Yield Curve Inversion: Should we Panic?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

If you have been following personal finance blogs or the news these recent weeks, you have probably heard a lot about yield curve inversion. But do you know what it is? Should we panic and sell all our shares? Is a recession starting because of this event?

Before we answer these questions, it is essential to know what is the yield curve. For this, we will need to review what we know about bonds. Then, we need to understand what does the inversion of this yield curve means. We can also see what causes such an event to happen.

As we are going to see, all of this is quite simple. So what is all the fuss about? In the past, the yield curve inversion has accurately predicted the coming of recessions.

And what will happen after such an event? Is the recession already upon us? Should we sell anything and get out of the market? The most important thing is to see what we should do, now that the yield curve in the U.S. is inverted.

And we know that the yield curve will invert again in the future. So, it is important to understand how we should react to these events.

Bond Yield

First of all, we need to talk a bit about bonds. Bonds are something we have not been talking about a lot on this blog. And bonds are more complicated than people realize.

When you buy a bond, you lend a certain amount of money (the principal) to a company or a government. In exchange for that money, the borrower will give you back some interest each year. A bond has a maturity, that is the time at which it will arrive at term. Once the bond matures, the buyer gets back his principal.

The return on a bond is called its yield. The yield is the interest over the invested principal. Many people think that the yield is the same as the interest rate. But this is not true. Bonds are sold on the secondary market. When a lot of people buy bonds, this will drive the price of the bonds up. The interest rate of the bond will never change. However, if the interest rate remains constant, and the price goes up, the yield goes down.

On the other hand, if the price of the bond goes down, the yields go up. The price of bonds is highly counter-intuitive. But this is the way it works.

So for the yield curve, we are only concerned about the yield of the bonds, not their interest rate. And this is more volatile than you think.

Yield Curve

Before even talking about an inversion of the yield curve, it is essential to know what is a yield curve.

The yield curve is an elementary graph putting together the yield of a bond and its maturity. It is straightforward to draw. You collect the yields of all terms bonds, and you graph it from the shorter term to the longer term.

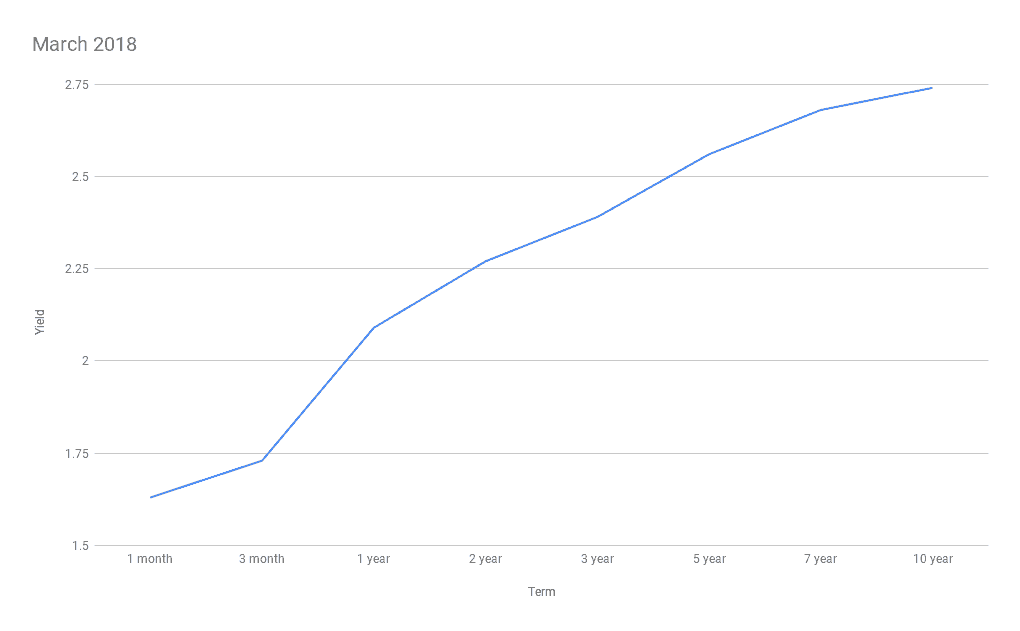

For instance, here is the yield curve in March 2018:

As you can see, it always goes up. That means it is more expensive to borrow money for the long-term than it is to borrow it for the short term. This situation makes sense. It is only logical. This yield curve is considered a normal yield curve. And it is expected from a healthy stock market and economy.

