Should you invest in gold in 2024? How to invest in gold?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

We have already covered many investments on this blog. But we have not yet covered gold as an investment! Most people know gold as a metal, and many people have some at home in the form of jewelry.

But not many people know that we can invest in gold. There are several different ways of investing in gold.

But should you invest in gold? And how can you invest in gold?

In this article, we answer these two questions. We will also see the impact of having gold in a portfolio on our retirement chances of success.

Gold

I probably do not have to explain gold to you. It is the most famous precious metal in the world.

Gold has always been a precious metal. For thousands of years, it has been a sign of wealth to display jewelry made of this precious metal. The primary reason it is valuable is that it is rare. It is not the most expensive metal on earth, but there is enough of it to make it very interesting to invest in.

Many people invest in gold to decrease the volatility of their portfolios. In this article, we will see whether this is interesting for financial independence. The idea is to see if you should add this to your portfolio for the long term.

One significant difference between stocks is that gold is tangible. It is metal. It would take a really major event for its value to go down to zero. Unless we discover a way to transmute it (the old alchemist) dream, its value should remain high in the future. It makes gold a good holder of value to hedge against the stock market.

So, we will try to see whether people should invest in gold.

Historical Gold Prices

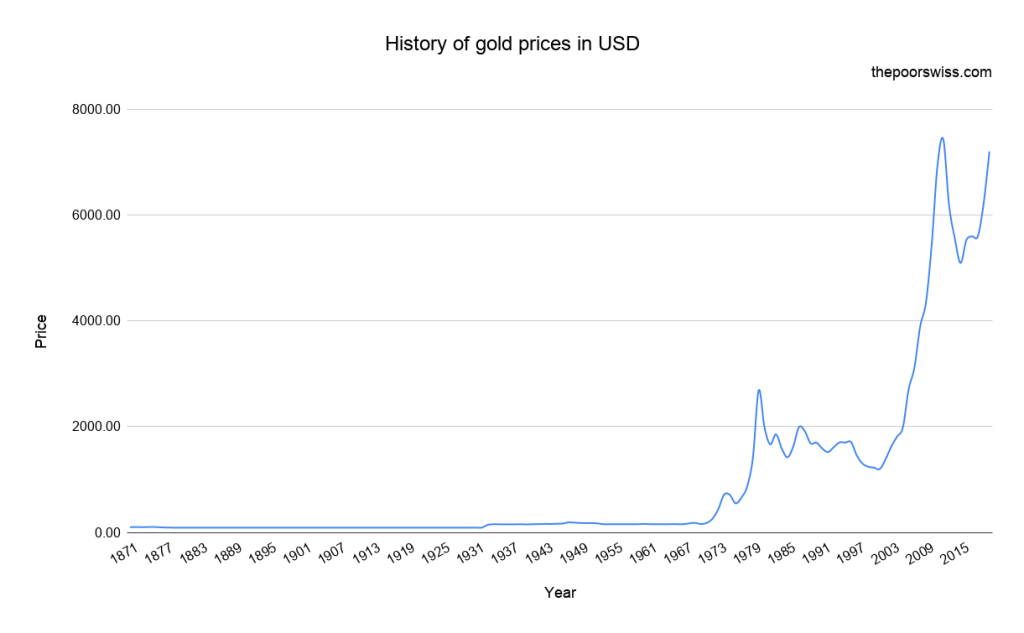

If you want to invest in gold, you need to know the history of its price. Here is the graph of the gold price in USD since 1871:

The first thing we can see is that the price of gold has been almost flat until 1971. It is not related to gold by itself, but it is more related to the U.S. dollar. Historically, the dollar was indexed on the price of gold. The gold standard made it, so there were almost no fluctuations in the gold price in USD.

It changed slightly in 1933 when Franklin D. Roosevelt, the president of the United States, devaluated the dollar against gold. But the most significant change was 1971 when Richard Nixon stopped the gold standard. It means that the dollar was not backed by any tangible asset anymore. The end of the gold standard also ended the Bretton Woods system when all other currencies were convertible to dollars. And this restarted speculation on the dollar and gold.

