11 Personal Finance Myths You should ignore

| Updated: |(Disclosure: Some of the links below may be affiliate links)

There are many personal finance myths out there. And many people believe in these myths very strongly. Basing your decisions on myths can do a lot of damage to your finances.

For instance, many believe only the rich can invest in the stock market. It is just a myth. Anybody can invest in the stock market. And many personal finance myths like this are being propagated.

Many of these personal finance myths can be detrimental to your finances. Some will not make significant impacts. But some could ruin your retirement plans.

Without further ado, here are eleven personal finance myths you should learn to ignore.

1. Credit Cards are evil

I have heard this myth so many times already. Many people believe that credit cards are evil and they should never use them.

This myth is entirely untrue. Credit cards are not evil at all. But the usage that some people do with credit cards is awful indeed. It is not credit cards that we should ban but carry a balance on them.

If you do not carry a balance on your credit cards, they are handy tools. They can even generate some extra income.

I have several credit cards as part of my credit card strategy. And I have never paid a cent for any of my credit cards. On the contrary, my credit cards are generating money for me!

But if you cannot handle a credit card without going into debt, you should get rid of them!

2. Income equals wealth

This myth is one of the most dangerous personal finance myths. Many believe the more income they have, the more wealthy they become.

In most cases, this is not true. Of course, they are some very wealthy people with high incomes. But many people with high incomes are not nearly as wealthy as you could think. In some extreme cases, they even have a negative net worth.

The main problem for high-income earners is Lifestyle Creep. The more money they get, the more money they spend. If you keep spending all the money you get, you will never get any more wealthy. And most of the time, they spend their money on depreciating assets like cars. And to continue keeping up with their lifestyle, they often have a high level of debt.

On the contrary, if you invest your income in appreciating assets, you will increase your wealth. For people that are smarter with their money, income helps to build wealth. But you need to keep saving part of the revenue to be wealthy. If you save a large part of your income, a higher income will be beneficial!

3. Owning is better than renting and vice-versa

In the personal finance community, everybody got an opinion as to whether renting is better than owning or not. The only accurate answer is: it depends!

First, owning versus renting is not only a financial question. If you want a house, you often have more choices of buying rather than renting. At least, this is the case in Switzerland. Also, if you buy, you can transform the house however you want. And you will be able to live in your home. For many people, this will outweigh the financial part of the equation.

From a financial perspective, it also highly depends on your situation and the real estate market. If the interest rates are really low and the market is in a good position, this could be very interesting to rent. Yes, there are opportunity costs that you need to take into account. But even when putting everything together, sometimes owning is better than renting. And sometimes it is not!

There is nothing wrong with either renting or buying a house. But you need to pick a house adapted to your needs. There is no point in living in a ten rooms villa if you will live alone in it. And you should also rent or buy something within your means.

Saying that renting is better than buying is a personal finance myth. And the contrary is also a myth. As long as it is your decision and you carefully weighed the pros and cons, it will be the right decision.

For more information, read whether you should rent or own in Switzerland. And as an example, you can also read how much we spent on our house after a year.

4. Investing is only for the rich

This personal finance myth is also pretty bad. Many people believe that only wealthy people can invest in the stock market.

It is not true. You can start investing in the stock market with little money. If you want to invest 1000 CHF, nothing will prevent doing so. And with 1000 CHF, you will probably earn the same returns as someone with several million.

Investing in the stock market is a great way to become wealthy. So, you should start as soon as you have money to invest. There is no point waiting until you have a particular amount of money to invest.

And if you have no idea how to start investing, I have an Investing Guide for Beginners.

5. All debts are Evil

Telling you that all debts are evil is the favorite advice of many people.

While not entirely wrong, this personal finance myth should be nuanced. Some debts are awful for your personal finance. There is no doubt about that. For instance, there is nothing good about credit card debt. And there is nothing good either about a high-interest loan for a car that you cannot afford.

However, not all debts are bad. A low-interest mortgage for your house makes sense from a financial point of view. You should see this debt as your rent. If you rent a house, you will pay for it every month. And nobody complains about that. You are paying for the mortgage of another person instead of paying your mortgage. It is precisely the same about owning a house.

I do not think it always makes sense to repay a mortgage. It may make sense to reduce it over time, yes. But sometimes, it makes much more sense to invest the money instead of using it to repay a low-interest debt.

In the end, you can use debt as powerful leverage. It can help you if you use it correctly.

If you are struggling with debt, you may want to pay off your debts soon. It is necessary if you have high-interest debt. However, you should be smart about it. You should not repay them just because somebody on the internet said so. Weigh the pros and cons and decide for yourself.

6. An emergency fund with six months of expenses

Contrary to this personal finance myth, there is such a thing as a too large emergency fund.

