February 2019 – China, dowry and ski

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I spent half of February 2019 in China. Me and Mrs. The Poor Swiss were visiting my in-laws for the Chinese new year. Most of the trip was very frugal since we stayed at my father-in-law house. And we mostly ate at home. However, I am following Chinese culture and paying a dowry to my father-in-law, this makes a big hole in the budget of the month.

Mrs. The Poor Swiss also started skiing this month. Since she had no equipment at all, we had to buy the clothes for skiing. And we had to rent the ski equipment itself for the season. This makes another hole in the budget.

Even though we had lower savings than what we are aiming for, this month was quite good for our net worth. With the stock market returns, our savings and the sale of my ESPP shares, our net worth made a nice jump this month!

In this post, you can find everything that happened to us in February 2019.

February 2019

Half of the month, we spent in China with my family in law. I described the trip in the next section. Other than that, there were not many special things in February 2019. We managed to save 32.5% of our income this month. This is not great, below my long-term objective of 50%. However, we spent 2000 CHF in China. Without these expenses, it would have been a good month for our finances.

I filled our taxes for this year. I think we will end up with about 1000 CHF more taxes. This makes sense since our income increased significantly. Maybe this year, I will contribute to my second pillar to reduce taxes for 2020.

As I said before, this month was also the first time Mrs. The Poor Swiss tried skiing. We only did about two hours for the first time and only went to the learning slope. But I think it went well even though she only had me as a teacher. Next weekend, we will ski again. This time, she will have better teachers with my brother and my father. While the ski station itself was free this time, the equipment is very expensive. We bought ski clothes and gloves. But we rented the skis and ski shoes for the season. Since we do not yet know if she will really like it, it is better not to spend several hundreds of dollars on equipment she only uses one year.

Trip to China

The first two weeks of the month were spent in China. We went there to see my family in law. Mrs. The Poor Swiss went there two weeks before me so she could see her family and friends more. Overall, my feelings about the trip are really mixed. I am really glad my wife was able to see her family and her friends. On the other hand, it was not enjoyable for me. We almost did not do anything but stay at home. And since we were the only couple without children, I felt like a babysitter without a wage.

And finally, we have been ambushed by two people from her side of the family for more than two hours to make us invest in their business. They assume that since I am a foreigner, I have a lot of money. And they want my money. In the end, we did not invest. But it was a really crappy moment.

I also wanted to take advantage of the trip to improve my Chinese. For that, the trip was okay. But not as good as I would have thought. Some of this is my fault since I am not a big talker and I do not often engage people in conversation. And often, when I try to speak in Chinese, they do not understand me. Another problem is that all my in-laws speak in a dialect. So listening to them does not help my Mandarin Chinese at all. Mostly, I spoke with the little Children. I really need to improve my level before we go back to China. I would really like to speak more.

From a budget point of view, it was not as bad as last year. We spent around 500 CHF in one week. This is not so bad honestly. Of course, we have to add the dowry of 1600 CHF to that. Together, it makes a lot of money! This will be around the same next year. But next year will the last part of the dowry I have to pay.

Expenses

Here are our February 2019 detailed expenses:

- Insurances: 860 CHF: Average

- Transportation:162 CHF: Below average. We used very little gas this month. For two weeks, our car was not used.

- Communications: 111 CHF: Below average. Last month, I reduced our internet bill. This has a small effect on our bill and it will be fully effective in March.

- Personal: 2664 CHF: Well above average. I spent 1600 CHF on the dowry and we spent about 500 CHF In China.

- Food: 329 CHF: Average. We spent very little in China. But we went to Aligro to restock our meat. We bought about 20Kg of meat this month.

- Apartment: 1247 CHF: Average.

- Taxes: 707 CHF: Average

Overall, we spent a total of 6081 CHF this month. Considering that we spent more than 2000 CHF in China, it is actually not so bad. We would have been well below our goal if not for our trip and dowry.