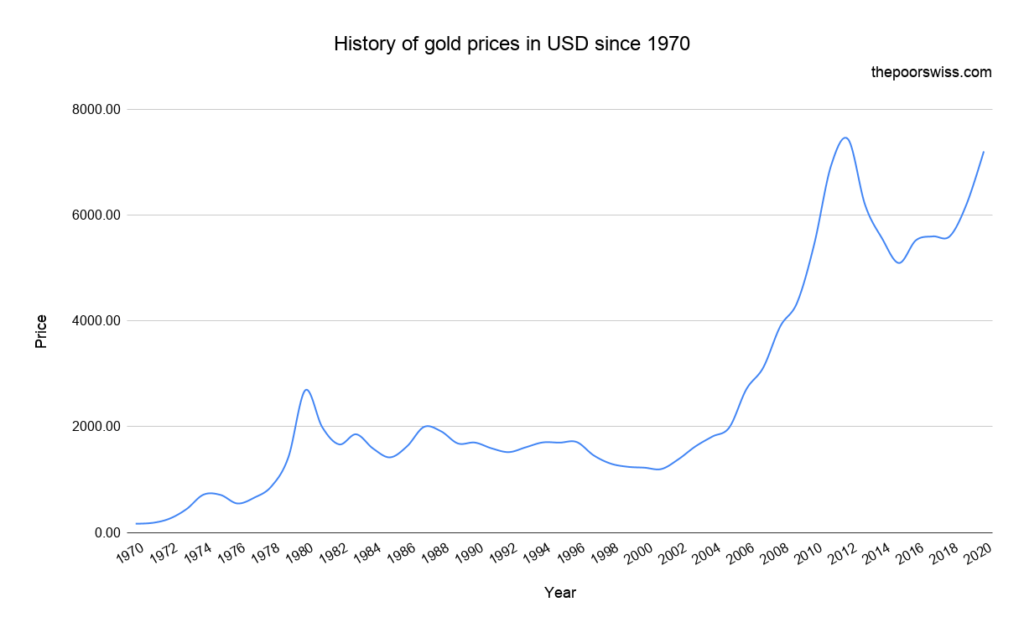

We can also take a look at the prices since 1970.

This graph tells a more exciting story about the price of gold in recent events. What is extremely interesting about gold is that its price is often inversely correlated to the stock market. When the stock market does well, people stop investing in gold. But when signs show that the stock market may drop, people rush to buy gold. This rush results in the prices of gold going up in times of uncertainty.

For instance, when the price of gold rose in 1986, it was the end of a bull market that ended in 1987. We can see that during the bull market that ended with the dot-com bubble burst, the price of gold fell significantly.

After the dot-com bubble, the price of gold rose to new highs. A lot of investors were afraid after the crash. The price started dropping after the stock market recovered from the Great Recession around 2012. It fell significantly until the correction of 2015 when it started increasing again. Finally, since the correction of 2018, the price of gold has been going up very quickly. It shows that many people were afraid of the bull market ending.

This inverse correlation is fascinating because it can help investors have better results during a bear market. This inverse correlation is why people want to invest in gold. If gold does better when stocks do worse, it can smooth your overall performance. Gold could reduce your chances of running out of money during retirement.

It is also interesting to see that aside from the significant rise in price between 2000 and 2012, the gold price has not been an excellent investment in the long term. It has added some high returns in the short term. But its performance has not been that great considering an extended period.

If you plan to invest in gold, you need to remember a few things:

- In general, gold is more stable than stocks.

- On average, gold has good returns but lower returns than stocks.

- Sometimes, the gold market can be very volatile.

How to Invest in Gold?

If you want to invest in a company, it is straightforward. You can just buy shares of the company on the stock market. But there are more ways to invest in gold. It makes it a bit difficult to choose which method to use.

Here is how you can invest in gold and the advantages and disadvantages of each method.

1. Invest in Physical Gold

The first obvious option is to invest in physical gold. It means you buy some actual gold, and you store it. And once you want to sell it, you take it, go to a seller, and get back some money.

Buying physical gold is the coolest way to invest in gold. I mean, who does not want to have gold bars at home? Having physical gold is more tangible than having some paper telling you you have some metal somewhere.

But there are some strong disadvantages to this way of investing in gold.

First, the main problem with physical gold is how to store it. If you have bought a few coins, then you are probably fine on that part. You can store it in a safe part of your house. But if you have invested a significant amount of money, you must invest in a safe at home or a safe deposit box. Securing your gold will cost you money.

If you have a significant amount of gold at home, you may also want to get insurance for this gold. And the insurance is costly.

