

gold had no value per sey. you can’t go to Coop and buy anything for gold.

gold mining has a terrible impact on environment.

its value is also highly volatile.

when bitcoin price hits 500K, its market cap will reach that of gold.

simply consider bitcoin as a better version of commodity than gold is.

now, a question – why pay greedy bankers for storage of your gold, if you can keep crypto on your cold wallet?

Hi Arsen,

Gold has the value of rarity (rare things are expensive), but it’s true that Bitcoin has some rarity.

I don’t particularly like gold either, but gold has been valuable for thousands of years. I’d much rather hold some gold than some bitcoin.

PoorSwiss,

It’s interesting to look at the same data points but take different paths. I guess that’s one reason why it’s called “personal” finance. In any event, I have actually increased my allocation in digital assets and thus far it’s been great for me the past several years. Then again, I’m a long-term hodler. Amongst other institutions, it’s very telling that Blackrock is now applying for a BTC spot ETF. I don’t buy paper shares but as time passes, certain crypto projects become more and more appealing.

WH

Hi WH

Totally agree that there are plenty of paths to personal finance :)

And I am glad digital assets work for you! Thanks for sharing!

You have shared the harsh truth behind cryptocurrency. Thanks for being so honest. But I think, if you don’t take cryptocurrency as a longterm investment asset and do some day trading, you can make some money with a little risk. What do you think?

Yes, you can make some money with crypto, many people did. But I would not say little risk, but high risk.

Good evening PoorSwiss,

Happy new year and wishing you good luck for 2021! I would like you please to clarify me the following:

Does cryptos like bitcoin and ether should be declared in Switzerland if bought during 2021, with a value of less than 2000 CHF? and if I have sold part of them in 2021 and still hold some in 2022?

If so, please explain how. I struggling to find information on this matter and for the next tax declaration.

Last thing is about the Neon bank or revolut/ any other online bank account. Do I have also to declare this accounts in Switzerland, even if I do not hold much money on them (less than 200 chf)?

Thank you so much for your help and letting me know how it works.

Bless to your family!

Hi Antonio,

Normally, you are supposed to declare all your assets, regardless of the value. I would say that if you have a negative taxable net worth, a few thousand should not matter much. But as a principle, I include every bank account and every asset I have.

I would s simply declare them the same way I am declaring stocks. You declare the buy operations and sell operations art the actual price and the value at the end of the year with the value from the last day of the year.

If you want to be sure, you can ask the tax office.

Thanks again for your kind reply. Would you anyway tell me how you did it exactly when buying and then selling your bitcoins? I mean, in the declaration form. This info was not provided to me by the tax office. Since you have some experience with this, I would appreciate your help…

Then, when you sold your bitcoins, did you have to pay dividend taxes on the extra gains, if any?

Thanks in advance!

Antonio

I don’t remember exactly what I did. I put the value at the end of the year (on the year I was holding) and put nothing the year after. I don’t remember if I declared the exact buy and sell points, but that’s what I would try to do today.

I sold at a loss, so no capital gains.

That way with the Fritax software, each canton has different rules and software.

If you want accurate info, you can try to look at bloggers that use crypto. I do not have experience with it, I did not know what I was doing when I did it last time.

I saw you had two ETF which were tracking Bitcoin and Ethrum. Which was your experience with that?

I have stopped holding the ETNs a long time ago and so far I do not wish to go back into cryptocurrencies. There was nothing wrong with these ETNs (they were expensive, but then, they all were). Cryptos are just not my thing.

Hi Mr. Poor Swiss,

As always, thanks for the great articles. I have a couple points to ask you.

After the current crypto rebound at the end of 2020 and in early 2021, do you still think you took the right decision by selling them back in 2017 instead of holding them during long term?

For the cryptos there is indeed no commodity behind as gold, but Ethereum, for instance has the value of their network which being used more and more by real companies. In addition to this, some startups as Celsius and Blockfi do pay interest if you lend them your cryptocurrencies. Does this change your view on cryptos?

About cashing them out and transferring them back to FIAT as Matt mentioned, I believe that as long as you declare them on your yearly tax declaration and that you can demonstrate the transactions you made to get them on the first place, should be fine.

Thanks again for the inspiring content!

Hi Henry,

1) No, I do not regret selling my cryptos. I would not have liked the volatility in my portfolio until now.

2) There are plenty of great networks, I do not see enough value in the Etherum network to back the value of the currency. That being, it’s already much better than for BTC.

3) Yes, I think the same, but I have never seen any official source about it. And I have never had enough cryptos in my portfolio to make it significant enough for my taxes.

Thanks for stopping by!

I experimented with speculating on them in past, and while I still hold some (hodl?) I’ve become much more interested in other more traditional non-speculative investments like stocks and REITs.

Hi JoeHx,

Thanks for sharing your experience!

I held some but sold them all. I much prefer traditional investment now.

Thanks for stopping by!

…if you were lucky enough and have earned a lot in Cryptocurrencies, it might be almost impossible to sell all at once and convert back into FIAT currencies. AML (anti-money laundering) and banks can’t just accept huge incoming payments without proper background validation, and your selling price can not just be defined by a mouse click with large volumes neither. Small amounts are not that problematic though. Great post, thanks for sharing!

Hi Matt,

That’s a great point. I didn’t think of that like that. That should be a bit harder to justify taking back a fortune from BTC than from stocks, but overall, the banks should act the same, no ? I’m not nearly an expert on the subject. Selling price is indeed difficult for large volumes! I agree that overall, it’s more difficult to get all your money out of the crypto game than from the stock market.

Thanks for stopping by!