2019 Goals

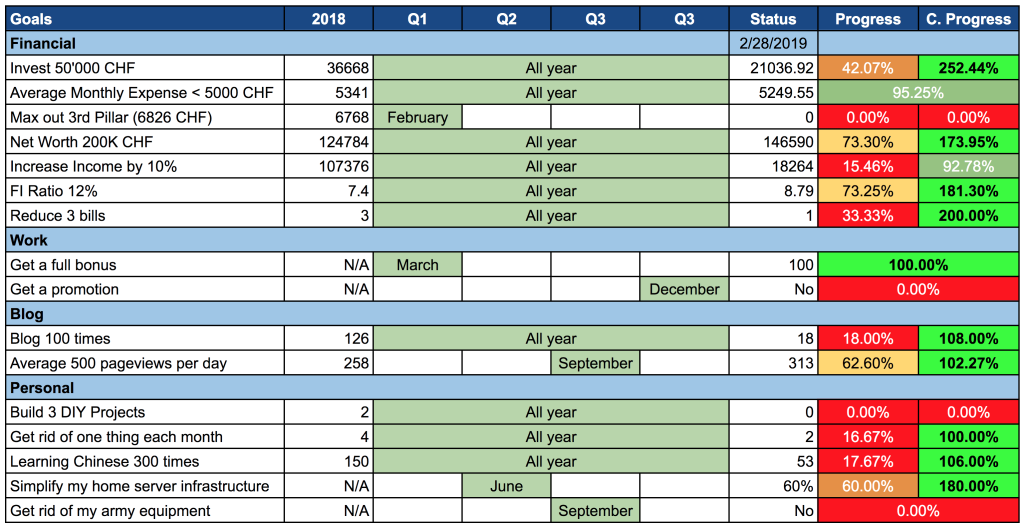

It is time to take a goal at our yearly 2019 Goals:

Overall, my goals are going great. There are a few things about which I am a bit late. First, I was not able to send money to my first pillar this month. But next month, we will get a big pile of cash from my bonus. And with that, we will finally reach the amount of cash we wanted. And I will invest my third pillar next month. It is still one month late though. The bonus will also help towards our income goal.

This month, I have been able to invest a lot because my ESPP shares were vested and I sold them for a 50% profit. This is really great! This also helped us starting to change broker. Because of the big expenses this month, we are below our goal of 5000 CHF of expenses per month. But this should be fixed next month.

Since we brought back some clothes from Mrs. The Poor Swiss from her house in China, we were running out of place in our closet. So I reduced the number of my clothes by a little to make her a little more room. Here are the clothes I was able to get rid off:

It is not a lot, a few shirts, a pullover, and an old army sports set. But I almost never wore them anymore and I have more than enough shirts and pullover. I donated all of them to the Red Cross. We are also trying to sell a juice extracting machine that we are not using anymore. But for now, we did not have a lot of success on that.

I also did a lot for simplifying my home server infrastructure. I have entirely disassembled two servers. Also, I have cleaned many files and saved a lot of space on our hard drives. I have installed the new home automation system that I ordered on Amazon, saving 50% of its price. It is not finished. But it is getting there! Now, I have a lot of computer pieces that I have to sell.

