Sequence of Returns Risk can ruin your retirement

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A sequence of Returns Risk, or simply Sequence Risk, affects people who regularly invest or regularly withdraw from their portfolios. When you invest, they should average out. But this effect is more important when you withdraw. The main idea is that negative returns in the early years are much worse than in the later years.

It is challenging to explain with words. But it is straightforward to understand with examples. I will show the differences a sequence of returns risk can make in different scenarios.

So this article will delve into the Sequence of Returns Risk and what we can do about it.

Sequence of Returns Risk (SRR)

A Sequence of Returns Risk (SRR), or a Sequence Risk, is the danger that some timings of withdrawals or investments reduce overall returns. Withdrawing during a bull market is not equal to withdrawing during a bear market.

A sequence of returns risk affects every kind of investment. However, some investment instruments are stable enough that this risk will not matter as much. For instance, treasury bonds and cash are affected, but not that significantly. However, for volatile investments, it is very significant. If you hold stocks, corporate bonds, or gold, you must be aware of this potential risk.

For investments (during the accumulation phase), we can almost ignore the sequence of returns risk. Because investing is a long-term effort, it will average out. Moreover, when you invest during a bear market, you can buy more shares for the same amount. During the accumulation phase, the sequence of returns risk can accelerate your net worth growth.

However, this is not the case for withdrawals (in retirement). In retirement, sequence of returns risk can put you at risk of running out of money. So, it is essential to understand that and to try to protect yourself from this risk.

We will run a few examples to get to understand these risks better.

Negative years vs positive years

We start with a simple example and a question. We assume you start with 1000 USD. How much do you have after one year with -10% and the second year with +10%?

You probably answered 1000 USD. But this is wrong! You will end up with 990 USD! It is a widespread mistake. After the first year, you are at 900 USD. Then, you will get 10% out of 900, which is 90 USD. So you will end up with 990 USD and not 1000 USD!

This fact is essential to understand. To recover from a year with -10%, you need a year with 11.11% returns, not 10%! And the more down it is, the more significant the difference is! You will need 25% returns to recover from a 20% down year! And in the extreme, you will need 100% returns to recover from a -50% year!

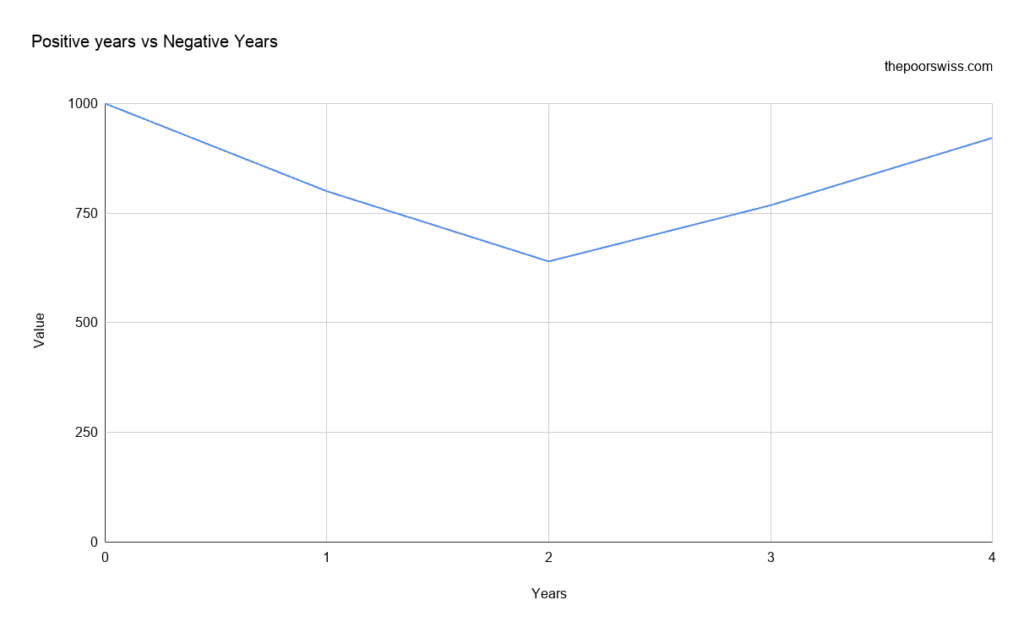

Here is the value of your money after two years at -20% and two years at +20%:

As you can see, you are not back where you started!