Second, having gold at home may make you uncomfortable. If you have a significant amount of physical gold, you should consider getting it insured. All this, put together, makes it difficult to invest in gold.

Third, physical gold is not very liquid. To get your money, you have to get the physical gold to a merchant and get your money back. It takes time. And this also means that there will be a significant spread between the buy and sell values.

And if that was not clear, I need to clear out something: buying gold jewelry is not investing in gold! When you buy a necklace, most of its value will be for the jeweler and the shop margin. The rest is the value of the metal. So, when you want to sell it back, you are very unlikely to get back more than the raw value of the metals.

So, investing in gold jewelry is a bad investment. If you want to invest in physical gold, you must invest in gold coins or bars.

Investing in physical gold is an interesting option. But it comes with some essential disadvantages. For this, I would not recommend investing in physical gold unless you want to invest a low amount of money.

2. Invest in physical gold indirectly

The first way of investing in gold was to invest in physical gold. But there is another way to invest in physical gold.

There are some websites where you can buy physical gold that offer storage and insurance. It means you can buy physical gold, and they will store it in their safe in your name. They will also offer insurance for this gold. And in several cases, they provide this service for free.

Here are two instances of that:

I have not tried any of these websites, but I know people that recommended them to me.

Buying through a platform is a great alternative to buying physical gold directly. If you want to buy some significant quantities, this could be a very good way.

If you invest through these websites, you should do proper research about the website. You want to be sure you can trust the website before investing.

3. Invest in precious metal accounts

The second way to invest in gold is to open a precious metal account in a bank.

Many large banks offer metal accounts. So, instead of having CHF or USD in your account, you have grams of some metal, such as gold or silver. You can buy and sell gold from your main account at the bank.

It is a straightforward way to invest in gold. It is probably the easiest. And it is volatile. You can quickly sell and buy metals from your account. It is also much safer than storing the actual gold at home.

Now, there is a disadvantage to this method: precious metal accounts are not free. And there are many such accounts, even in a small country like Switzerland.

When you choose such an account, you need to look at two things:

- Custody Fees: How much will you pay each year on the value of your portfolio?

- Transaction Fees: How much will you pay for each buy and sell transaction?

For instance, there are the details of three banks for their gold accounts:

- UBS: 1% custody fee, no transaction fees

- Migros Bank: 0.19% custody fee, 0.30% for selling and buying

- Zurcher Kantonalbank: 0.2% custody with 30 CHF minimum

At first sight, Migros Bank has the lowest custody fees but has very high transaction fees. The custody fee of UBS is just too high. The gold account from the Zurcher Kantonalbank is the best one I have found. But the 30 CHF minimum is pretty bad. It means that below 15’000 CHF invested, you will pay more than 0.2%. For large amounts, it is an excellent account.

Investing in a precious metal account is safer than investing in physical gold. But it has some essential costs. It is difficult to say if this is cheaper than investing directly in the physical metal. If you want to invest a significant amount of money in gold, this is a better method.

4. Invest in Gold ETFs

The fourth way to invest in gold is through an Exchange Traded Fund (ETF). Many ETFs are related to the price of the yellow metal. There are mainly three classes of gold ETFs:

- ETFs that invest in physical gold. These ETFs directly buy physical gold to back the shares. You will not have a claim on physical metal. But the share price will be very closely related to the cost of gold.

- ETFs that synthetically replicate the price of gold. These ETFs will use some derivatives (futures and contracts) to synchronize with

- ETFs that invest in gold mining companies (and sometimes related companies). These ETFs are loosely associated with the price of the precious metal since they will generally simply invest in an index of companies.

If you want to invest in gold, only the first class makes sense. The second class will also work, but I do not like synthetic ETFs. Even though with the first class of ETF, there is no claim to physical metal. The ETF holds the physical gold. For me, this makes more sense than the other two classes.

If you already have a broker account, this is a very convenient way of investing in gold! You just have to buy one more ETF, and you are done. If you have no broker account, this is more complicated than purchasing physical bars or billions or using a precious metal bank account.

The safety of this method is also quite high. If you are using a good broker, you should have good security, and your shares will be insured.

There are also two issues with this method. First of all, it is not free. You will pay transaction fees, but you should pay very little of that if you use a good broker. But you will pay management fees in the ETF (like any other ETF). It is the TER of the ETF.