Net Worth

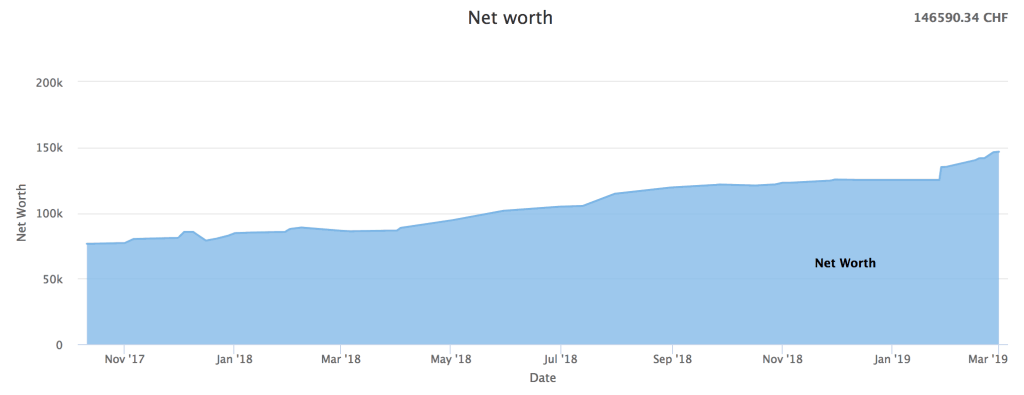

Let’s take our look at how our net worth did in February 2019:

From the image, it is pretty clear that we did pretty well this month! Our net worth stands at 146K CHF. It is a jump of 10K in one month. We are really happy with this result. This nice rise comes from three things. First, my ESPP shares were sold at about 50% profit. This means about 4000 CHF increase. This is really nice. Then, it also comes from our savings from this month. Finally, the stock market was still up this month, adding a nice improvement to the results.

I am still in the process of transferring our portfolio to Interactive Brokers. I have moved some of my Swiss shares and some of my VOO shares from DEGIRO and transferred the results into Interactive Brokers. For now, we even made a small profit in the process. But it is not over and the biggest of my position I have not yet sold. I will keep you up to date with the process in March.

Once we will have transferred all our positions, we should have a balanced portfolio once again. That is another advantage of portfolio transfer! And with some of the selling, we have been able to get more cash into our bank account. So we will be able to invest in my third pillar next month.

The Blog

February 2019 was not a great month for the blog. The traffic was down 13% in one month. I kind of expected that because last month was a really big month with a mention from RockstarFinance. Moreover, I was not here during the first two weeks. This means no answers to comments, less social media sharing and so on. Even though I expected this, it is a bit disappointing. Nevertheless, it is still higher than last year. I will continue on my way in March. And if the traffic continues to decline after March, I will try to find new options.

I took some time this month to clean up the categories of the blog. This task has been on my todo list for quite a while now. I reduced the number of categories from 25 to 11. And I changed a few of them to reflect better what this blog is about. It is still not great. But it is much better already. It was a good exercise to give shape to the blog type of content!

I have also reviewed my posts about the Three Pillar system of Switzerland. I feel it is much better and more complete right now. Also, I want to make a roundup page about all the books I have read. This should make it much easier to navigate. I have a few other ideas on how to improve the blog this year. I hope it will make it better for you!

Do you have any suggestions on what to change on the blog?

Here are the three most read posts in February 2019:

- Revolut Review: This post seems to really work well. It has been on the monthly top three several times. Moreover, it also had many visits on its AMP (mobile) version.

- What is the best credit card in Switzerland? It seems that people really like to optimize credit cards to minimize fees and optimize cashback.

- 25 Money-Savings life hacks for 2019: This guest post by Aiden White did really good. It was a really good experience to have a guest post on my blog.

Except for the guest post of Aiden, no new post did really well this month. This is a bit disappointing for me.

What about you? Which post did you prefer this month?

Next Month – March 2019

For now, I do not see a lot of special things happening to us in March 2019. However, there will be many things happening with our money. Our finances will definitely be better. I will receive a bonus. This will almost double our income. This means that our savings rate should be at a record high unless there are some big unexpected expenses. We should also be able to fill our third pillar. And hopefully, we should be able to finish the transfer of our broker from DEGIRO to Interactive Brokers. I will let you know how that goes.

What about you? How was February 2019 for you? What do you expect for March 2019?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

“What about you? How was February 2018 for you? What do you expect for March 2018?”

ehmm… 2019? :-)

Thanks Ricardas! It was indeed obviously 2019 ;) It is fixed!

Thanks for stopping by :)

👏👏nice poor Mr.Swiss

Thanks :)

I would not have been to do it without you!