Now, this is not directly a sequence of returns risk. But this effect will be increased when you start withdrawing from your portfolio. To recover from a 4% withdrawal, you will need a 4.166% return.

Example without withdrawals

We start with a scenario with the given returns per year. Here is scenario A:

- 10%

- 10%

- 10%

- -10%

- -10%

And here is scenario B:

- -10%

- -10%

- 10%

- 10%

- 10%

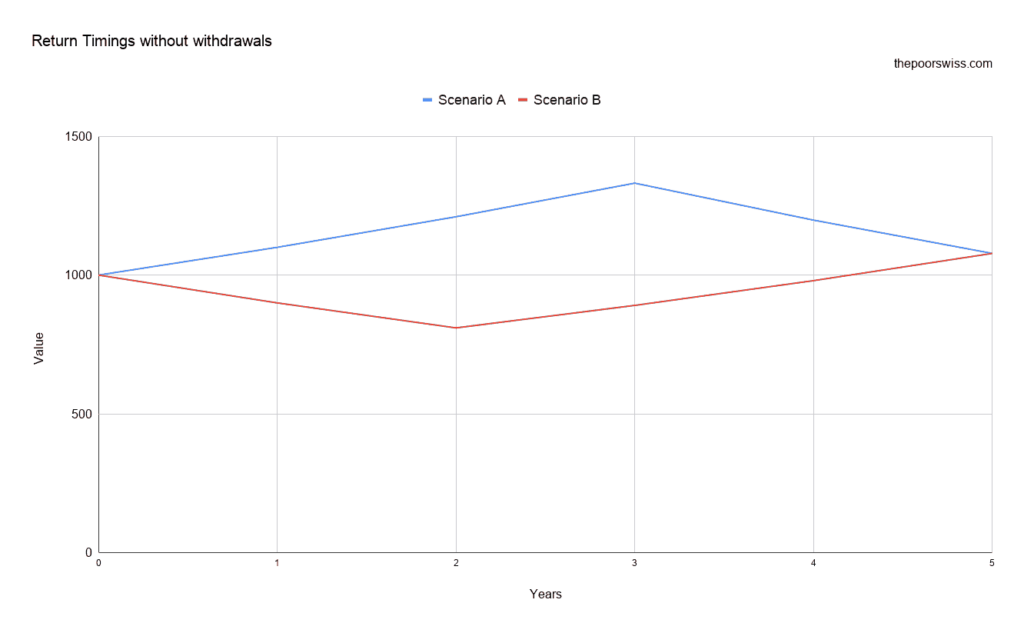

And here is a graph of both scenarios when starting with 1000 USD:

As you can see, you end up precisely in the same position. The difference is that the first scenario goes up faster and down quicker.

If you do not make any withdrawals or investments, there is no sequence of returns risk.

Example with withdrawals

Finally, we can start an example with a sequence of returns risk. You will see that everything is tied together.

Now, we can run the same simulation, but imagine you are in retirement. We assume you follow the 4% rule. So, you will withdraw 40 USD from the assets at the end of every year.