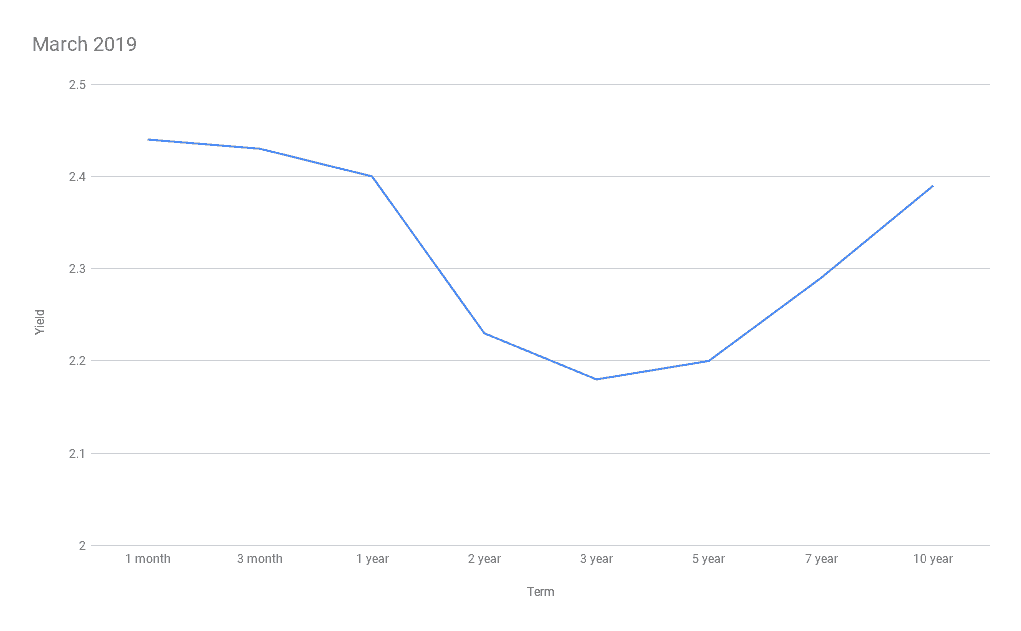

On the other hand, here is the yield in March 2019:

You can see that the curve goes down from one month term to the three-year term. This downslope is what is called inversion of the yield curve. It is cheaper to borrow money for the long-term than the short-term. This situation is not logical and should not happen if everything was logical. So, in March 2019, the yield curve inverted!

Which bonds matter?

We have seen that the yield curve is based on the yield of bonds and their maturity.

However, there are many types of bonds: Treasury bonds, municipal bonds, or even corporate bonds. That meant that there are as many yield curves as there are types of bonds. A yield curve is just a tool. There is not one yield curve, unfortunately.

However, when we speak about the yield curve in the context of the stock market and recession, we speak about the yield curve of the United States Treasury bonds. The U.S. government emits these bonds. They are considered almost risk-free. They pay interest semi-annually. These are the types of bonds we are going to focus on when we speak of the yield curve.

What causes inversions to happen?

An inversion can be caused by two factors: an increase of short-term yields or a decrease in long-term yields. Generally, these two factors come together and make the inversion faster.

The short-term yields are pushed up by the Federal Reserve in the United States. The Federal Reserve controls the rate of treasury bonds in the United States. They increase or decrease the yields to follow inflation or to make people spend more. Generally, they are doing that to improve and stabilize the economy.

If the economy goes well, the Fed can increase the rates so that people can save a little more money. But if the economy goes poorly, the Fed will decrease the rates so that people spend their money rather than save.

On the other hand, the long-term yields are pushed down by bond traders. When investors are purchasing many long-term bonds, this is pushing their price up. And we have seen that higher price means lower yields. Some people fear a recession and thus are buying more long-term bonds these last months.