And also, there are tons of ETFs to choose from. The biggest ETF is the SPDR Gold Trust (GLD), with a TER of 0.40%. If I wanted a USD ETF, I would invest in the iShares Gold Trust (IAU) with a TER of 0.25%.

But if you are in Switzerland, you should invest in an ETF in CHF. Gold should be here to reduce the risks of your portfolio. So you do not want to pay the price of having an additional currency risk.

For me, the best CHF Gold ETF is the iShares Gold Hedged CHF ETF (0.22% TER). With this ETF, you will have almost the same prices, a precious metal account, and higher safety. The barrier of entry is also quite low.

For me, investing in Gold ETF is the best way to invest in gold. If I choose to invest in the future, this is what I would do.

5. Invest in Gold Futures

The final way to invest in gold is to use gold futures.

It is the most complicated way of investing, and this is not something I would recommend. But it is interesting to know that this exists. Investing in gold futures is probably much closer to speculation than investing.

A future is a contract to buy or sell an asset at a given price. The price is set when you buy the contract. But the payment will only be settled in the future. Generally, you can buy and sell futures up to three months in advance. By entering a buy future contract, you are gambling that its price will increase. And by entering a sell contract, you are speculating that the price will decrease.

For instance, you could buy a gold future for 10’000$ for 5000$ an ounce in three months even though the price is currently 6000$. Futures are done on margin. So, you will have to deposit some money, maybe 2000$ in this example. The rest is done on margin. If the price goes up to 7000$, you will have bought gold at a 2000$ premium. At this time, you will need to settle the price. But if the price goes down to 4000$, you will have bought gold 1000$ more expensive than it.

The problem with this technique is that it works on margin. Since both parties are investing on margin, you are at risk of default. And since you are investing on margin, your losses can quickly become significant.

Compared to the other techniques, this is the riskiest and most complicated, in my opinion. I would not invest like this.

Gold and Financial Independence

One fascinating question is whether gold increases or decreases your chances of a successful retirement.

Investing in gold will reduce the volatility of your portfolio since it has a low correlation to stocks. But its returns are not as high. So, from a withdrawal point of view, should you own gold in your portfolio?

We will run some simulations! For this, I will simulate retirement with different withdrawal rates. I use the dollar as the base currency and use U.S. stocks. With varying periods of retirement, we will see if investing in gold in a portfolio can help or not your chances of success. The idea is to use the same measurements as the one of The Trinity Study but using gold.

If you are unfamiliar with withdrawal rates, the Trinity Study, and the retirement simulations, I encourage you to look at my article about the Trinity Study first.

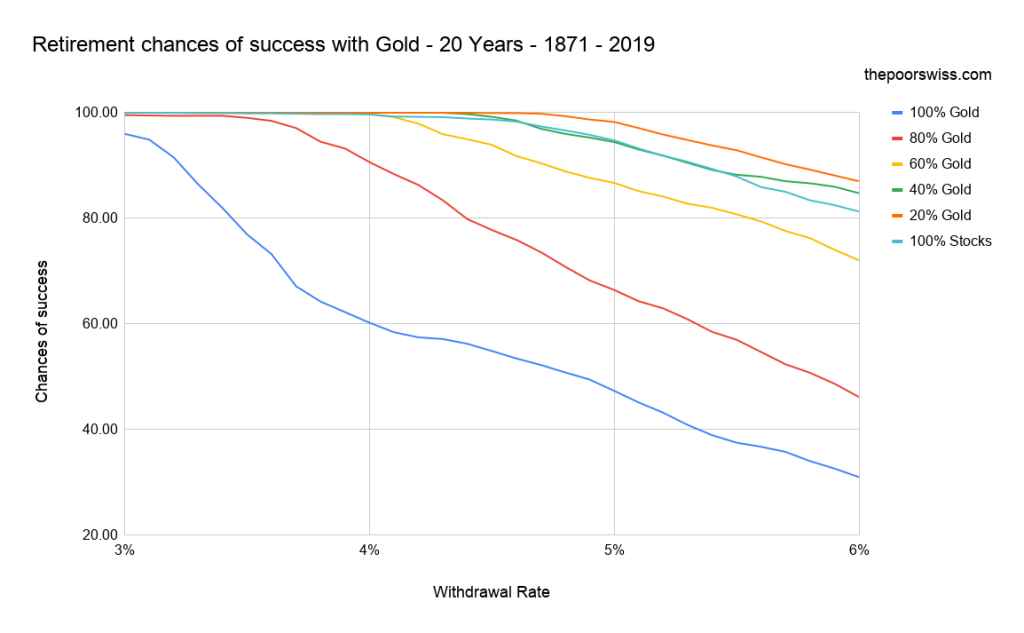

Retirement of 20 years

First, we start with 20 years of retirement. I will not do ten years since the chances of success are simply too high. With 20 years, it starts getting interesting.