The general rule of thumb of many people is that you should hold three to six months of expenses in your emergency fund. For some people, it may be necessary to hold that much cash. But for people that can manage their finances properly, even three months may be too much.

There are many things you need to consider to decide on the size of an emergency fund. For instance, how safe is your job, and how well are you insured against significant expenses? For example, the maximum you could pay for a health emergency could be your deductible if you are insured. Many people do not think of that.

Now, if your job is unsafe and you are not well-insured, you will probably need more than three months of retirement. But it is essential that not everyone needs a large emergency fund. My emergency fund is currently one month of income or about two months of expenses. And there are many examples of people with smaller emergency funds than me. For instance, Big ERN has a zero-dollar emergency fund.

My experience is mostly with Switzerland. We have several mandatory insurances, such as health insurance, unemployment insurance, invalidity insurance, etc. There are very few emergencies that could end up costing a lot of money. Therefore, we only need a small emergency fund.

But even in the United States, where people have less insurance, some do well with low emergency funds. It also depends on your risk-management capability.

7. Investment X is without risk

It is a personal finance myth that many advisors (or scammers) would like you to believe. I have often heard people say that a particular investment was without risk and guaranteed return.

But there is no such thing as an entirely safe investment. Moreover, there is also no such thing as guaranteed returns. If you hear somebody telling you that an investment will give you 10% in one year without any risk for a long time, you should not listen.

There are some safer returns, such as cash and bonds. But I would not say they are without risk either. Cash is dangerous because it is unlikely to match inflation. And bond issuers can default. In the case of a government, it is unlikely to default. But it is not impossible either. And bond values are subject to changes in interest rates.

You should be realistic about what you can expect from an investment such as the stock market. Historically, you can expect an average of 5% returns per year. However, this is an average. It means you may be down 30% for a few years. You need to hold your assets for many years.

8. It is too early to save for retirement

Many people believe that they should not start to save for retirement before they are old already. But by then, it will be too late. This personal finance myth could be dangerous for your retirement!

Now, you may think your country will take care of you in retirement. And it may be right. But it may also be wrong. And, if you want to sustain a higher lifestyle, your country’s retirement system will not help you. Even if it helps you, it will help with the bare minimum for living. And you do not want your children to have to take care of you financially.

Now, you do not have to focus entirely on your retirement when you are forty years away! But you need to plan for it. If you save some money every month and invest it until you are retired, this will go a long way toward sustaining your lifestyle once you reach the official retirement age.

And if you ever want to retire early, you must save as soon as possible. You need to remember that you could achieve a lot of your wealth-building with compound interest. Starting investing early can help tremendously.

Not everyone needs to save the same amount of money for retirement. It will depend a lot on the lifestyle you have chosen for yourself. The higher the lifestyle you want to live, the more you need to save, and the less your pension will help.

9. Sell when the stock market goes down

This personal finance myth is probably one you have already heard before. You should sell when the stock market starts to go down. That way, you will make a profit, and you can buy back your shares at a lower price.

In theory, it sounds great. But in practice, it does not work that way.

The problem is that you cannot predict at which point in the market you are. If you could predict it, you would be rich beyond measure. The market may drop 2% in a single day and rally 5% the next week. If you sold after 2% down, you would lose much money.

It is also important to note that the stock market is unrelated to the economy. This makes it even more difficult to predict.

If you invest long-term, you are better off not selling your shares unless you need the money. When the market is down significantly, it will mean that you can purchase these shares at a better price.

It is the best you can do. Do not think you are smarter than everybody else. If you want higher-than-average returns, you must take on higher risks.

10. Everybody needs a budget

This personal finance myth will surprise you. I used to believe that everyone needed a budget. But I do not think like that anymore.

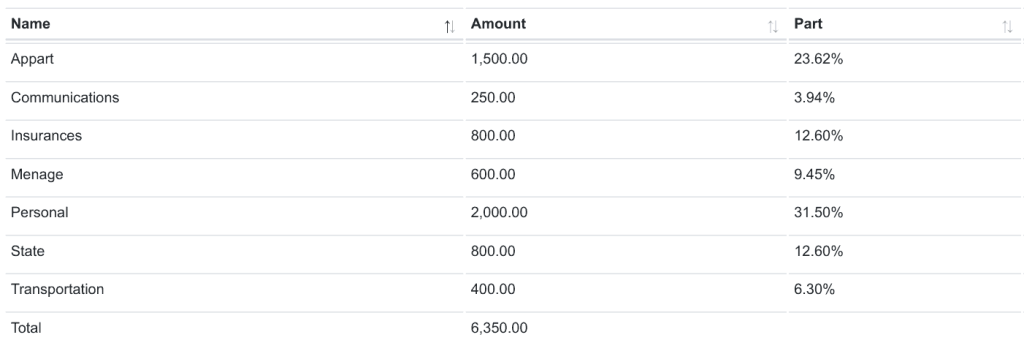

Most people can live without a budget after they put their expenses into order. However, everybody should track their expenses.