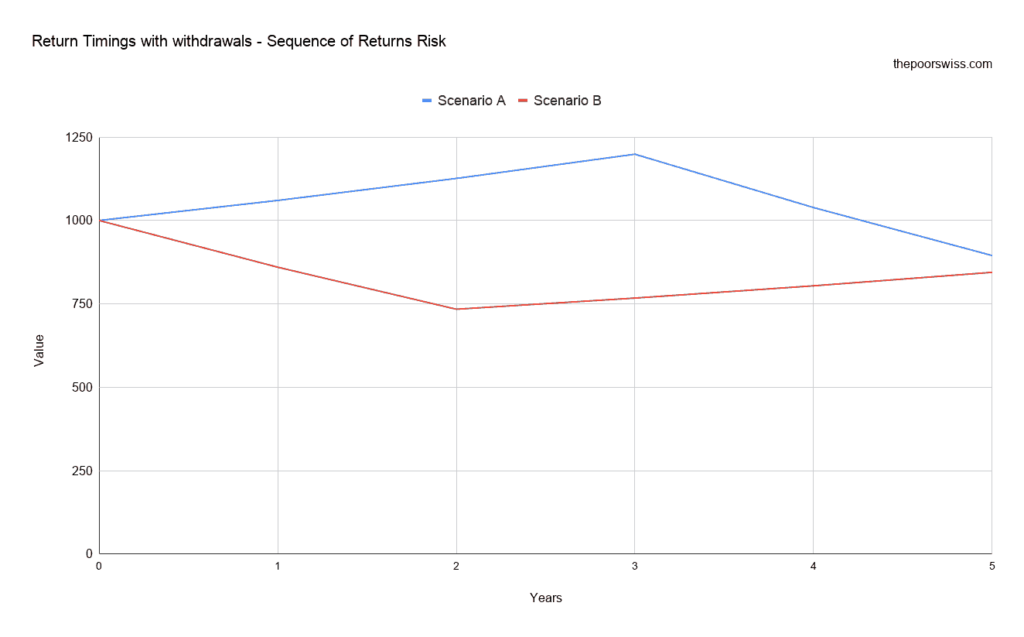

If we keep the same two scenarios and we add the withdrawals, this gives us the following results:

This time, the results are different. With Scenario A, you end up with about 894 USD. In Scenario B, you end up with only 844 USD. Timings of the stock market just made you lose 50 CHF. You may think this is not significant, but this is 5% of your initial portfolio. This loss is more than what you spend in a year! You have effectively lost one year of expenses.

Effective Withdrawal Rates

This difference is very significant for your retirement. Where does that difference come from?

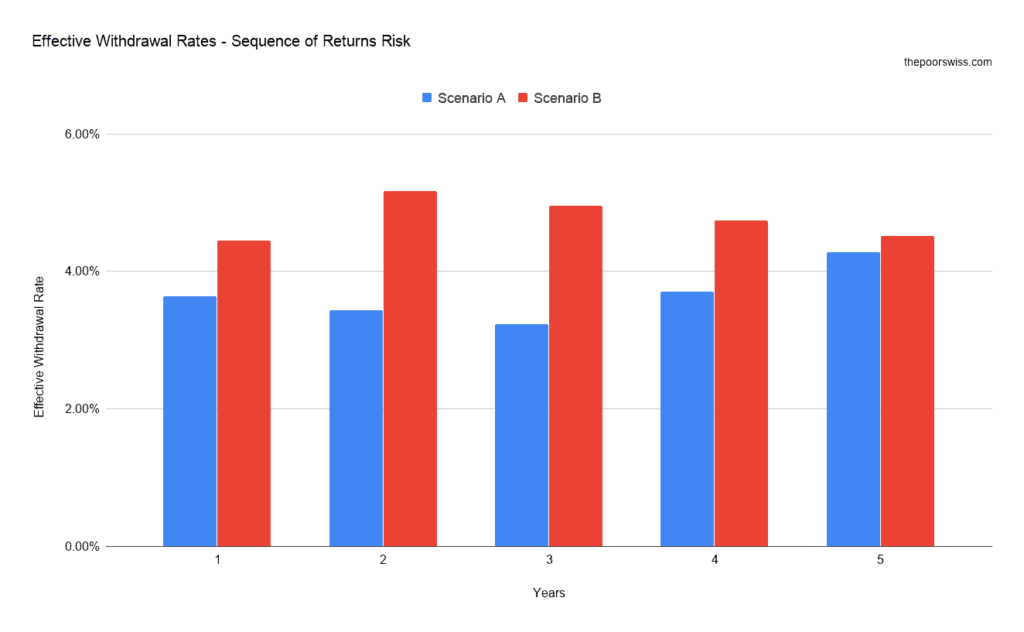

The difference is that your withdrawals are higher in the second scenario. In the second scenario, every year, you withdraw more than 4%! In the first scenario, only in the last year will you withdraw more than 4%.

The 4% withdrawal is based on the initial portfolio, not the actual one.

Therefore, it is necessary to consider your effective withdrawal rate. Your effective withdrawal rate is the current withdrawal amount divided by the current amount of money you have. We can look at the effective withdrawal rates during this scenario:

As you can see, the second scenario’s effective withdrawal rates are always higher than in the first. And most importantly, they are always higher than what you planned for!

When your portfolio value goes up, your effective withdrawal rate goes down. But when your portfolio goes down, your effective withdrawal rate goes up!

You need more than 4% returns to recover from a 4% withdrawal, as we saw before. So, if your effective withdrawal rate is higher than 4%, you will need even more profits to recover from it! That is also why higher withdrawal rates are dangerous.

Realistic scenario

At this point, you may be wondering if these scenarios are realistic.

So, we will try a more realistic scenario. We will take the S&P 500 Index starting during The Great Recession.