So here are the chances of success with different portfolio allocations.

As expected, a portfolio with only gold would not fare well with any withdrawal rate. Even with a 3% withdrawal rate, which is highly conservative, it would only give you a 95% chance of success after 20 years.

On the other hand, having even a 60% allocation in your portfolio gives you a high chance of retiring for 20 years!

And even more interesting, having 20% gold in your portfolio increases your chances of success with large withdrawals. In this simulation, a portfolio with 20% of gold and 80% of stocks is consistently the best performer.

But for most, 20 years is quite short of retirement. So, we need to run more extended simulations.

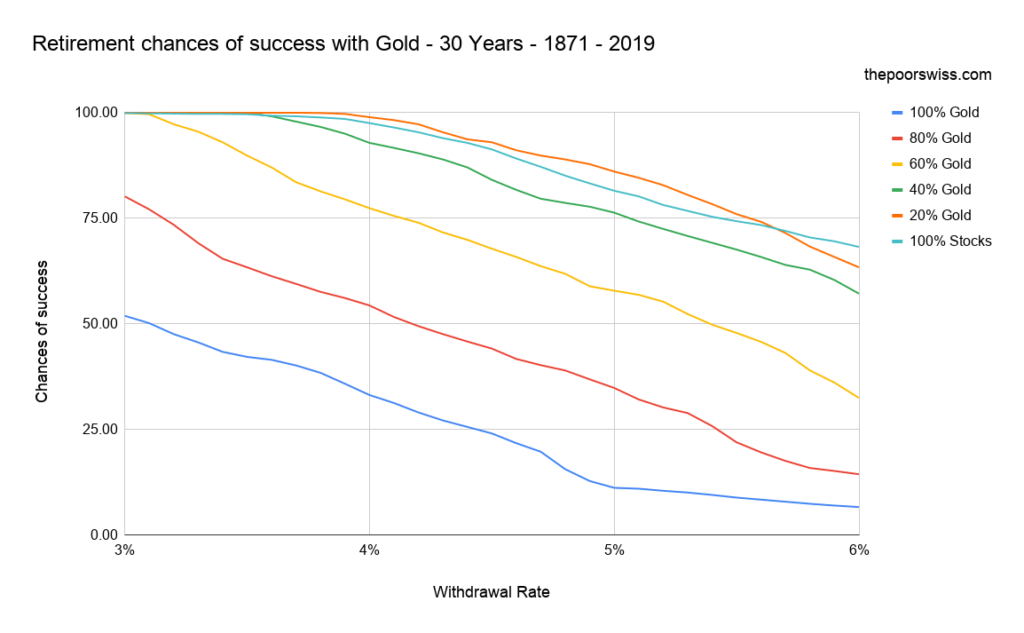

Retirement of 30 years

Here is what would happen if you invest in gold and want to retire for 30 years.

The results are already more interesting. Thirty years is already a long time to sustain a portfolio. And we can see that some gold in a portfolio can help the chances of success. Here, again, the best results are achieved, with 20% allocated to gold. It is interesting. And even 40% allocated to gold yields quite good results.

However, we can see that allocating more than that is not great for your retirement unless you plan a very low withdrawal rate.

If you plan a very high withdrawal rate (more than 5%), you should not invest in gold in your portfolio. But this is logical since gold has lower average returns than the stock market. And in any case, retiring with such a withdrawal rate would be risky anyway.