Together, these two factors are why the yield curve can invert.

What does the inversion predict?

Now that we know what this event is about, we need to understand what it means for the stock market and the economy! The inversion of the yield curve is an event known to predict a coming recession in the United States.

We have stated many times on this blog that market timing does not work. Nobody can predict the stock market. Can this be an exception to this rule? Let’s see.

First, it is quite impressive that an inversion of the yield curve preceded every single U.S. recession in the last 60 years. But much more impressive, every inversion, but one, has been followed by a recession. The exception was in the sixties already. Since then, there has not been an exception to this rule.

However, a recession does not start directly after the inversion. It is not that powerful as a prediction. The time between inversions and recessions has been historically between one and two years. So we have plenty of time in front of us! Of course, there could be exceptions. The recession could start tomorrow or in five years. I cannot tell, and nobody can! But it is highly likely that we have one recession before the end of 2020.

Moreover, there is one more thing that is important to consider. A single day inversion of the yield curve does not predict a recession. Many people forget that! The yield curve should stay inverted for at least a few months before this can predict a recession.

And there is one more thing not to forget. The inversion of the yield curve could be causing a recession. If people expect a recession after a yield curve inversion, they will be investing differently after such an event. And if enough people change the way they are investing, this could cause a ripple effect that would cause a recession.

What about other countries?

I mentioned several times the U.S. Treasury Bonds for the yield curve. We can create a yield curve for each country based on treasury bonds. And very interestingly, the prediction of recession by the inversion of the yield curve only works in The United States.

For instance, Japan had seen many recessions in recent years, but the yield curve never inverted! In the United Kingdom, the yield curve inverted several times, never followed by a recession. The yield curve was also inverted several times in Australia. But a recession did not follow these inversions.

It is interesting that this prediction only seems to work in the United States. Now, does that mean we are safe, in other countries, if the U.S. enters a recession? Probably not!

A national recession does not necessarily cause a global recession. And in fact, a national recession of a tiny country is unlikely to cause a global recession.

But the U.S. economy is huge, making it more likely to be a global recession. In the last decade, global economies have been synchronized more than ever. The last recession, in 2009, has been global, but it started as a national U.S. recession. The previous U.S. recession, the dotcom bubble, was not a global recession.

However, even if the next U.S. recession is not global, we are not entirely safe. If you invest with a world stock market index, you will likely have at least 50% of your stocks in the U.S. stock market. That means that a national U.S. recession can cause a lot of stress to your portfolio. However, you will be more protected against the recession itself.

The vicious circle of recession

Now, we have seen that the inversion of the yield curve can more or less predict the next recession. But, it could also cause a recession to happen. In my opinion, this is especially true since people are expecting a recession after a yield curve inversion.

In the beginning, when banks become aware of the inverted yield curve, they may reduce their lending. This reduction is logical since they expect less profit from long-term lending.

At a later time, many companies are going to slow down if they do not have access to credit. Slowing down of companies may mean less hiring and even some layoffs.

Finally, consumers are starting to spend less when they think a recession is coming. By spending less, they are slowing down the economy and slowing down the profits of many companies. This circle goes back to the second time, and businesses are starting to slow down even more and lay off more people. This situation is a vicious downward circle that is difficult to stop.

Should we panic?

No! You should not panic. The worst thing you can do in such an event is to sell your shares.

You would do yourself a disservice! As I said before, even though the prediction is generally correct, it can take up to two years before a recession occurs after an inversion of the yield curve. It has been less than a month! And emotions are your worst enemy for investing decisions.

Moreover, the months before the recession are generally the months with the most growth in the stock market. Many people who sell early are buying back the shares before the recession even starts, losing money in the act!

Many people will think that they should sell now and buy again during the recession. On paper, this is a great technique. If you could predict the highs before the recession and the lows of the recession, you could make a ton of money with this technique. But you cannot do that! Although if you can, please let me know!

If you want more information about why we should not panic, Big ERN, one of my favorite bloggers, wrote an article about eight reasons not to worry about yield curve inversion.

What to do about it?

Now, there are a few things you can do to be prepared for a recession.