Here are the returns of the S&P 500 from 2008 to 2018:

| 2008 | -38.49% |

| 2009 | 23.45% |

| 2010 | 12.78% |

| 2011 | 0.00% |

| 2012 | 13.41% |

| 2013 | 29.60% |

| 2014 | 11.39% |

| 2015 | -0.73% |

| 2016 | 9.54% |

| 2017 | 19.42% |

| 2018 | -6.24% |

These returns are typical of a bear market, followed by a bull market. It is a regular stock market cycle. For decades, the stock market has behaved like this: each bull market is followed by a bear market.

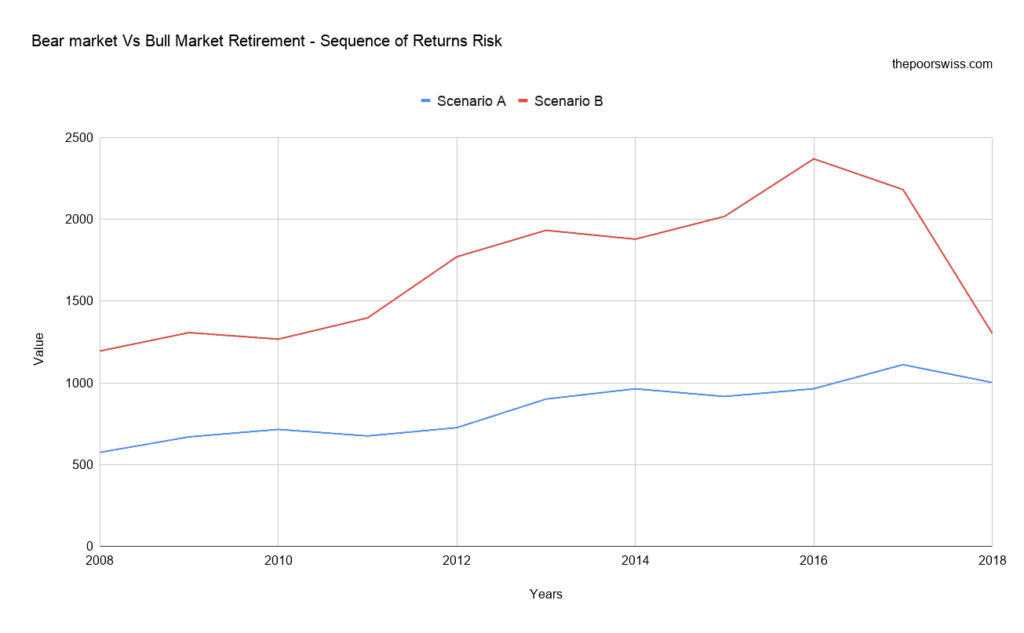

So, we can imagine two scenarios again. In the first scenario (A), we have precisely the returns of the S&P 500 Index. In the second scenario (B), the bear market appears at the end. In this case, we switch the returns of 2008 with the returns of 2018.

Here is what happens with the 4% rule in these two scenarios:

The difference is very significant between these two scenarios! You have 1002 USD in the end in the first scenario, while you have 1301 USD in the second scenario!

This difference represents almost eight years of expense. This difference is not something you can ignore.

You may think it is not too bad in the first scenario since you still have the same amount as when you started. However, if you follow the typical lifecycle, the next thing in the first scenario is another bad year. The second scenario just went through a bear market and had more value!

Moreover, the Great Recession is not the worst example of recessions. The cumulated negative years of the Dotcom Bubble (2000-2002) are significantly worse than -38.49%. And I am not talking about The Great Depression, which would have destroyed almost any hope of retiring.

So, this shows a massive difference between retiring at the top of a bull market or the beginning of a bull market!

Of course, this is still a strong example since our first scenario starts in the worst year in these ten years. But you also have the same effect, to a smaller extent, if you retire two years before a bear market against two years after.

Negative years at the beginning of your retirement will negatively influence your chances of success!

Protecting yourself

Now that we know that a sequence of returns risk can ruin a retirement, what can we do about it?

The first obvious solution is to not retire just before a bear market! However, this is easier said than done. If you are ready for retirement and a bear market has just started, you should continue working until the end of it. But if you are currently in a bull market, it is impossible to predict the next bear market.

The sequence of returns risk is especially dangerous during the first years of retirement. These first years are where they will do the most damage.