Retirement of 40 years

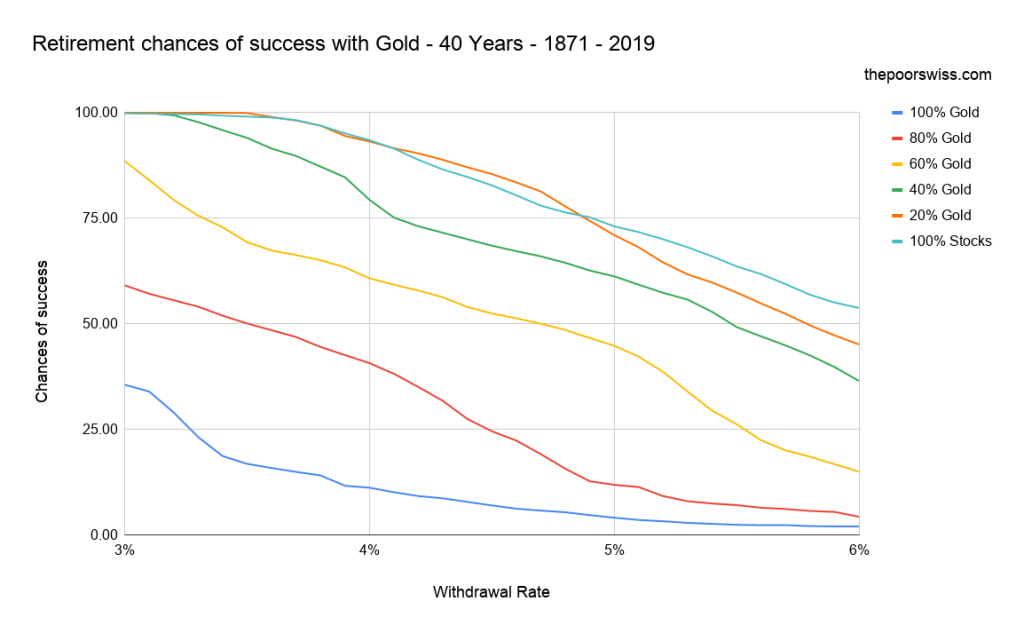

Finally, here is what would happen for a 40 years retirement.

For such a long retirement to succeed, we need high returns. It is where gold starts to fail. However, having 20% gold still helps in smoothing out the results. But it will not increase your chances of success significantly.

When you plan for your portfolio to last for so long, you want to increase your chances of success. When you are young, it is okay to fail because you can still go back to work and earn some money. But if your portfolio fails when you are seventy and have not worked for 20 years, it may be more difficult. Therefore, it is essential to have proper planning. And it seems that investing in gold could help.

I am surprised by these results. I did not expect Gold to perform so well, honestly. I am starting to understand why so many people invest in gold.

Conclusion

There are many things we learned about investing in gold.

First, if you want to invest in gold, you must know that the returns will be lower than stocks. But it will often correlate negatively to stocks. It will help during bear markets. This inverse correlation is the more important reason to invest in gold.

Therefore, the main reason to invest in gold is to reduce the volatility of your portfolio. By allocating a small portfolio to gold, you will increase your chances of success in retirement if you plan to rely on the withdrawal rule.

As we have seen, investing about 20% of your portfolio in gold could help give you a few more percent chances of success in your retirement.

For full disclosure, I currently own no gold. Now, will I invest in gold? I do not know! I was surprised y the results. I did not think investing in gold could be efficient for Financial Independence.

I will consider whether to invest in gold in the future. I will probably buy some physical gold for my children when they are born. But I am also considering investing in Gold ETFs now. I will have to run simulations taking currency fluctuations into account based on which ETF I choose.

If you plan to invest in Gold ETFs, you must learn how to get started on the stock market.

What about you? Do you invest in gold?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Alternative Investments

- More articles about Investing

- The 6 Biggest Problems of Investing in Cryptocurrencies

- The cost of owning our house after a year

- A short history of Cryptocurrencies

Hi Baptiste,

Thank you for this fantastic website! I live in Geneva, but I happen to have half of my savings in EUR due to my travel history. I plan to live long-term in Switzerland. How do you think it is best to invest this EUR (gold ETF EUR, convert in USD and invest in stock ETF or invest in EUR ETF) considering that EUR is so low compared to CHF?

Thank you!

Alex

Hi Alex

I would say it highly depends on your needs.

Personally, I would convert it all now with IBRK and invest in US ETFs.

If you often travel to Europe, you may want to spend it.

If you are investing in UCITS ETFs, you can invest directly in them with your EURs, but I would not complicate your portfolio just for the sake of avoiding a currency conversion fee.