First, you can work on reducing your debt. It is much safer to have no debt if you are laid off or if your salary is reduced. If you do not feel safe enough, you can also increase the size of your emergency fund.

It is also an excellent time to check that your asset allocation is adapted to your capacity to take risks. If you feel you cannot handle too much loss in your portfolio, you should add more bonds to your portfolio. Since short-term bonds have a high yield, you can start investing in a short-term bond portfolio to become more defensive.

Conclusion

The yield curve in the United States for the Treasury Bonds inverted in March 2019. That means that short-term bonds have a higher yield than long-term bonds. In the past, this event almost always predicted that a recession was coming in less than two years!

Now, what should we do about this coming recession? Nothing! You should not do anything about it. You should not panic with this news! A yield curve inversion does not mean a recession will start tomorrow. Historically, it took up to two years for a recession to start. The yield curve just inverted. We should be safe for a little while.

Now, you should make sure your asset allocation is relative to your risk tolerance. And you should have an emergency fund adapted to your situation. If you use bonds, make sure you have the correct allocation in bonds before the recession. They should help you weather the negative returns.

I will continue to invest for the time being. I am investing in the long-term, and as such, I am prepared for my portfolio to take a beating during the next recession.

Next, I strongly encourage you to read more about recessions.

Do you think a recession is coming anytime soon? Are you prepared for it?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Who Is John Bogle? Founder of Vanguard

- What happened to GameStop in 2021?

- My Investor Policy Statement – You Need One Too!

I just happened to stumble over this old post of yours. Since more than 2 years have already past, would you please comment on whether the yield inversion from 2019 predicted anything until now or not? Of course, we have the pandemic, which no one predicted, but still, has the yield inversion predicted any of the high inflation rate in US, or these events are totally unrelated?

Thank you for your thoughts.

Hi Cristian,

I would think it predicted nothing in that case :)

I believe the high inflation is entirely unrelated to the yield curve, related to the unpredictable pandemic crisis.

The other indicator to follow is the US unemployment curve. See: Civilian Unemployment Rate, https://fred.stlouisfed.org/series/UNRATE/

Before the recession starts the unemployment curve forms a trough or a bottom and unemployment starts to rise. Stock market typically reacts some months in advance before the statistics show recession has started.

I seem to remember there was nervous US stock market reactions in about July-August 2007 and the recession started in December with 5.0 unemployment rate. The lowest unemployment before that was 4.4 on 4 months in Oct 2016 – May 2007 range. The yield curve was inverted at least 3 times in 2006-2007.

In November 2007 I had an anticipation of things to come because of certain black crows in discussion forums with good reasoning and reference data and not just personal opinions. I used the opportunity in November 2007 to refinance my mortgage from 12 month to 3 month euribor rate with 0,28% interest margin. It seems the banks were totally ignorant at the time of things to come. I knew only that recession is coming. Now the bank is paying me interest.

I have also made many poor investment decisions typically related to bad timing when trying to buy at the bottom and sell at the top.

I have shifted some of my Finnish stock positions to low duration high investment grade bond instruments. Germany is slowing down because China and USA are slowing. The employment here is still at record levels like it is in States but the downwards risk is evident.

I have kept my emerging and frontier positions intact although they may be even more sensitive to beating than the stocks in the developed markets. I cannot buy my preferred frontier market ETFs (FM, AFK) back if I sell them away.

Hi Finn,

That’s a very good point! The unemployment rate is a very good indicator of a coming recession / bad economy.

It seems the U.S. is at a record low (for a long time) unemployment rate. Very good! Remains to see if this will continue to go down or plateau and then go up.

It seems you have a good plan in your head! Good move with your mortgage!

I do not plan to change anything in my investments currently. But I may keep a bit more cash ready.

We’ll see how that goes.

It all depends on how you look at it: I would want to buy an apartment between now and two years so if this yield curve leads to a recession in the US that leads to a recession in Europe, which means a drop in prices for real estate, then I’m buying :)

Hi Jo,

If you are waiting for opportunities for buying a house, then it’s indeed not so bad.

On the other hand, you may have to wait a certain number of years for it to happen. What if a recession does not start before 5 years, are you ready to wait that long?

Thanks for stopping by :)