1. Be careful with average returns

When planning for retirement, you should not plan for huge returns. If you plan for 10% returns per year after inflation, you may be surprised in the case of a bear market. I account for an average of 5% returns per year after inflation. Considering lower returns is much safer. If my portfolio can survive this, I should be fine.

The reason you should account for lower returns is that they are just average. Half of the time, the profits will be lower than the average. And you need to account for this. It is the reason why simple retirement calculators are generally inaccurate.

2. Withdraw Less Money

Since the Sequence of Returns Risk reduces your chances of success, you can increase your chances of success by withdrawing less money.

If a sequence of returns can ruin your retirement with a 4% withdrawal rate, you could use a 3.5% withdrawal rate instead. Using a lower withdrawal rate would significantly increase your chances of success.

But, this would not entirely protect you against the risks. And this would significantly increase the amount of money you have to accumulate.

Reducing risks is excellent, of course. But if you are too conservative, you may end up never retiring. Or you will end up with a ton of money. It is always a matter of balance.

3. Be Flexible

The best course of action against the sequence of returns risk is to be flexible.

If you see that your effective rate is higher than the planned withdrawal rate, you could reduce your expenses. The idea is to plan for some reductions that you can do when the market is not doing well.

For instance, you could consider your vacations optional and only go on holidays when your effective withdrawal rate is lower than a certain threshold.

Another way to be flexible is to generate some income when necessary. For instance, you could pick a side hustle when the economy is not excellent. Or you could do some part-time jobs during that time.

Some extra income will significantly help to reduce the risks of running out of money.

You can also be flexible in the other direction. If the stock market is doing well, your effective withdrawal rate may be very low. In that case, you may also withdraw some extra money.

Of course, there are limits to flexibility. Some people think they can be incredibly flexible. But in practice, people are often not as flexible as they believe. Many expenses simply cannot be cut.

You need to be realistic about your flexibility. If you plan for 50% flexibility and a 6% withdrawal rate and only achieve 20% flexibility, you should be ready for trouble.

4. Use a separate reserve of cash

We said that a bear market happening during the first years of your retirement could be quite harmful to your chances of success.

You could use a second cash cushion that you would only use during the years when the stock market is down at least 20%. That way, you will not withdraw from your principal when your effective withdrawal rate is too high. You can use other conditions to decide when to use it, of course.

This cash cushion should hold at least one year of expenses. You could even go higher and accumulate two years of expenses to be on the safe side. After the bad years, you will want to refill it by selling some good investments.

This second cash cushion is not your emergency fund. And it is not your cash account for your expenses. And it is not even part of your primary portfolio. It should be kept separate and only used in this case. Otherwise, it will lose its advantage.

Of course, this is not without disadvantages. It means that you need to accumulate more money than if you were simply following the 4% rule. Moreover, this has a substantial opportunity cost. This money will be dormant and generate no returns.

I would probably use this strategy if I was ready to retire when we would already be many years into a bull market. Or I would defer my retirement by putting more money in the portfolio.

If you are interested in this strategy, I talk more about cash cushion in another article.

5. Use a bond ladder

Another solution that many people recommend is to use a bond ladder.

The idea is to buy several sets of bonds. Each set of bonds would mature in a different year. For instance, you could have five sets of bonds, one maturing in the first year, one in the second year, and so on until the fifth year.

That way, you will have some guaranteed income during the first years of your retirement. You will receive the interests and also the principal once it matures. The advantage is to significantly reduce the risks of running out of money in the early years.

You can do this for five years or even ten years. Some people do it for even longer.

Of course, as with every other technique, there are some disadvantages. There is still an opportunity cost. A bond ladder does not have the same returns as stocks. But the most significant drawback is that this is a bit complex for most investors to set up. You will need to hold many different bonds yourself.

I would not use this technique myself. But this is an interesting solution. A bond ladder could solve issues during the first years of retirement.

FAQ

What is a Sequence of Returns Risk?

A Sequence of Returns Risk (SSR), or simply Sequence Risk (SR), is the risk that some timings in the stock market are worse than others. For instance, negative years in the early withdrawal years could be awful.

What is the biggest Sequence of Returns Risk for your retirement?

The biggest issue during your retirement is if a bear market starts at the beginning of your retirement. Your withdrawals will be larger than expected, and you will significantly lower your chances of success.

Conclusion

By now, you should know that you should not ignore the sequence of returns risk.

They have the potential to reduce your chances of a successful retirement significantly. Retiring just before or after a bear market can make a huge difference in your results!