Tracking your expenses is much more important than setting a budget. If you track your expenses correctly, you will know exactly how you spend each month and on what.

You can improve your expenses by checking where you are overspending. Once you have your expenses under control, it does not matter to allocate a certain amount of money to each of your budget categories. Just spend less than you earn!

Some people need a budget for their finances to go well. For some people, this is the only way to get their finances in order. But even these people, after a while, may not need a budget anymore.

Even tracking your expenses may not be necessary in the long term. It is something I enjoy. But this is something that many people do not like doing. And once you have done it for a long time, you can keep your expenses at the same level without precisely tracking them.

11. Investing is too complicated

Many people believe that investing is too complicated for them.

This personal finance myth is very dangerous. Indeed, it prevents many people from investing in the stock market (or in any other investments). And investing is our best weapon against inflation.

Investing in the stock market can be complicated; there is no doubt about that. But you only have to learn some critical things before you start, and then you should be set for life.

And there are many ways to invest in the stock market. If you do not feel like investing yourself, you could use a Robo-Advisor or invest with a bank.

I have a guide to help you get started investing in the stock market. And investing does not take that much time either.

Conclusion

As you can see, there are plenty of personal finance myths. I am sure you already know about some of them. Hopefully, you did not know about all of them, and you learned something from this article.

We need to be careful with these personal finance myths. If you strongly believe in some of these personal finance myths, this could harm your personal finances.

I am disappointed that there are so many people out there that contribute to these myths. People should know better than pass on these myths. Even though some of these have some basis, they do not apply to everybody. Everybody’s personal finance is different.

If you were interested in these personal finance myths, you might be interested in some stock market myths.

Do you know any other personal finance myths that we should ignore?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- How to manage your finances as a couple?

- I Will Teach You To Be Rich – Book Review

- Working may cost you more than you think!

I think more than 6 months of savings is needed. In reality from personal experience having about a years salary saved will put in anyone in a better situation. This gives you a recovery time that is realistic.

Nice tips..

Hi Enrico,

Just for context, are you in Switzerland or in another country?

This will indeed highly depend on where you are. In Switzerland, we have many mandatory insurances that other countries do not have.

Thanks for stopping by

Great stuff, almost every myth is spot on. My personal fav is #1, credit cards. I’m not sure how in the world they got such a bad rap. When used responsibly, they are an amazing tool for consumers. It’s like saying cars were a bad invention because when driven recklessly you could get hurt… that’s your fault not the car’s fault! Maybe a bad example, but you know what I mean..

Hi Kevin,

The problem with #1 is that many people do not use them responsibly. And many people do not want to change the way they use them. They prefer avoiding rather than fixing.

I actually like your analogy of a car. It makes a lot of sense! I will definitely reuse this example!

Thanks for stopping by!

I am going to disagree with #6. As someone who unexpectedly lost her job and was unemployed for 5 months- the money runs out very quickly! And it takes time to downsize/rearrange your life. So I will still be encouraging myself and others to have a very large emergency fund!

Hi, A Dime Saved,

Sorry to hear that!

As I said, it highly depends on the situation. In Switzerland, we have unemployment benefits for up to 2 years if we get fired.

If we didn’t have so many insurances, I would also pile up more money.

Thanks for stopping by!

OT, but wanted to share the link to the documentary Playing with Fire: https://vimeo.com/374814086 Password: FIRE I think that it’s available for free until December 11th.

See it as an early Christmas gift for the great blog! :)

Thanks for sharing this Christmas gift ;) I will take a look once I get the time!

Totally agree that these 10 myths are wealth destroyers and should be busted!

#8 really stood out to me. I was once a young and naive girl who doesn’t want care for retirement topics. Now I realize that it’s an important one for anyone starting out in the workforce despite the age!

I wrote about exactly this topic just recently. Check it out if you like :) https://mamabearfinance.com/can-retirement-be-sexy/

Hi Mama Bear,

Yes, I am sure #8 is something everybody is guilty of (even me!).

Very interesting article! Thanks for sharing! And very catchy title :) I will share it.

Thanks for stopping by!

Thank you for sharing! I’m glad you find the title catchy. It’s not easy to capture people’s attention whenever the topic about retirement is brought up, so I had to be creative lol.

I planned to write more about this topic in the future especially as it’s related to taxes and investments! If I find posts here on TPS, I hope you won’t mind that I link it. So far my audience are mostly Americans with Swiss being a close second so I’m sure people would really benefit from your blog!