They are several solutions to improve this situation. But there is no way to avoid it entirely. I believe that the most effective strategy against the sequence of returns risk is awareness.

Once you know about it, you will plan a better and safer strategy. Some people should be less cocky about their retirement strategy. Several people are taking many risks and do not even realize it!

Now that you know about these risks, make sure that you plan your retirement with that in mind!

Since the sequence of returns risks is highly related to recessions, you should learn more about recessions.

If you want even more information about the sequence of returns risk, you should read this great article by big ERN.

What do you think about Sequence of Returns Risk? How do you plan to protect yourself from this?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Financial Independence and Retire Early

- More articles about Retirement

- Not All Assets are Created Equal – Introducing the FI Net Worth

- Does the 4% rule work with low yield bonds?

- 7 Best Blogs on FIRE

hi, is there enough money for 30-40 years of retirement, if we will withdraw 4% not from the initial, but from the actual portfolio?

Hello.

What if we base 4% on the size of not the initial, but the actual portfolio?

thanks

Hi Mikhail,

That’s a good question. I did not run full simulation with this in mind. But I definitely could, I will add this to my list.

There is actually one advantage in doing so: you will never withdraw more than 4%! On the other hand, you will never withdraw less than 4% either.

You basically have no chance of failing with doing that. However, what if you only have 10’000 left, are you going to live with 400 for a year?

I would guess that this would work for up to 30 years. But I do not think it would work for 40 years.

Thanks for stopping by!

Very clearly laid out post. What are your thoughts on how frequently someone should be withdrawing? Should it be once a year? Once a month? The follow up question would then be, if you withdraw once a year per say, would it make sense to hold 2-3 years worth of expenses in something very safe, and once a year replenish another years worth? That way, in a down market, you could wait 2-3 years without having to replenish anything?

Hi Kevin,

These are very good questions :)

I think once a month is what is best but it depends on you do it. What I would do is start by saving an extra one year of expenses on top of my investment portfolio. For the first year, I would not withdraw money. And then, at the end of each month, I would withdraw money. With this technique, you can delay withdrawals by one year and get a feeling of your spending. However, this means that you have to accumulate one year of cash. Withdrawing one year of cash is not great for your returns. But this is something I want to simulate with the data I get.

I think having an extra stash of money makes a lot of sense. But you need to remember that you cannot include that in your net worth when you do FI calculation. Otherwise, having all that cash will reduce your chances of success. I am thinking of having at least one year of cash before thinking of retiring, and maybe two years. I am not entirely set on that.

What are your thoughts on that?

Thanks for stopping by!

Got it! I didn’t know about the nuance of tax inefficiency in dividend investing in Switzerland. Thanks for the explanation!

You’re welcome :)

This is a great technical analysis and explanation on SRR. I agree that having the awareness is so important because it could change the course of the rest of one’s wealth during the retirement period.

Do you have any advice on how to build a yield shield so that the SRR could be removed entirely? Especially when it comes to retiring in Switzerland? Some of the examples I have in mind are dividend investing and building a bond ladder that you have already mentioned. Do you know of any other viable strategies when having a retirement portfolio in Switzerland?

Thanks for sharing your insights!

Hi Mama Bear,

I do not think a yield shield would remove SRR entirely. If you are mainly investing in stocks, you will susceptible to this risk. And even if you are mainly invested in real estate or even bonds, this risk will be here.

But it’s true that having a better diversification and some income could reduce the risks a bit.

Some dividend investing could help, especially in Switzerland. These stocks are quite safe and the dividends can be high. However, in Switzerland, dividends are not efficient for taxes.

As for a bond ladder, it’s very interesting. However, in Switzerland, bonds do not return anything. So you would have to build a bond ladder of other countries such as the U.S. and then you will introduce currency risk.

In general, the yield from the stock market will not help as much as people think for SRR. You can read this great article about the yield shield illusion.

I would say that some extra income from P2P lending and real estate could help a bit more. But it also adds risk and work.

Thanks for stopping by!

Thanks for sharing. I wonder, can’t you use the bond part off your portfolio for withdrawing during these years?

Hi Andre,

That’s a good question!

Yes, you can take advantage of the bonds for this. However, in the case of a bad stock market, the bond market will also take a hit. Normally, this hit will be lower and as such, you should be able to compensate this with the bonds indeed.

There is one case when you can’t: when you have no bonds, like me :)

More and more people are using a 100% stock portfolio.

Thanks for stopping by!